Here we are again:

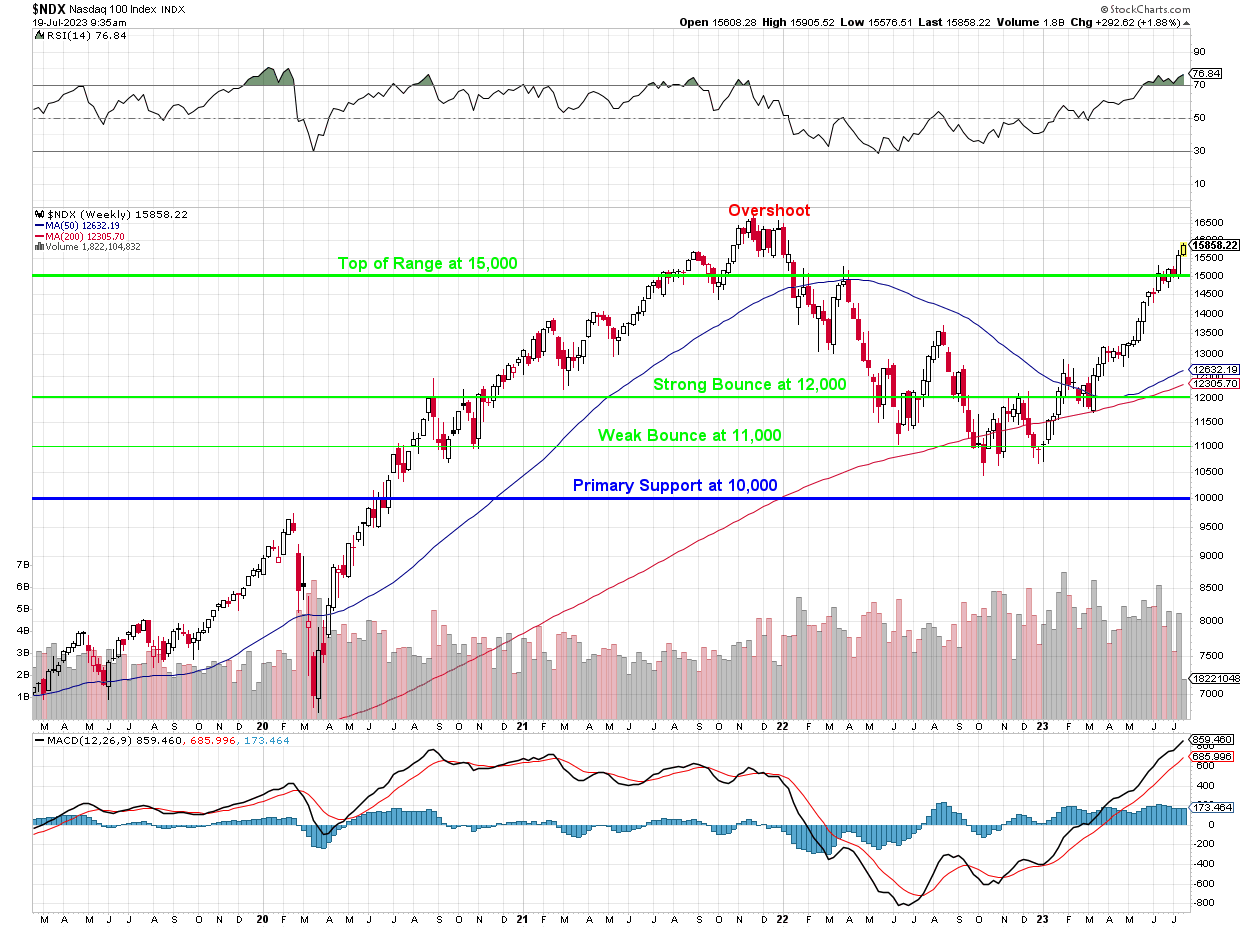

As you can see, our last Nasdaq rally topped out at 16,500 and we’re just testing 16,000 again and, at the time (around November of 2021), we took about half our positions off the table as 16,500 seemed ridiculous. Unfortunately, in July of 2023, 16,000 still seems a bit ridiculous – but we only just started a brand new set of portfolios in May (see yesterdays review) and our main hedge is the Nasdaq – so we’re riding this one out for now.

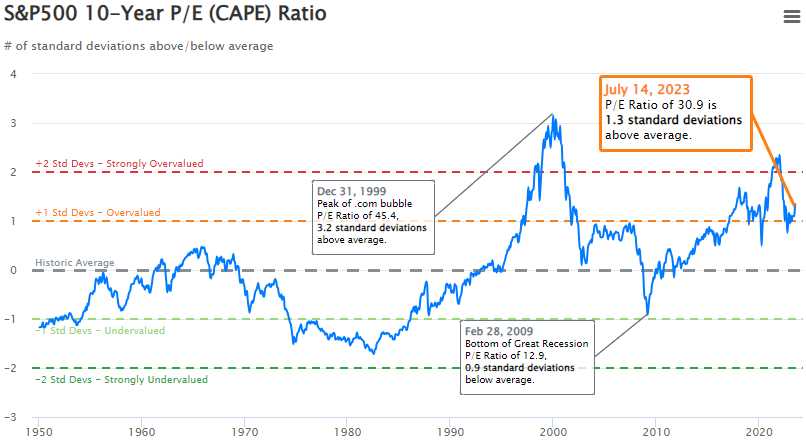

The S&P 500 is also rocketing to the moon at almost 4,600 and that’s over 30x earnings for the senior index. You would think the bubble will burst at some point but we topped out around 40x in November of 2021 (no wonder we took it off the table!) so you never know how far these things will go before reality hits.

The reason this rally is more surprising now is that, unlike 2021, there are alternatives. In 2021, the bond market was not an option and we used to say there was simply nowhere else to invest during Covid as commodities were crashing and homes weren’t selling but stimulus money was pouring into S&P companies and the zero-interest loans worked in their favor to boost earnings.

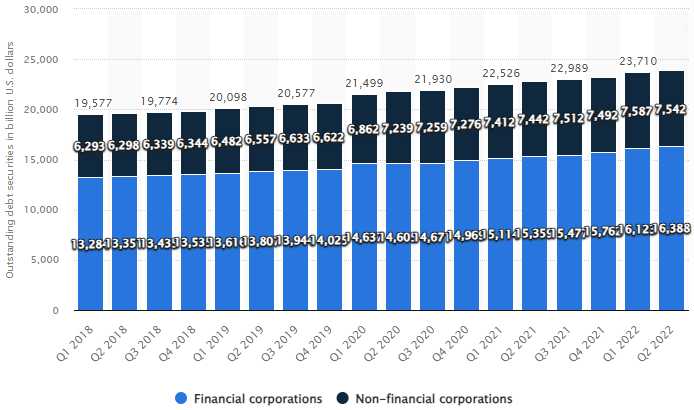

Now bonds pay 5% so that market, at least, should be attracting some cash. I guess bonds have become scary because of all that borrowing Governments did to bail us out of Covid? Corporate debt jumped 25% under Covid and will pass $25Bn this year – that’s 100% of the US GDP in ADDITION TO our $33Tn National Debt!

Investors are being pretty unrealistic in their expectations but it’s hard to bet against them when a company like UNH, who just reported and earnings beat, can jump 14% in a few days – and that’s a $500Bn company! Did UNH really justify a $70Bn higher valuation off a 2.7% earnings beat? Of course not! The good news simply has traders willing to pay 23 times earnings when before they were paying 20 times earnings at $450.

And that is the story of the whole market. Sentiment has gotten very bullish and, if you want to play, you have to bid heavily for many stocks. We’ve been sticking with the bargain stocks but what happens when there are no more bargains? Usually we cash out but, as I noted, we just started new portfolios, so we’d rather not start again so we have to keep bargain-hunting and HOPE (not a valid investing strategy) that when the corrections come – our hedges will hold and the stocks we have prove resilient enough when the tide goes out.

Be careful out there!