36,952.

36,952.

That’s where the Dow was in the first week of January, 2022. The recent huge rally we’ve been having in the indexes has still left the Dow down 1,900 point (5%) for the past 18 months and we’ll see if it can hold up better on this second attempt – because the first one turned south and bottomed out at 28,725 (22% lower) at the end of September last year.

That’s why we were thrilled to cash out our old portfolios in May, we had recovered our losses from September and we still remembered that markets can go down as well as up (unlike current traders) and we decided it wasn’t worth risking our 10x gains.

Now we are having our AI rally and we’ll see how far things can take us. I would put forward, however, that it’s not so much AI that is driving the market higher but Bonds, which had their worst year EVER in 2022, with 10-year Treasury Notes falling 18% and 30-year Notes dropped 39%. That sent people fleeing out of bonds and into the stock market.

As I had been warning for years, Treasuries are not “risk-free” and holding onto notes that paid less than 2% interest was madness – as rates had to go up eventually – which, in turn, devalues all the lower-rate notes. It’s Econ 101 but try explaining it to the Bond crowd (I did – didn’t work).

As I had been warning for years, Treasuries are not “risk-free” and holding onto notes that paid less than 2% interest was madness – as rates had to go up eventually – which, in turn, devalues all the lower-rate notes. It’s Econ 101 but try explaining it to the Bond crowd (I did – didn’t work).

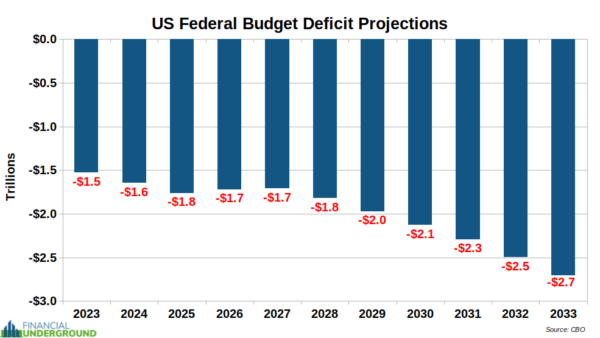

The Global bond market is still $133Tn vs all the gold in the World being worth about $15Tn. There’s another way bonds can lose money other than rising rates and that’s if the currency they are based in begins to devalue – and that happens when the host country has too much debt – like this one:

So the US alone is going to issue $21.7Tn of new debt over the next 10 years and that’s assuming no more banks need bailing out and there’s no Recession and no other emergencies come up. We’re certainly NOT going to be paying off our existing $33Tn in debt so that will bring us to just under $55Tn in debt, which is currently more than double our GDP.

The debt service on $55Tn at 5% is $2.75Tn a year, which will make it very hard to balance the budget going forward when $2.75Tn is one half of all Federal Spending at the moment. Currently we are servicing our debt at $800M per year so we’ll need to cut about $2Tn worth of other things (which would be everything) OR we could raise taxes.

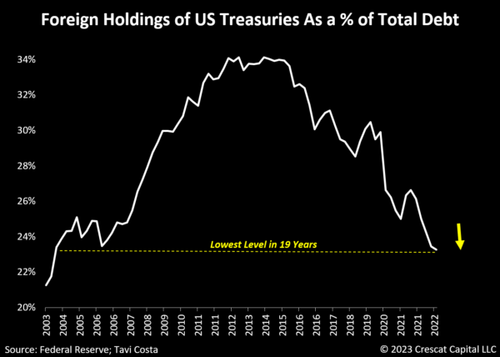

Sadly, we’re like a country full of children who don’t like to make hard choices (because we have spineless leaders). so we just ignore the problems and pretend they will just go away when, instead, they get worse and worse each year. Other countries can see this and they have been dumping our debt for the past decade – 1/3 of their holdings so far.

Sadly, we’re like a country full of children who don’t like to make hard choices (because we have spineless leaders). so we just ignore the problems and pretend they will just go away when, instead, they get worse and worse each year. Other countries can see this and they have been dumping our debt for the past decade – 1/3 of their holdings so far.

Less demand for our debt means we have to keep offering higher rates at Note Auctions and this is a much bigger concern to the Fed than Inflation as they know how to do math and the math says we can’t afford to service $55Bn in debt at 5% so they MUST find a way to substantially lower rates over the next few years or the decade after this one we’ll be adding $4Tn a year to the deficit.

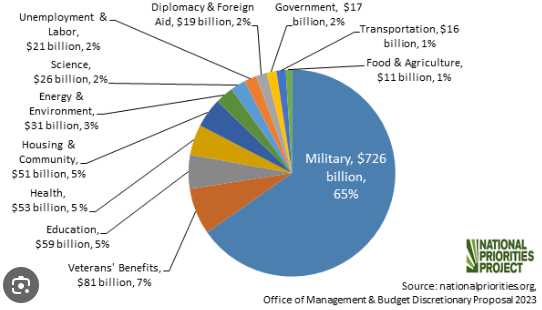

Here is how our Government is currently spending your money – you decide what needs to be cut:

Notice Veteran’s Benefits are not included under Military Spending because, apparently, Veterans just fall out of the sky of their own accord, not a by-product of the Military. Of course, if you included Veterans Benefits under Military Spending, then Military Spending would be 72% of the total budget and that might make people wonder if we’re spending too much on it…

It could be just me but, MAYBE if we spent more than $19Bn on Diplomacy and Foreign relations – we wouldn’t have to spend $726Bn on our Military. Well, “have to” is a strong phrase – let’s go with “have any logical reason for“.

So, given $1.1Tn in Government spending where $807Bn is being spent on the Military, how much of the other $293Bn will we need to cut to make an additional $2Tn in annual interest payments? Interest on our debt is already $800Bn a year. If not for that deficit, we could TRIPLE our spending on Health, Education, Energy, Transportation, etc. but, instead, we have our collective head in the sand while the tide of debt is rising around us.

Here’s how consumers are trying to balance their budgets this year:

Meanwhile, BX just said that its net profit from Asset Sales plunged 82% to $388.4 million from $2.2 billion in the year-ago period, as higher interest rates, sticky inflation, and economic uncertainty have continued to weigh on its merger-and-acquisition activity. A major share of the reduced asset disposals came from Blackstone’s real estate unit, where its net profit sank 94%, while that of its credit division dropped 46%.

BX had been trading around 20 times earnings so we’ll see how their guidance looks but it’s another indication that not everything is awesome as we look into 2nd quarter earnings. GS missed yesterday along with FHN, COLB, DFS and NBHC. This morning we had Banking misses from BHLB, FITB, KEY and TFC – that’s a lot of bank misses when we have just (supposedly) come out of a banking crisis.

This evening we hear from ASB, BANF, OZK, COF, FFBC and GBCI and tomorrow we get AXP, HBAN, and RF and we’ll see what kind of trend the Financials are in as we close out the first week of earnings.

“His father works some days for fourteen hours

And you can bet, he barely makes a dollar

His mother goes to scrub the floors for many

And you’d best believe, she hardly gets a penny

Living just enough, just enough for the city

“I hope you hear inside my voice of sorrow

And that it motivates you to make a better tomorrow

This place is cruel, nowhere could be much colder

If we don’t change, the world will soon be over

Living just enough, stop giving just enough for the city” – Stevie Wonder