Initial jobless claims were better than expected but Philly Fed Manufacturing, Existing Home Sales, and Leading Economic Indicators all weakened and disappointed.

Source: Bloomberg

But the big drivers for the day were in tech (after earnings).

Tesla tumbled (down over 9%)…

Netflix not chill (down over 8%)…

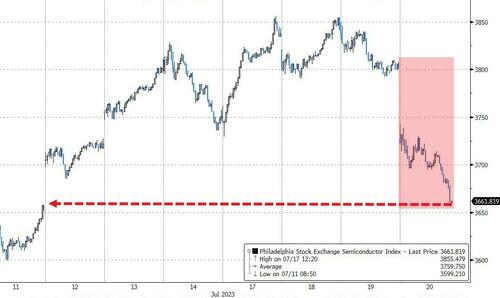

Chips stocks stumbled after TSMC pissed in the AI punchbowl…

Source: Bloomberg

As an aside, CVNA soared over 30% in the pre-market after its debt restructuring and capital raise; then faded back in the US day session…

All of which pummeled the Nasdaq. which suffered its worst drop since Feb. Only The Dow was green on the day among the US majors.

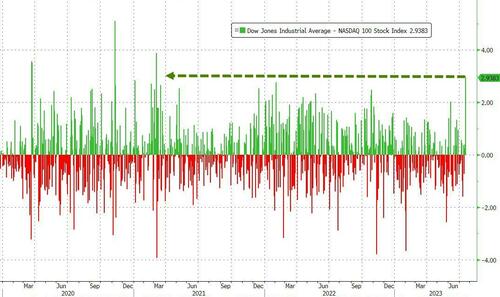

Today was the biggest Dow outperformance of Nasdaq since March 2021…

Today is the 38th day in a row since the S&P had a 1%-down-day – the longest streak since Q4 2017…

Source: Bloomberg

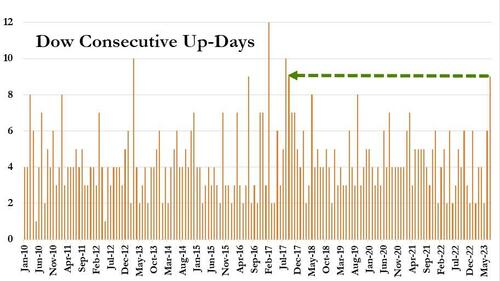

The Dow is up for the 9th day in a row – the longest streak since Aug 2017…

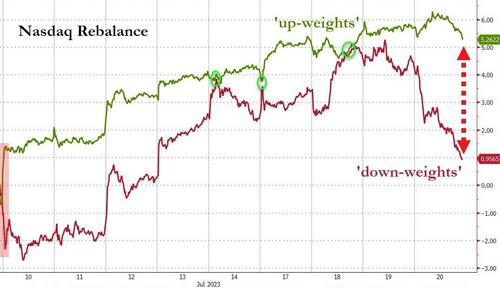

Notably, with the Nasdaq rebalance looming, today saw the mega-cap “down-weights” get monkeyhammered relative to the “up-weights”…

Source: Bloomberg

‘Most Shorted’ stocks fell today for the first time this week

Source: Bloomberg

It was VIXperation today, and the fear index dumped and pumped on the day…

Treasuries were dumped on the day with the belly underperforming (2Y & 30Y +6bps, 5Y +11bps), pulling all but the 30Y yield higher on the week…

Source: Bloomberg

The dollar extended gains to one-week highs….

Source: Bloomberg

As the Nasdaq began to accelerate lower, so Bitcoin joined the party, tumbling back below $30k…

Source: Bloomberg

Gold slipped lower on the day as the dollar rallied…

Despite a sudden puke mid-morning, WTI ended marginally higher on the day…

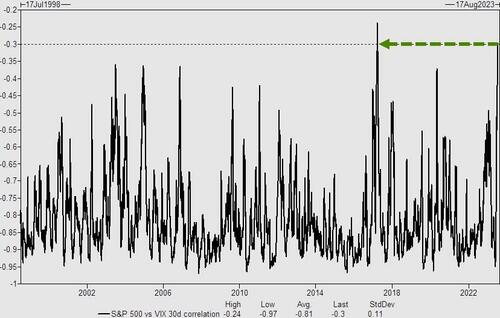

Finally, the correlation between VIX and the S&P has surged of late as negative gamma increases which infers dealers must buy stock into higher markets, sending correlation higher and higher…

Source: Goldman Sachs

The last time this correlation hit these highs was late ’17…which was the lowest VIX reading ever & the previous all time low in the CBOE correlation index.

Translation: regime change is coming.