5%

5%

That’s up from 0.25% just over a year ago and it is very unlikely the Fed is done raising rates. I had originally predicted 6% back before the Fed made their first hike and my target has not changed as we still have 5% inflation and we still have 8.5M unfilled jobs – which drives the wage pressure that drives inflation.

More to the point, we still have a $7.25 minimum wage in 20 states and under $10 in 30 states – that’s slavery folks! When you work all day just to have enough for food, clothing and shelter (barely) and nothing left for yourself – just enough so you can get up and work the next day until you die or retire in abject poverty – that’s slavery!

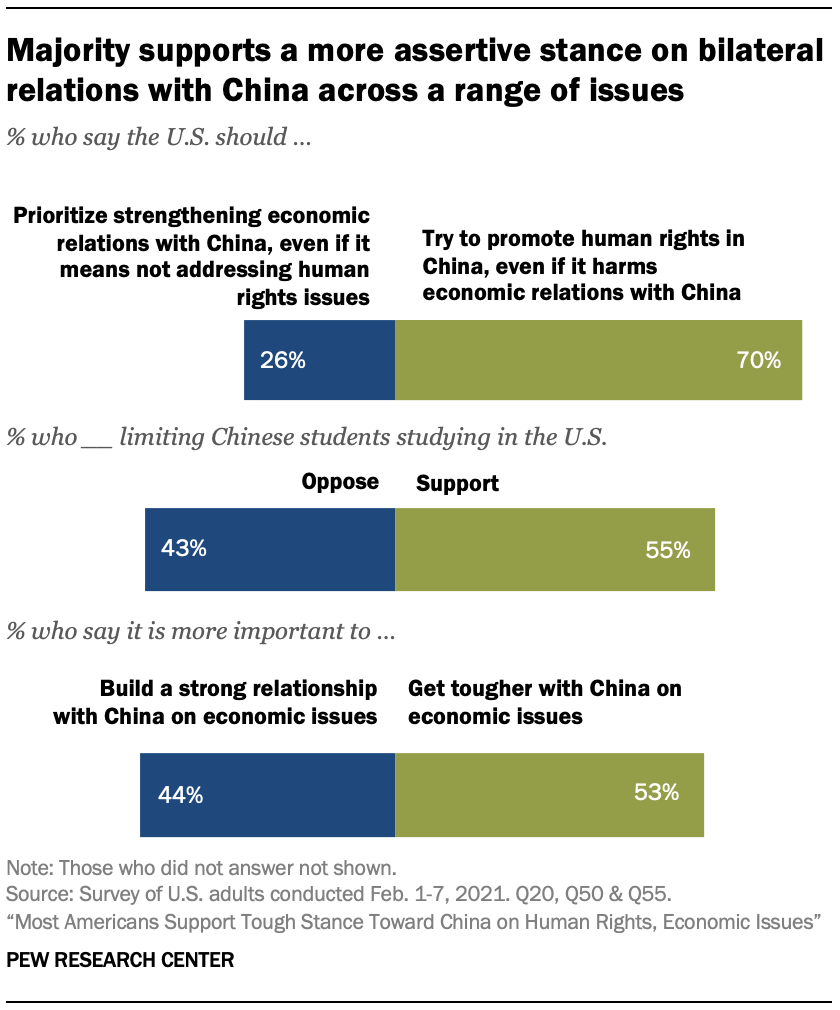

Don’t go pointing fingers at other countries when we are committing atrocities right here in the USA. This country prosecutes doctors who give 10-year old rape victims abortions. 4,000 people PER MONTH die in this country from lack of Health Care. Sadly, it goes on and on. In March, China released a report on Human Rights Violations in the United States – just like we release for China – only our media doesn’t cover it when China has a report, which highlighted our:

I. Dysfunctional Civil Rights Protection System

II. Hollowed-out American-style Electoral Democracy

III. Growing Racial Discrimination and Inequality

IV. Worsening Subsistence Crisis among U.S. Underclass

V. Historic Retrogression in Women’s and Children’s Rights

VI. Wanton Violation of Other Countries’ Human Rights and Trampling on Justice

Now you can just dismiss it as “Commie Talk” or whatever the latest Fox buzzword is for China these days but you KNOW, in your bones, that this is not completely off-base. For our part, we have called China out on:

-

- Repression of civil and political rights

- A crackdown on Hong Kong’s autonomy and democracy

- Genocide and crimes against humanity against Uyghurs and other ethnic minorities in Xinjiang,

- Coercion and intimidation of Taiwan

- Arbitrary detention and forced disappearance of dissidents and activists

- Censorship and propaganda of information

- Abuse of religious freedom,

- Violation of labor rights

- Environmental degradation

- Lack of transparency and accountability on the COVID-19 pandemic.

10 to 6 – we win!!! To be fair, #3 is only and advantage to the US because we have already completed our genocide of Native Americans – China is just a bit slower to cleanse their land than we were. We did build a great big wall to intimidate Central and South America and you KNOW we have our own censorship and proaganda and everyone is screaming about their religious freedoms being violated – so that must be true (and keep in mind the Uyghars are Muslims – the US certainly does not have clean hands there). Environment is not our strong suit either and lack of Covid transparancy is all the GOP candidates are talking about – so it looks like it’s tied at 10 human rights violations per side – as long as you forget about our new fad of persecuting the LGBTQ community – then we win!

10 to 6 – we win!!! To be fair, #3 is only and advantage to the US because we have already completed our genocide of Native Americans – China is just a bit slower to cleanse their land than we were. We did build a great big wall to intimidate Central and South America and you KNOW we have our own censorship and proaganda and everyone is screaming about their religious freedoms being violated – so that must be true (and keep in mind the Uyghars are Muslims – the US certainly does not have clean hands there). Environment is not our strong suit either and lack of Covid transparancy is all the GOP candidates are talking about – so it looks like it’s tied at 10 human rights violations per side – as long as you forget about our new fad of persecuting the LGBTQ community – then we win!

As Hitler said, “You can’t make a Reich without breaking a few bones,” and that guy got 100% of the vote – who are we to argue with success?

As Hitler said, “You can’t make a Reich without breaking a few bones,” and that guy got 100% of the vote – who are we to argue with success?

Anyway, I’m not trying to get political – there are “very fine people on both sides” but this boiling tension between the US and China can’t be ignored and, with campaign season heating up, many GOP candidates have accused President Joe Biden of being weak or naive on China, and have called for a more assertive and competitive approach to counter China’s influence and aggression in the Indo-Pacific region and beyond.

In retaliation against the U.S. and its allies for imposing restrictions on China’s access to advanced semiconductors and equipment, China recently announced that it will restrict the export of two rare earth metals, gallium and germanium, starting on August 1st. These metals are used to make computer chips and other high-tech products, such as electric vehicle batteries, radars, and satellites. China is the world’s largest producer and exporter of both metals, accounting for 80% of global gallium production and 60% of global germanium production.

China’s export restrictions could have significant implications for the global chip industry, which is already facing a severe shortage of supply and rising demand. The restrictions could also affect other industries that rely on rare earth metals, such as Renewable Energy, Aerospace, and Defense. Some countries may try to find alternative sources of supply or develop their own production capacity of rare earth metals, but this could take time and money .

The implementation of alternative strategies face many challenges. Developing domestic production and new ventures requires substantial investment and time. Additionally, political and environmental factors might affect the feasibility of certain approaches, especially in regions with sensitive ecosystems or competing interests. There’s a reason China is the World’s largest producer of Rare Earth’s – the labor conditions and pollution we now list as human rights violations are what make this kind of environmentally destructive mining possible. Do we really wan to bring that industry home to the US?

Meanwhile, poor China has been working like Hell to stimulate their economy including $445Bn worth of Business Investment Projects and, don’t forget, their economy is half the size of ours so that’s like us rolling out a $1Tn package. And, on Friday, China vowed to support urban construction along with a 10-step plan to increase car sales (which is why Elon Musk is over there kissing ass).

All that stimulus would have been great for us, but we don’t play nice with China anymore – so who knows what’s going to happen? Meanwhile, Europe’s July PMI looks like this:

Anything below 50 is contraction so – yikes! The Eurozone Manufacturing PMI fell to 42.7 in July from 43.4 in June, the lowest in three years, missing expectations of EU Economorons (yes, they have their own!) of 43.5 to point to one full year of consecutive contractions in the currency bloc’s manufacturing sector as higher borrowing costs from the ECB continued to bite. The decline in new orders sank at one of the fastest paces since 2009, widening the gap to the drop in output and signaling more decreases in future production, as backlogs of work continued to be cleared to sustain current operating levels.

Meanwhile, we are still pretending none of those things are happening here – such fun!

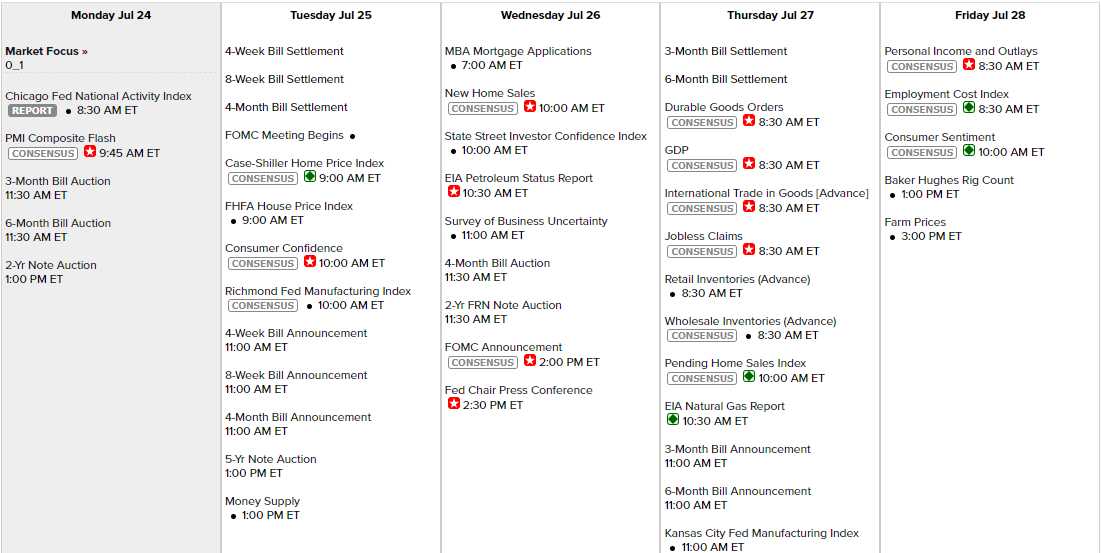

We have our own PMI Report this morning after the bell and the Chicago Activity Index was down another 0.32 for June after a -0.28 in May – slip sliding away… Tomorrow we have Housing Data, Consumer Confidence, and the Richmond Fed along with an important 5-Year Note Auction. Wednesday is New Home Sales, Investor Confidence and Business Uncertainty followed by the Fed at 2 and Powell at 2:30 (during our Webinar). Thursday we have Durable Good, Q2 GDP, Business Inventories and even more Housing Data and Friday is Personal Income & Outlays AND Consumer Sentiment but that is NOTHING compared to 135 S&P 500 Earnings Reports, including:

I still think the market is toppy and earnings are very dangerous but I’ve been wrong about that since Q1 – so why stop now? The Dollar has bounced 1% off its lows since Thursday and the indexes are shaking that off – so why not everything else?