Moments ago the Treasury concluded the week’s first sale of coupon paper when it sold $42BN in 2Y paper in what was a solid, if not stellar auction.

The auction stopped at a high yield of 4.823%, which was above last month’s 4.670% and the highest yield since June 2007. The auction tailed the When Issued 4.820% by 0.3bps, ending the brief streak of two stopping through 2Y auction.

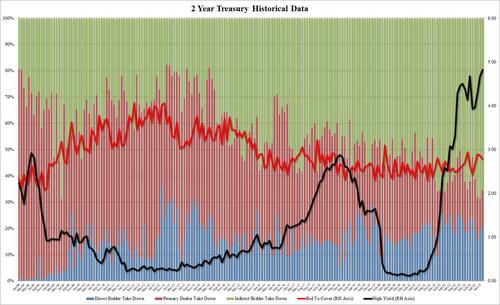

The bid to cover of 2.782% dipped below last month’s 2.860% but was above the recent average of 2.74%.

The internals were also above average, if hardly spectacular, with Indirects taking down 65.5%, below last month’s 68.5% but above the 63.0% recent average; and with Directs taking down 20.8%, or the most since March, and just above the six-auction average of 19.9%, Dealers were left with an award of 13.8%, the most since May.

Overall, a solid if hardly spectacular auction, one which benefited from the modest concession today as 10Y yields rose to 3.86%.