It's that time again!

It's that time again!

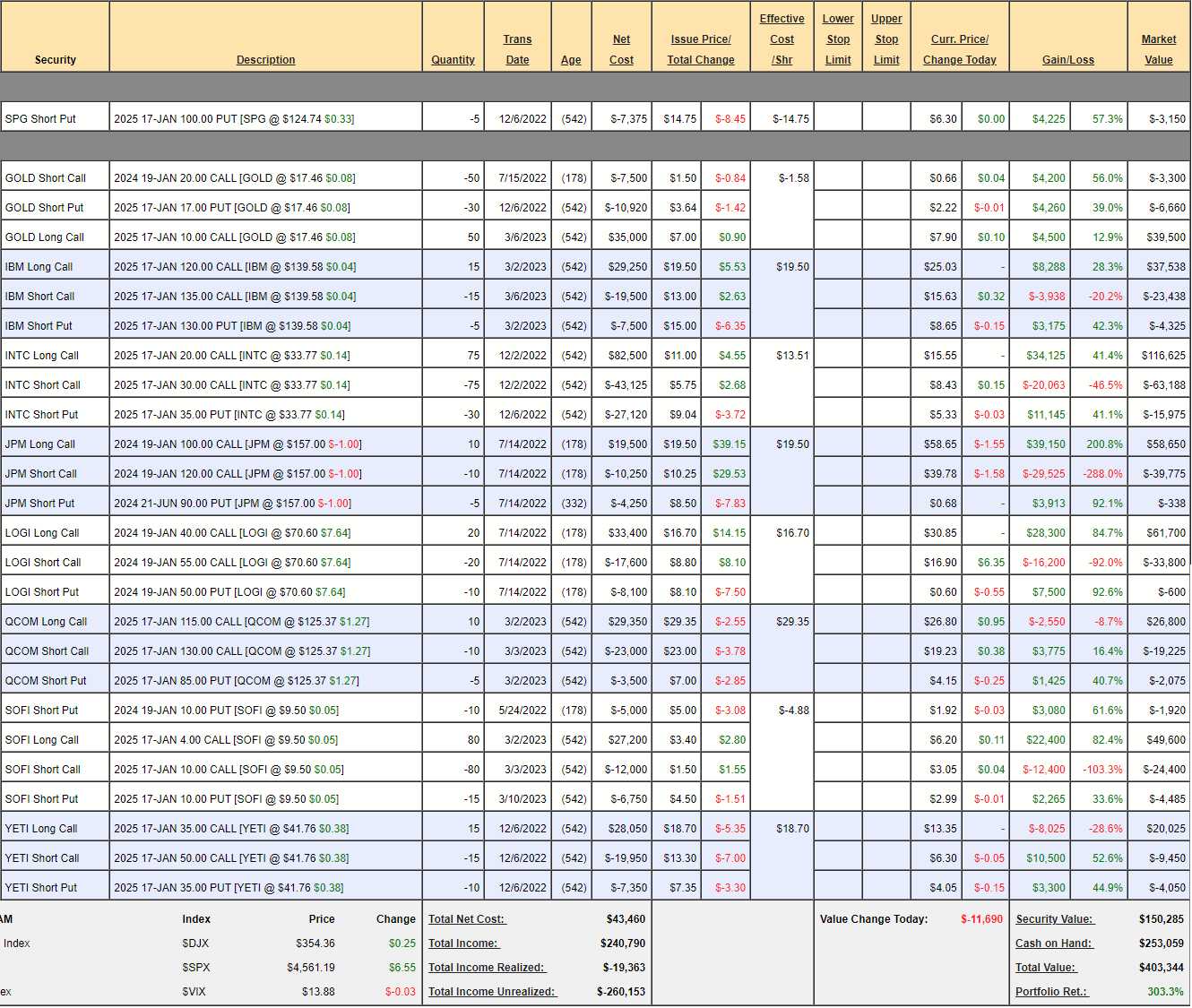

Last time I was on Bloomberg's Money Talk Show our portfolio was at $310,971 (up 211%) on March 1st and we had no clue there was about to be a financial crisis. We mostly talked about AI, which was just heating up at the time and it does, in fact, seem to be a big thing - as we predicted...

What's scary is that in March we were thinking musicians and writers and artists would be safe from AI but the actor's strike seems to say otherwise and AI is already doing the entire title sequence for the new Nick Fury show - that's how quickly thing are advancing...

For the portfolio, we decided to add trades on QCOM and IBM to participate in the hoopla and our QCOM trade is already up 100% but there's still 172% left to gain - so you haven't missed much! IBM is up 334% in 4 months but that still has 130% of additional upside - so not bad either!

The whole portfolio is, in fact, now up to $403,344 (up 303%) and that's up a whopping $92,373 (29.7%) since March 1st.

After such a big market run, I'm looking to take something off the table but, as usual, we'll also add a couple of new trades. This is the ultimate low-touch portfolio as we only adjust it every 3-4 months, on days when we're taping a show. You would think that's a handicap but we simply pick our most bullet-proof value plays - as recent events have demonstrated.

- SPG – We sold short puts to remind us to keep an eye on them. We got paid $14.75 ($7,375) for promising to buy SPG for $100 so either we get to own the stock for net $85.25 (30% off the current price) or we just keep the $7,375.