“I’m travelin’ down the road

I’m flirtin’ with disaster

I’ve got the pedal to the floor

My life is running faster

I’m out of money, I’m out of hope

It looks like self destruction

Well how much more can we take

With all of this corruption” – Molly Hatchet

The Russell is trading at 27 times earnings.

Actually it’s a bargain compared to the Nasdaq, which is at 32.72 times earnings and the Russell was over 2,400 in November of 2021 – so this is not uncharted territory but, as you can see from the chart, this is our 3rd attempt in the past year to get back over 2,000 – right into earnings as well as what is almost certainly more Fed tightening.

At the moment, the Russell is up 12.5% for the year so we’ll see if earnings can justify it or if, once again, we crash back below 1,800 (down 10%) – as we did in August and February. Russell stocks aren’t actually that small, the average Market Cap in the index is $2.8Bn and there are, in fact, 2002 companies in the index, not 2,000. The Index is dominated by Industrials, Health Care and Financials, which make up half the Index. Consumer Discretionary and Technology are another 26% and then Real Estate, Basic Materials, Utilities, Consumer Staples and Telcom bring up the rear at single digits each.

We will be watching earnings closely to see what the companies say about the risks and challenges that could affect the earnings outlook for 2023 like the impact of inflation and interest rate hikes on small-cap companies, which tend to have higher debt levels and lower profit margins than large-cap companies and competitive pressure from large-cap companies, which have more resources and scale to adapt to the changing market conditions and customer preferences.

We will be watching earnings closely to see what the companies say about the risks and challenges that could affect the earnings outlook for 2023 like the impact of inflation and interest rate hikes on small-cap companies, which tend to have higher debt levels and lower profit margins than large-cap companies and competitive pressure from large-cap companies, which have more resources and scale to adapt to the changing market conditions and customer preferences.

As we discussed in last week’s Webinar, small cap companies are consumers of AI – not providers and, while small caps can be nimble, this kind of implementation takes time and resources they may not have in this tight-credit environment. If the large caps have really been doing so well – has it been at the expense of the small caps?

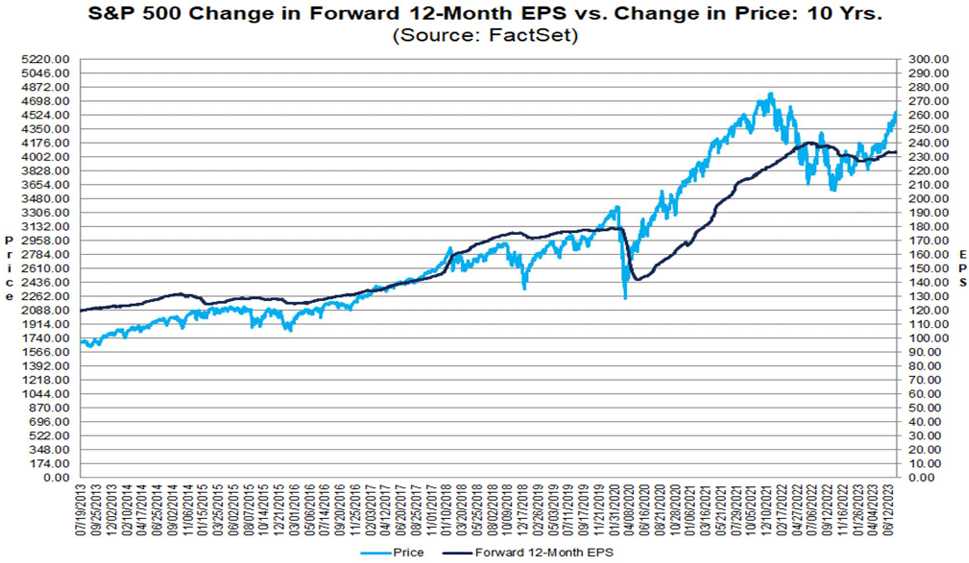

Only 18% of the S&P 500 have reported so far and they tend to report first because they have huge accounting firms that spit out Q2 Reports much faster than small-caps tend to. 75% of the S&P Reporting Companies have beat so far but they beat expectations that assumed we’d be in a Recession this year – so don’t get too excited about it.

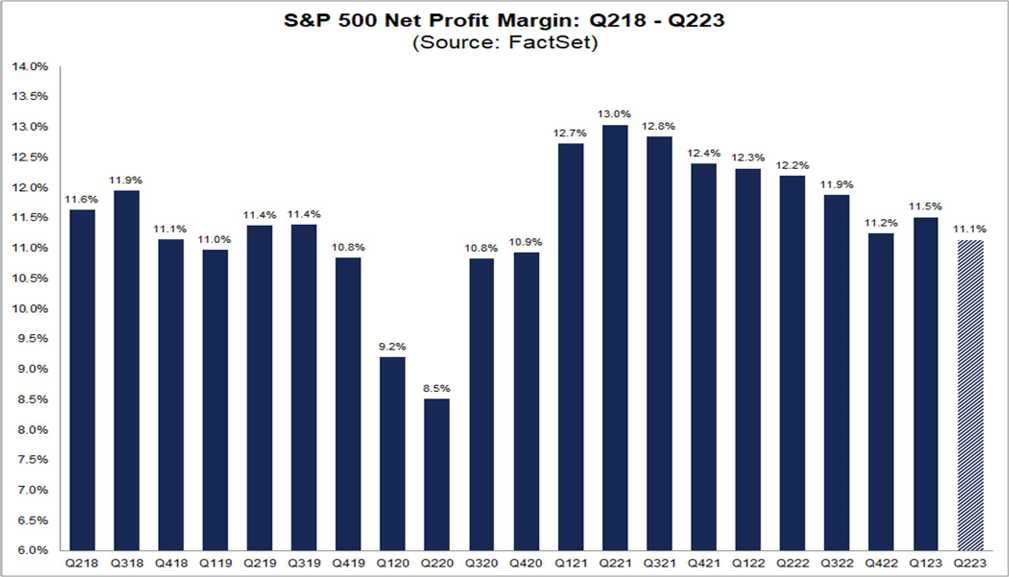

Oops, too late, it looks like the index is already excited at 4,554 which is funny because from June through September last year, the S&P was lower when actual earnings projections were higher. Overall Q2 earnings are expected to be 9% lower than they were last year – a very low bar to climb over… Also worrying is the consistently lower profit margins we’ve been seeing as the stimulus wound down:

There have been revisions and the average revision was down 7% from last year – this is why we added more hedges in our Short-Term Portfolio – so far, so wrong on that one! As much as I’d like to take the blue pill and continue to ignore the fact that we’re in the AI matrix of irrational market exuberance – I just can’t – I’d seen this 3 times now – 1987 (S&L Crisis), 2000 (Dot.com) and 2008 (Housing) and here we are in 2023 and we haven’t learned a thing, have we?

And I’m not even counting the complacency we had into Covid (this is why we made so much money in our last set of portfolios, we saw that one coming!) and we had yet another banking crisis in MARCH – of 2023! Have we already forgotten?

This reminds me of when my kids were little and I realized it was easier to let them hurt themselves once in a while than to try to police all of their actions as they really only learn by experience. So, while I would leap to stand between them and the stovetop, if they wanted to put their hand on the oven door I would simply say “Ouchie Hot!” and let them defy me. That was hot but didn’t burn and they learned to stay clear of the oven area in general.

This reminds me of when my kids were little and I realized it was easier to let them hurt themselves once in a while than to try to police all of their actions as they really only learn by experience. So, while I would leap to stand between them and the stovetop, if they wanted to put their hand on the oven door I would simply say “Ouchie Hot!” and let them defy me. That was hot but didn’t burn and they learned to stay clear of the oven area in general.

Morgan Stanley’s Chief US Equity Strategist, Mike Wilson has been bearish on the markets and wrote a capitulation letter to clients yesterday, saying: “We were wrong. 2023 has been a story of higher valuations than we expected amid falling inflation and cost cutting.” Wilson has spent most of 2023 warning the rally would reverse itself, sounding alarms on technology shares and arguing that March’s banking turmoil portended a “vicious” selling climax that was needed before shares could start rising again.

JP Morgan’s Marko Kolanovic, on the other hand, is still with me, warning yesterday that the delayed impact of aggressive interest-rate hikes by Global Central Banks, dwindling Consumer Savings and a “deeply troubling” Geopolitical Backdrop are poised to spur fresh market declines and volatility. “We acknowledge that we cannot time this inflection near term, but there are no data points that would prompt us to change our methodology or conclusions,” Kolanovic wrote.

From his perspective, this year’s advance is the result of a “mechanical re-risking” amid low volatility and hype around artificial intelligence that’s stoked gains in big technology stocks. He said the extreme concentration in the S&P 500 “could be indicative of a bubble” and predicted that macroeconomic indicators will soon reflect the lagged impact of monetary tightening.

David Rosenberg, for his part, sees the U.S. Federal Reserve ending its rate hikes soon — but says the economic damage has been done. He expects U.S. businesses and consumers to cut spending, unemployment to rise, and companies and consumers to turn increasingly cautious as the U.S. economy slips into Recession.

David Rosenberg, for his part, sees the U.S. Federal Reserve ending its rate hikes soon — but says the economic damage has been done. He expects U.S. businesses and consumers to cut spending, unemployment to rise, and companies and consumers to turn increasingly cautious as the U.S. economy slips into Recession.

As he puts it: “Recessions are like an odorless gas. They sneak up on you. “There is no chance we’re having a soft landing in the context of the most pernicious tightening by the Fed since the Paul Volcker years,” Rosenberg says.

At the moment, as we wait for the earnings data – all I can say to you is – Be careful – Ouchie hot!