Heading into today’s FOMC day, it was iffy if the Dow Jones would be able to extend its string of 12 straight gains to a 13th day (which would mark the longest such stretch since 1987). However, after prominent Dow member Boeing (which was a 4% weight in the index) unexpectedly reported solid numbers sending its stock sharply higher, the odds of a lucky 13 for Dow bulls have increased substantially.

In a welcome twist from a company whose earnings have generally disappointed for much of the past 4 years, Boeing reported that in Q2, it generated $2.58 billion in free cash flow, far exceeding expectations of a $74 million in cash burn, as a flurry of jet deliveries and customer deposits helped overcome the financial strain from supplier glitches. Analysts had expected the airplane giant to keep burning through cash after it grappled with output disruptions to its workhorse 737 Max and the 787 Dreamliner.

Still, despite the impressive FCF, Boeing notched its eighth straight money-losing quarter, The adjusted loss stood at 82 cents a share, according to a statement Wednesday, compared with the consensus estimate of a 84-cent loss.

Here are the highlights of the company’s Q2 report:

-

Revenue $19.75 billion, beating estimates of $18.53 billion

-

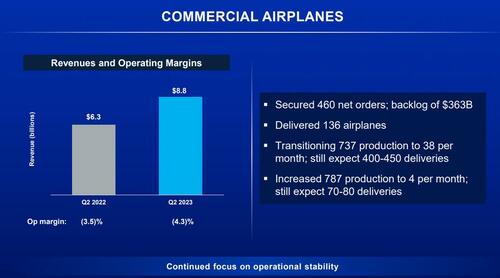

Commercial Airplanes revenue $8.84 billion, estimate $7.64 billion

-

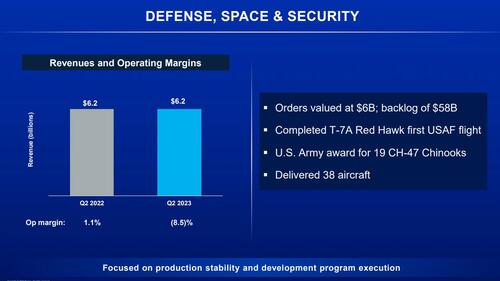

Defense, Space & Security revenue $6.17 billion, estimate $6.16 billion

-

Global Services revenue $4.75 billion, estimate $4.63 billion

-

-

Core loss per share 82c, exp. loss 84 c

-

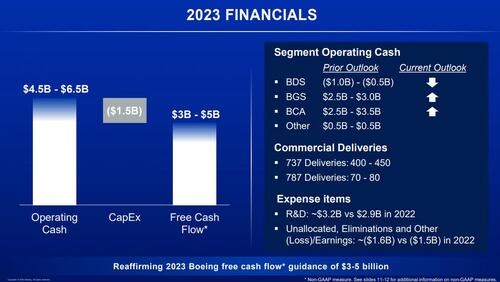

Adjusted free cash flow $2.58 billion, smashing estimates of negative $73.6 million

-

Operating cash flow $2.88 billion, beating estimates of $435.6 million

The company took a $257 million accounting charge after indefinitely delaying the first crewed flight of its Starliner spaceship, bringing its total overruns for the years-late capsule to more than $1.3 billion. The performance of the defense division was also crimped by new charges for a T-7 training jet and MQ-25 aerial refueler.

Boeing’s defense and space division posted another quarterly loss – this time $527 million, missing badly the est. profit of $102.3 million, as it struggles with worker turnover, parts shortages and inflation, particularly on fixed-price contracts that it won last decade with bids that were near break-even.

Investors will wait patiently for Boeing to turn around its defense business as long as the performance of its mainstay commercial airplanes division continues to improve, George Ferguson, an analyst with Bloomberg Intelligence, said before the results were released.

“The upside for commercial is a lot more than the upside for BDS,” Ferguson said, referring to the defense and space unit by its acronym.

Elsewhere, the company Global Services division generated operating earnings $856 million, beating est. $753.2 million

Boeing delivered 136 jets in Q2, about 21% more than expected, while inspecting and repairing 737s and 787s for defective supplier parts and contending with the strike at Spirit, its largest supplier.

“We have more work ahead to improve performance, but our progress is clear and we’re confident in our path forward,” Calhoun said.

In a further sign its aircraft production is stabilizing after years of turmoil, Boeing said it is starting to raise output of its 737 jetliners to a 38-jet monthly rate, which according to Bloomberg is a 23% jump from the previous manufacturing pace, which had been in place for about a year as the US planemaker worked to get its factories and suppliers in sync.

-

The company also said it plans to reach a level of 50 737s per month in the 2025/2026 timeframe, and still expects to deliver 400-450 airplanes this year.

-

Boeing increase production in the 787 program to four per month with plans to ramp to five per month in late 2023 and 10 per month in the 2025/2026 timeframe. The program still expects to deliver 70-80 airplanes this year

The steps are crucial if Boeing is to reach Calhoun’s goal of generating $10 billion in free cash in that timeframe.

“This is a complex business and we expect challenges to come up. When they do, we are transparent, we take action and we move forward, one airplane at a time,” Dave Calhoun, Boeing’s chief executive officer, said in a message to employees. “While it can be difficult in the moment, this is what progress looks like.”

Last month, workers at Boeing supplier Spirit AeroSystems Holdings Inc. went on strike for a few days. Spirit makes most of the fuselage of Boeing’s all-important 737 model. Boeing and rival Airbus SE have both cautioned that supply constraints continue to hurt output and might remain a headache for years.

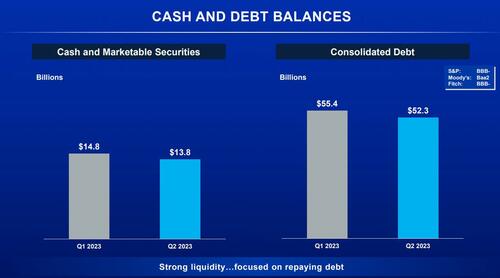

Boeing’s impressive cash flow generation helped reduce the company’s consolidated debt by $3.1 billion from $55.4BN to $52.3BN sequentially, which however was offset by a $1BN decline in cash to $13.8BN. Still, net debt declined by more than $2BN in the quarter, solidifying the company’s investment grade rating.

The company remains on track to generate between $3 billion and $5 billion in cash this year. Boeing also affirmed its previous target of delivering between 400 and 450 of its narrowbody 737 jets and 70 to

The solid earnings come one month after workers at Boeing supplier Spirit AeroSystems Holdings went on strike for a few days. Spirit makes most of the fuselage of Boeing’s all-important 737 model. Boeing and rival Airbus SE have both cautioned that supply constraints continue to hurt output and might remain a headache for years.

Airbus and Boeing have been struggling to return their factories to pre-Covid production rates as they grapple with inexperienced workers and shortages of micro-electronics, seats and other parts. Even so, demand is booming for new, fuel-efficient jetliners and the planemakers are enjoying their largest sales boom in years.

Boeing unveiled its earnings ahead of Airbus, which comes out with its numbers later on Wednesday. Before the report, the US planemaker’s shares had gained 12% so far, outpacing the 6.9% increase for the 30-member Dow Jones Industrial Average. Airbus, based in Toulouse in France, is up about 18%. Boeing rose about 3.6% in early morning trading as it also beat on revenue and earnings.

The full Boeing presentation is below (pdf link)