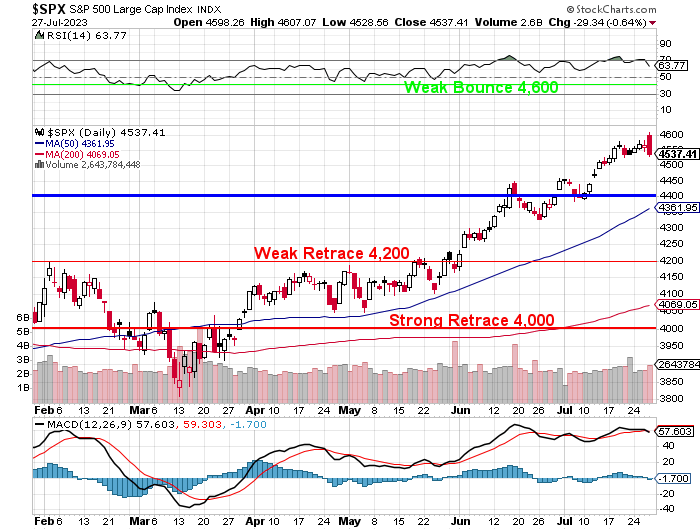

It’s not working out so far on our aggressive S&P chart as we’re still below the weak bounce line, despite rising 2.22% for the month (4,500 to 4,600). Our old S&P chart had a mid-point of 4,000 but that was from way back in March of 2020, when we predicted S&P 4,000 by the end of 2021 (nailed it) and we saw no reason to change our target for 2022 (nailed it) and this year, just last month, we decided we should at least give the S&P the benefit of the doubt and adjust 10% for inflation – if not actual profits.

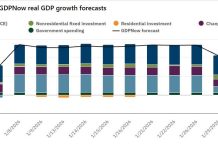

But the inflation already happened so why can’t the chart make a break higher? It’s because the actual profits of the S&P 500 haven’t kept up with inflation. The S&P 500 isn’t even keeping up with GDP, which was $20.5Bn in 2018 and $21.1Bn in 2020 and a whopping $25.5Bn last year – up 25% from 2018.

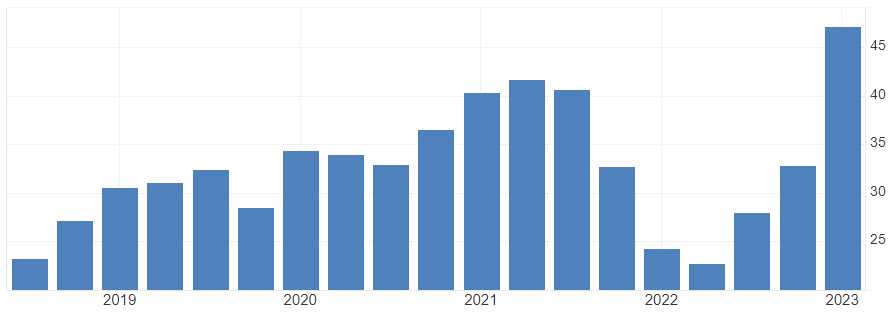

What has kept up with inflation – for some crazy reason – is earnings multiples, which are as out of control as eggs or cream cheese:

That’s the S&P Global, fortunately, our S&P 500 is “only” at 30x earnings but that’s pretty bad and the rest of the World is INSANE! Our strategy for 2023 has been to stick to stocks that are trading well below 20x earnings and not carrying too much debt with a high earnings/employee ratios – to avoid getting burned by wage increases too. That has given us solid performance so far and I see no reason to change that strategy in the second half.

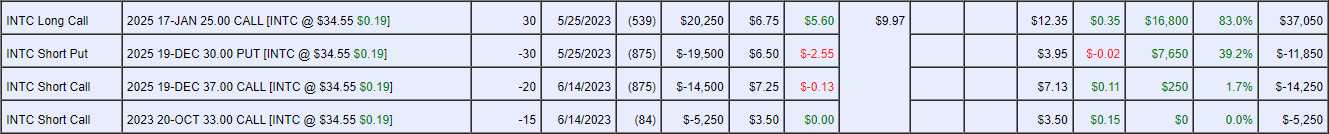

This morning one of our sleeping giants, Intel (INTC) knocked it out of the park by beating top and bottom lines and raising guidance. This seemed to surprise everyone but our Members, as INTC is in all of our portfolios!

As I just noted in Wednesday’s Money Talk Portfolio Review:

“INTC – We bought back our short-term calls in March and that was good timing as INTC is finally popping up a little. Now the spread is net $37,462 not even counting the $25,825 we already made on the short calls (it’s been realized as cash on our balance sheet) but I’m in no hurry to re-cover as we’re almost 100% in the money now. The net of the $75,000 spread is $37,462 so there’s $37,538 left to gain – almost exactly a double from here if Intel can get over that $35 target in 18 months.”

In our Income Portfolio Review, we added another spread on the 18th:

“INTC – Finally waking up after a long, long slumber. We’re getting stung by the short Aug $30 calls now and I expect them to keep going so we’re going to roll the 5 short Aug $30 calls at $4.73 ($2,363) to 10 short Nov $35 calls at $2.70 ($2,700) and we’re going to buy 10 Dec 2025 $30 ($10.25)/45 ($4.50) bull call spreads for $5.75 ($5,750) and that gives us another $9,250 of coverage for $5,750 and also gives us more comfort selling 10 short calls in the future and we have 885 days to sell and we’re using 122 of them for November but the original spread was a net $5,725 credit so now we’re at net $312 credit on what is now a $30,000 spread with the potential for 6 more sales of $2,700 ($16,200) while we wait.“

In our Long-Term Portfolio Review, also on the 18th, we got much more aggressive:

“INTC – Thank goodness for this one! Way, way up and I think perfectly positioned. Only net $5,137 on the $36,000 spread so let’s double down on this one as it’s got $30,868 (600%) left to gain! I can’t think of a trade more likely to make 600% than this…“

Remember – I can only tell you what is likely to happen and how you can profit from it – that is the extent of my powers…

For my next trick, let’s look at Crocs (CROX) who are on our watch list be were too expensive for us over $100. They just had very disappointing earnings and are plunging back there this morning – but are they still a buy?

Q3 Revenues were expected to be $1.06Bn but now the company is saying more like $1.02Bn (gasp!) but they did beat the top and bottom line for Q2 and full-year 2023 looks like about $3.85Bn vs their prior forecast of $4.05Bn and EPS estimates have been RAISED from $11.47 to $12.

WFT are people selling this for? I have not got a clue but thank you for the opportunity as $100 on CROX is $5.4Bn in market cap and they are dropping $720M to the bottom line, which is a p/e of 7.5x earnings. They have $2.2Bn in debt but that’s pretty normal for a Manufacturer/Retailer.

Just to be sure, I’ll ask Warren to summarize the Earnings call for us:

🤖 Summary and Analysis of Crocs, Inc. (CROX) Q2 2023 Earnings Call Transcript:

Crocs reported strong Q2 2023 earnings, beating expectations. The company reported an EPS of $3.59, surpassing estimates by $0.61, and generated revenue of $1.07 billion, exceeding estimates by $29.23 million. The company’s revenues grew by 11.17% year-over-year.

Andrew Rees, CEO of Crocs, expressed his pleasure with the results, highlighting record quarterly revenues of over $1 billion. The Crocs brand continued to perform well, showing strong growth in Asia and North America. Additionally, the company’s HEYDUDE brand experienced exceptional direct-to-consumer (DTC) growth of 30% and digital growth of 37% on a constant currency basis.

Despite the impressive results, the company issued cautious guidance for HEYDUDE’s growth in the back half of the year due to uncertainty in future bookings and distribution challenges related to ERP and warehouse transitions.

The company emphasized its focus on product innovation and brand health to drive growth. They highlighted their success with new product introductions, diversifying their clog offering, and strong performance in the sandal category.

Regarding geographic performance, the Crocs brand saw significant growth in Asia, with revenues in China increasing over 100% in Q2. The company expressed confidence in the long-term potential of the Crocs brand in China, an underpenetrated market relative to the US.

Crocs also discussed their digital-first approach, emphasizing strong growth in online sales driven by new product introductions and investments in digital marketing and customer acquisition.

In terms of financials, the company reported improved adjusted gross margins of 58.1% and adjusted operating margins of 30.3%. Crocs is actively managing its debt, using its free cash flow to repay approximately $300 million of debt in the first half of the year and resuming share repurchases.

For the full year 2023, the company raised its revenue growth outlook to 12.5% to 14.5% on a reported basis, up from the previous guidance of 11% to 14%. They also raised the adjusted operating margin outlook to approximately 27.5% and adjusted diluted EPS to $11.83 to $12.22.

Regarding HEYDUDE, they lowered their full-year growth outlook to 14% to 18% on a reported basis due to cautious wholesale partners and distribution constraints.

Analysis:

Crocs reported impressive Q2 results, with significant revenue growth and strong profitability. The company’s focus on product innovation and brand health seems to be paying off, as evidenced by robust sales in both the Crocs and HEYDUDE brands. The company’s performance in Asia, particularly in China, is noteworthy and reflects the potential for future growth in the region.

However, the cautious outlook for HEYDUDE’s growth in the back half of the year raises some concerns. It appears that the company is facing challenges with wholesale partners and distribution capabilities, impacting the brand’s near-term revenue outlook. Despite this, Crocs remains optimistic about the long-term potential of the HEYDUDE brand, which has shown strong consumer demand and growth in digital sales.

Overall, Crocs’ Q2 2023 earnings call highlights the company’s continued success in the footwear market, driven by strong brand momentum, global expansion, and a digital-first approach. However, investors should keep an eye on the company’s ability to overcome the challenges faced by the HEYDUDE brand and maintain its growth trajectory in the future.

So the panic people are having are over issues involving HEYDUDE, which is a casual footwear brand they bought last year for $2.5Bn. These are more traditional shoes so CROX is investing time and money to integrate it with their current offerings. This is certainly no reason to shun the company.

For our Long-Term Portfolio (LTP), let’s add the following spread:

-

- Sell 10 CROX 2025 $110 puts for $25 ($25,000)

- Buy 20 CROX 2025 $100 calls for $30 ($60,000)

- Sell 15 CROX 2025 $130 calls for $18.50 ($27,750)

That’s net $7,250 on the $60,000+ spread (it’s not fully covered) and we have room to sell 5-10 short-term calls for income – once things calm down. I love these kinds of opportunities. If all goes well, we’ll make $52,750 (727%) PLUS whatever we make selling short calls while we wait.

This is so good, we can’t pass it up in the Income Portfolio:

So let’s do the exact same play in the Income Portfolio, but with 5 short puts ($12,500) and 12 long 2025 $100s ($36,000) and 8 short $130 calls ($14,800), which would be net $8,700 but has half the obligation from the short puts and still makes net $27,300+ (313%) if all goes well .

Aren’t options fun? This is the kind of money we can make in a relentlessly up market – so I’m certainly not worried we’re going to miss anything by being “mostly” cautious.

Have a great weekend,

-

- Phil