“Maybe you’ll get a replacement

There’s plenty like me to be found

Mongrels who ain’t got a penny

Sniffing for tidbits like you

“Oh, I’ve finally decided my future lies

Beyond the yellow brick road“ – Elton John

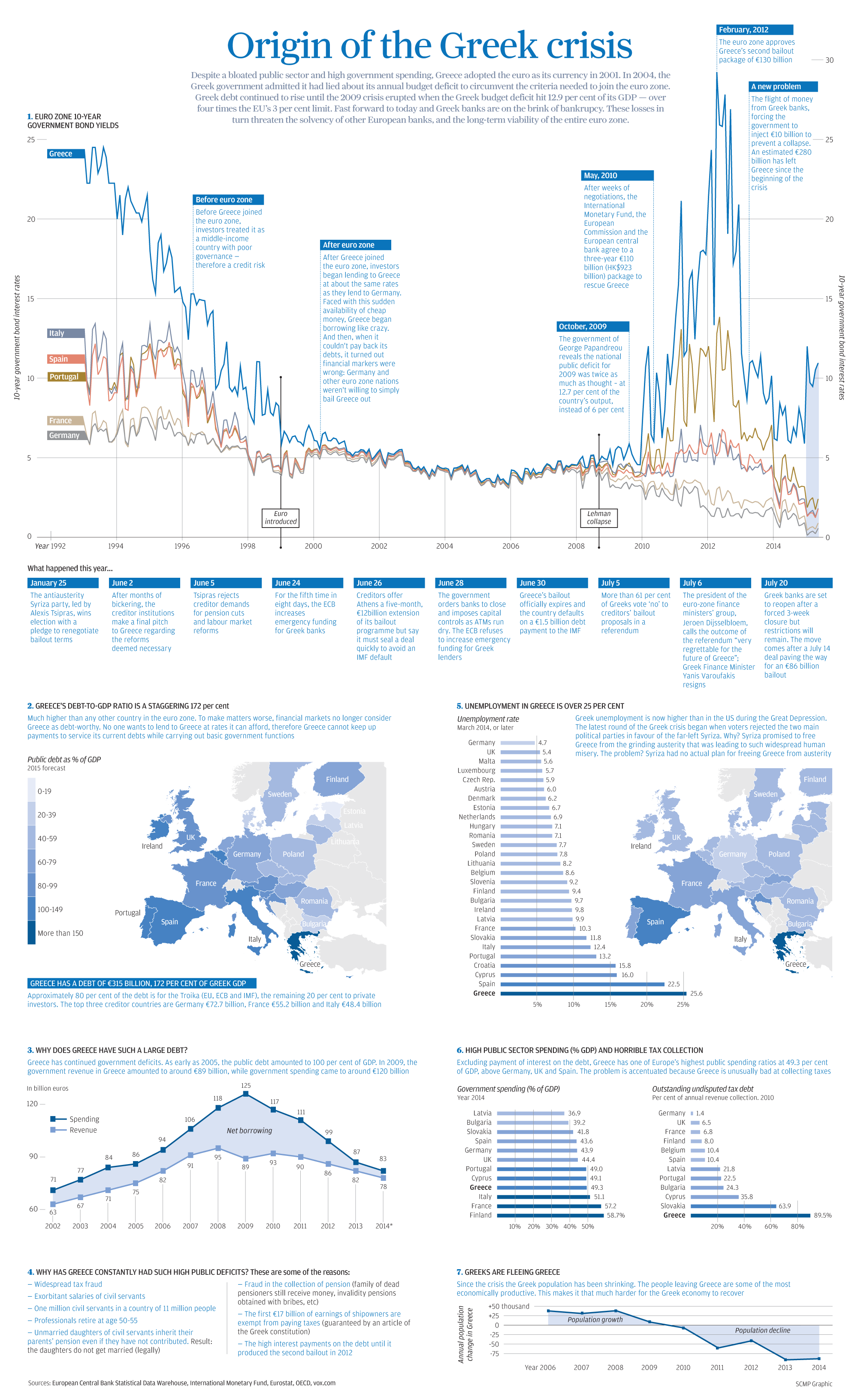

Very suddenly, Yellow (YELL) has shut down.

They have been in a death spiral for the last two years but rising rates and rising wages finally caused the company to decide to suspend operations and file for bankruptcy last night. Though the did not make any money, YELL had $4.6Bn in revenues on which they were losing $200M (4.3%) and SOMEBODY will take a hit on their $1.3Bn (28%) in debt.

I tell our Members over and over again not to buy companies where it will take more than 5 years of earnings to pay off their debts and this is why – at a certain point, it’s simply not possible to pay your bills.

UPS, by comparison, just settled with their Labor Unions and they make $10Bn (10%) on $100Bn in annual revenues so hopefully, between UPS and other trucking survivors, they can pick up YELL’s slack without too much chaos. YELL’s biggest customers are WMT and HD and other companies will do whatever it takes for their business but thousands of other small businesses who rely on YELL – and their much lower prices – are going to be in a world of hurt in August – not to mention YELL’s 30,000 employees, who have lost their jobs and their pensions and their health care.

UPS, by comparison, just settled with their Labor Unions and they make $10Bn (10%) on $100Bn in annual revenues so hopefully, between UPS and other trucking survivors, they can pick up YELL’s slack without too much chaos. YELL’s biggest customers are WMT and HD and other companies will do whatever it takes for their business but thousands of other small businesses who rely on YELL – and their much lower prices – are going to be in a world of hurt in August – not to mention YELL’s 30,000 employees, who have lost their jobs and their pensions and their health care.

A shutdown would also bring new scrutiny to the Trump administration’s decision to give the company a $700 million Covid rescue loan in 2020 (YELL did have some DOD contracts). The U.S. Treasury now holds about 30% of Yellow’s shares, which have plunged and ended Friday at 71 cents apiece. All that $700M did was buy YELL 2 more years of operation before the inevitable. A congressional report in June concluded that the Treasury Department had skirted its own rules in giving out the loan and that the Trump administration erred in lending the money to the troubled company.

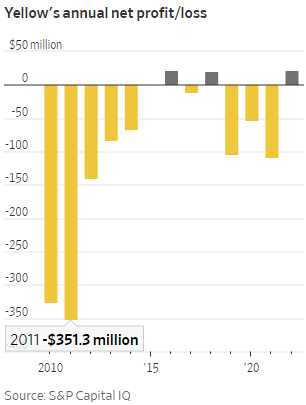

Speaking of lending – 7-Year Auction Prices hit a record high last week in a stark reminder that the Fed doesn’t actually control rates – they are set at auctions by bidders who WANT to buy US Debt and, if those bidders decide US Debt is as big of a risk as Yellow’s debt (the US is losing $1.5Tn (6%) a year on a $25Tn GDP). Unlike YELL, the US is $33Tn (132%) of Revenues in debt.

Speaking of lending – 7-Year Auction Prices hit a record high last week in a stark reminder that the Fed doesn’t actually control rates – they are set at auctions by bidders who WANT to buy US Debt and, if those bidders decide US Debt is as big of a risk as Yellow’s debt (the US is losing $1.5Tn (6%) a year on a $25Tn GDP). Unlike YELL, the US is $33Tn (132%) of Revenues in debt.

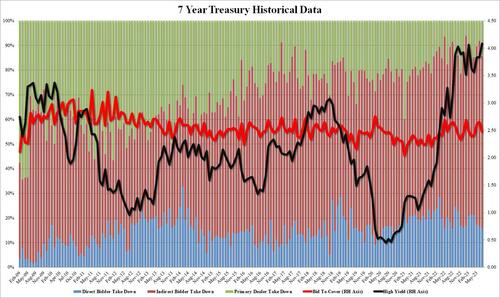

As with YELL, there comes a certain point at which no one is willing to lend you money and you can’t pay your bills anymore – and that event can seem to happen very suddenly (like Greece) – despite the fact that it was obviously coming to that point slowly for many years…

As with YELL, there comes a certain point at which no one is willing to lend you money and you can’t pay your bills anymore – and that event can seem to happen very suddenly (like Greece) – despite the fact that it was obviously coming to that point slowly for many years…

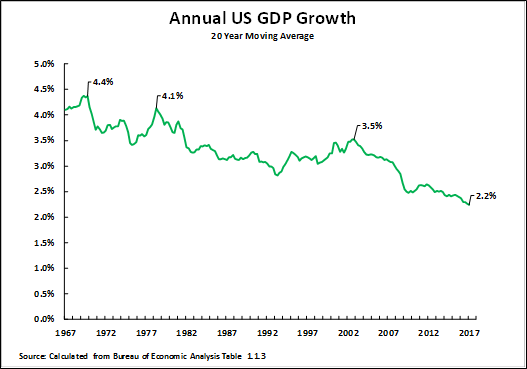

As you can see on this chart, the US used to grow like China – over 4% per year – so of course everything seemed great (again) in that sort of economy but, with 8Bn people already on a planet that is clearly over-stressed, we’re not likely to grow like that ever again.

Once “investors” (buyers of our debt) begin to feel we’re never going to grow our way out of debt and we’re never going to raise our revenues (taxes) or lower our spending (military) enough to balance the budget – then we begin to look like a credit risk and the Investors will begin to ask for more and more interest on their loans and, eventually, will stop lending us money. Then what?

Meanwhile, as noted in the WSJ, the benefit of owning stocks over bonds has shrunk to its lowest level in 20 years. This reduction in the equity-risk premium, which indicates how much investors are being compensated for the additional risk of owning stocks compared to “risk-free” government bonds, has raised concerns about the sustainability of the recent stock market rally. The earnings yield of the S&P 500 relative to government bond yields has narrowed significantly, and experts believe that the equity-risk premium cannot remain this low indefinitely.

The risk premium began to decrease in the second half of the previous year as stocks stabilized, while bond yields rose due to the Federal Reserve’s interest rate hikes to combat inflation. However, this year’s reduction in the premium is attributed to a different reason: bond yields haven’t risen significantly, but stocks have surged due to growing economic optimism among investors.

The risk premium began to decrease in the second half of the previous year as stocks stabilized, while bond yields rose due to the Federal Reserve’s interest rate hikes to combat inflation. However, this year’s reduction in the premium is attributed to a different reason: bond yields haven’t risen significantly, but stocks have surged due to growing economic optimism among investors.

Despite the low risk premium, investors and analysts do not believe that the stock rally has peaked yet. They point out that risk premiums have been even lower during the dot-com bubble in the late 1990s (which is an idiotic comparison when trying to explain how “safe” you are). Additionally, historical patterns suggest that risk premiums tend to revert to average levels over time, primarily because prospects for corporate earnings dim rather than due to investor concerns about valuations.

Some analysts hope that risk premiums may normalize if bond yields fall instead of stock prices – but that is also wishful thinking – as it ignores the outside forces we noted above. They find encouragement in the belief that the Federal Reserve might have completed its tightening cycle, as inflation shows signs of cooling. This optimism stems from interest-rate futures data indicating that investors see only a slightly better than 30% chance of further rate increases this year – something I noted on Bloomberg last week that I disagree with.

On the calendar, it’s the last day of the month so we’re dressing the Windows. We started the month at S&P 4,500 and, this morning, we’re just under 4,600 for a 2.22% rise for the month and we started the year at 3,900 so just under an 18% gain for the first 7 months is certainly off to a good start but, will we finish the year up 35%? That doesn’t seem likely, does it?

Meanwhile, earnings continue to come in fast and furious with a lot of big tech reporting this week as well as our beloved holdings of SOFI, SPWR, PFE, MO, GNRC, QCOM and COIN and SOFI has already beat and raised so we’re starting our earnings week off on a very strong note:

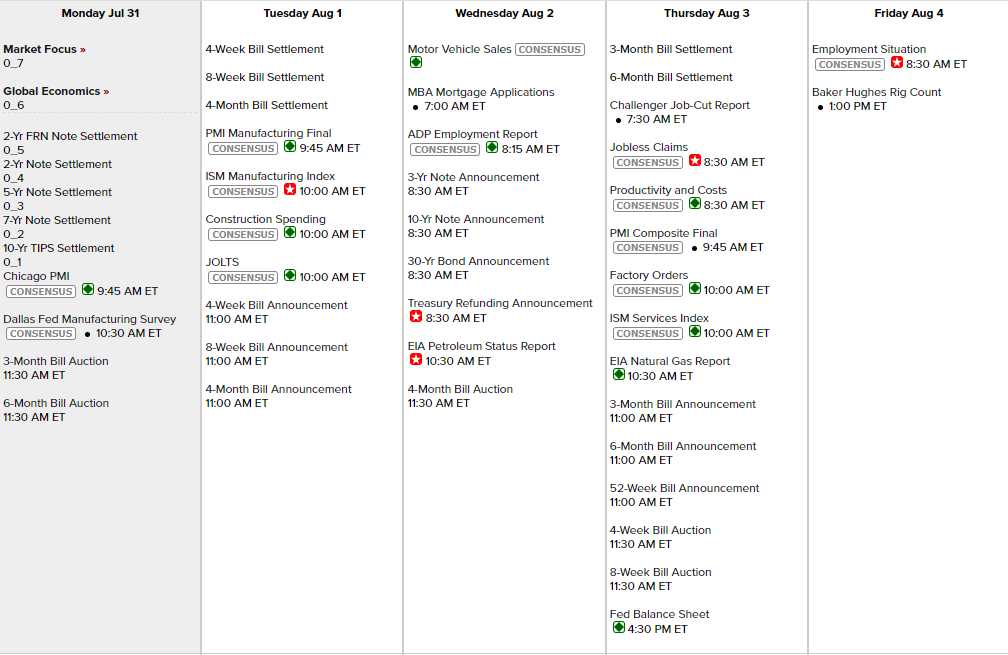

As to the Economic Data, there’s lots of stuff to keep us busy ahead of Friday’s Non-Farm Payroll Report: This morning we have Chicago PMI and the Dallas Fed, tomorrow it’s PMI, ISM, Construction Spending and JOLTS. Wednesday we have Mortgage Applications and ADP and then Thursday is packed with Productivity, PMI, Factory Orders and ISM.

It’s going to be an interesting week. The Russell keeps getting rejected at 2,000 so I expect the S&P to be rejected at 4,600 until that is resolved so it’s all up to earnings and data now that the Fed has fired their gun – we’ll see how things go.