There are 500 stocks in the S&P.

There are 500 stocks in the S&P.

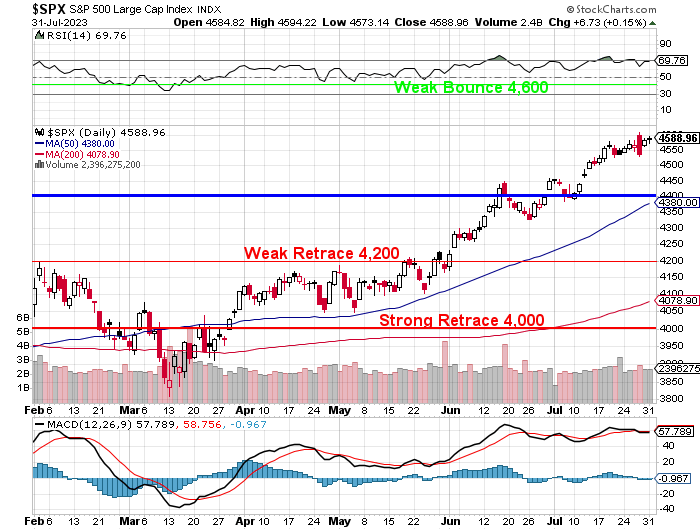

5 of them (1%) are responsible for 2/3 of the gains this year. Only 26% of the index (130 stocks) are above the 18% gain the overall index has had for the year and the other 370 stocks are “underperforming.”

This is the problem with earnings – we are forced to look at the other 370 stocks and think about whether they too should be bought in a SPY basket that is up 18% for the year. So far, they’ve been dragged up by the leaders and the over-achievers but, when push comes to shove and we finally see the numbers – those sky-high valuations can seem a bit STUPID in the light of day.

AMD, for example, promises to be making their own AI chips so they are trading at $184Bn ($114), which is up from about half that at the beginning of the year. AMD HOPES to make $4.5Bn this year, up from $1.3Bn last year and we’ll see how well that’s going but I certainly don’t see this as a Billion-Dollar Quarter for them as Q1 was a $127M loss – so they’ll have a lot of work to put in if they are going to hit those BS numbers!

Even if they do manage to find $4,500,000,000 in profits this year, they would still be trading at 44 times earnings – so any kind of disappointment here could send the stock sharply down but we don’t bet against AI in 2023, do we?

Salesforce (CRM) is another fun one at $225, which is $219Bn (so they must have about a Billion shares) but last year they only made $208M, which is a P/E of 1,052. In Q1 (Jan 30th for them), they lost $98M and in Q2 they made $199M so that’s positive $101M for the first half of the year – again investors seem to be overly enthusiastic about their chances…

Palo Alto Networks (PANW) also reports oddly and Q1 $84M and Q2 was $108M so it will be tricky for them to hit their projected $1.3Bn in profit for the year as they are running out of Quarters but, even if they do, $250/share is $76Bn so trading at 58 times earnings – a miss at the end of the month may be a hard slap in the face for unrealistic traders, who have taken PANW up 66% since the start of the year.

See – this is the problem. The “leaders” of the S&P (and the Nasdaq), who are carrying the rest of the indexes higher are often getting insane valuations that are unlikely to hold up. What will then happen to the indexes when they price back to reality? Unfortunately, we may find out soon.

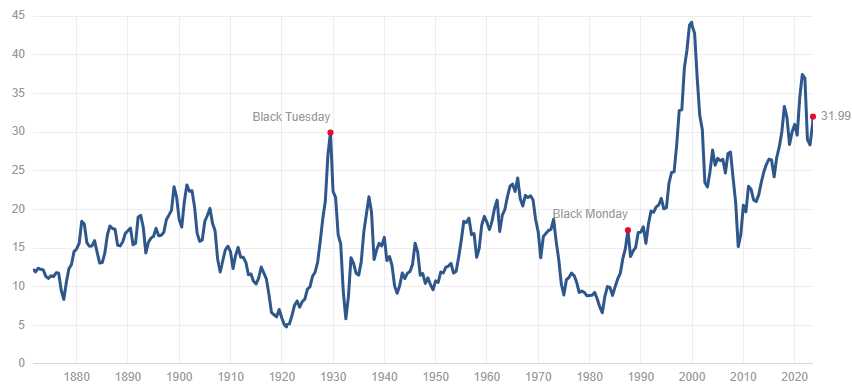

Expectations are certainly low, overall, the S&P 500 companies are projecting a 7% year/year DECLINE in earnings and projections are for Q3 and Q4 to also be lower – yet the S&P is up 17% over last year – go figure! The CAPE Ratio (the real p/e) for the index is now 31.99 – it was higher last year, when the S&P hit 4,800 and it was higher in 1999 – in 2008 it was “just” 27 before things collapsed.

There is very clearly a mis-match between the market’s impressive gains and declining Corporate Profits. All year long CEOs have been singing “the sun will come out tomorrow” but half the year is over – where’s the sunshine? If they don’t bring it – the second half could get very dark indeed!

UBER made a profit this morning – their first ever – making 0.18 per $49.50 share and let’s say they make 0.80 for the year, that’s a p/e of “only” 62 but that’s not what they project, they project just $5M in total profits for a p/e of 500,000 but they say the sun will come out in 2024 and they will make $2Bn for a p/e of “just” 50 times their earnings…

Be careful out there!