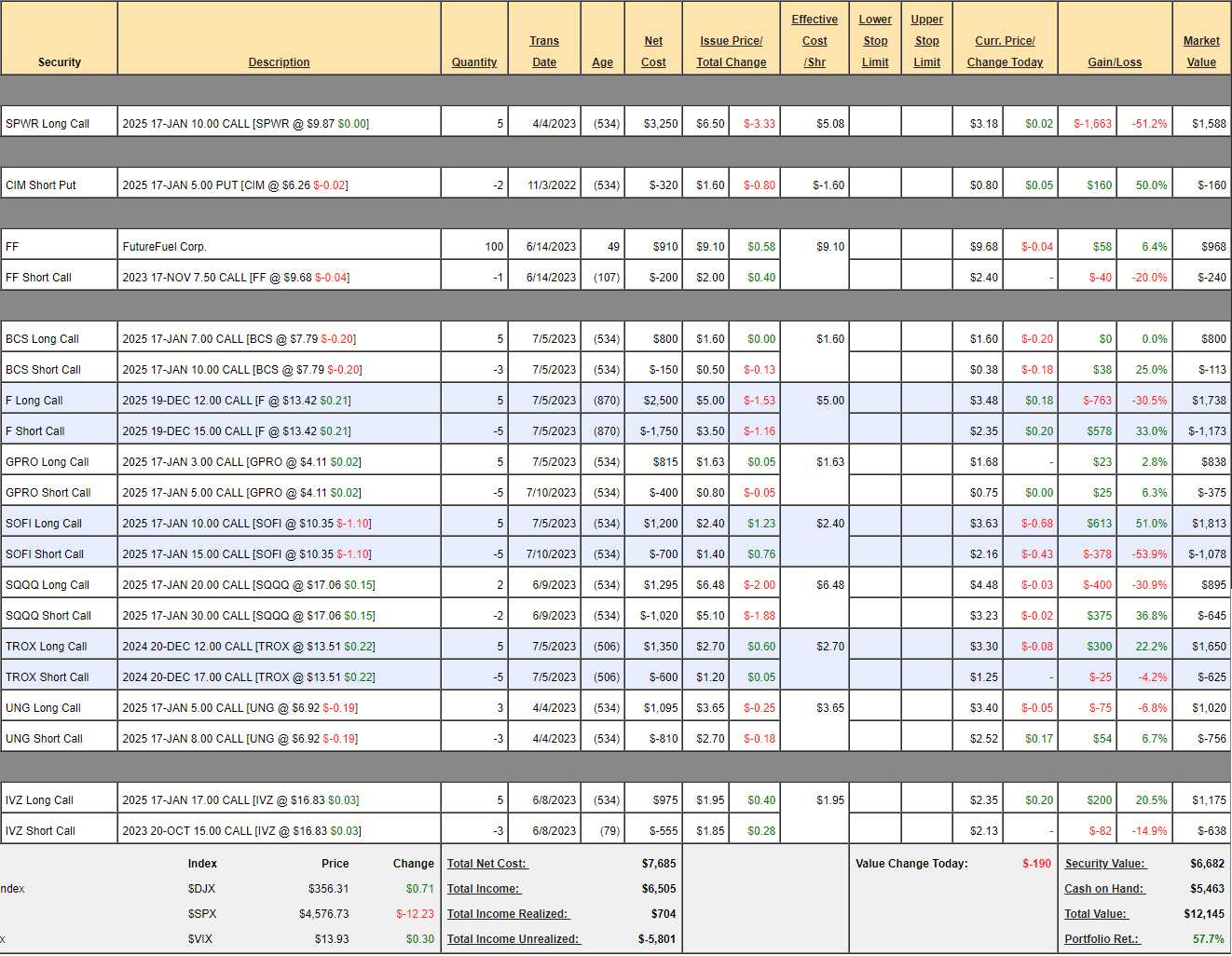

$12,145 – only $987,855 to go!

That is up a fantastic $1,589 (15%) from our July 5th review as our positions are starting to gain some traction. And that is before we deposit this month’s $700. On the $7,700 we’ve invested to date, we’re up $4,445, up 57.7%! The purpose of this portfolio is to teach beginners how to save and build a portfolio DESPACITO – one month at a time! You can apply the same principle to $7,000/month or $7M a month – or any number you wish – the important thing is to get started and learn the discipline.

Since the goal of this portfolio (which we are already miles ahead of) is to have $1M in 30 years, you haven’t missed very much at $12,145 and you can go over months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10 and 11 to see all the moves we’ve made to get this far. This is small portfolio, which means we can’t use our favorite option techniques but it’s a great way to learn how to get started on a wealth-building adventure.

We are using $1,000 in margin at the moment (we assume full margin – as you would have in an IRA of 401K account) but we left ourselves with $5,453 in CASH!!!, which means we have $4,453 to spend PLUS this month’s $700 contribution so that’s $5,153 of buying power – very exciting! We’re still cautious in this overpriced market and, before we spend – we need to look over our current positions to see if anything needs to be nudged back on track:

-

- SPWR – We got caught off guard when they lowered guidance because we bought back the short calls last month but SPWR was at $9.85 on July 5th and it’s at $9.87 this morning – so nothing has really changed. It’s tempting to double down but $1,588 is a lot to spend in a small portfolio BUT we can drastically improve our position by selling 5 of the 2025 $15 calls for $1.70 ($850) and rolling the 5 2025 $10 calls ($1,588) to 5 2025 $5 calls at $5.80 ($2,900). So we’re spending net $462 to push our 5 long calls $2,400 in the money – that’s worth it!

-

- CIM – This is where that $1,000 of margin is being used. If they stay over $5 through Jan, 2025, we make another $160 and that’s 16% of the $1,000 but we have plenty of cash so there’s no reason to kill it yet.

-

- FF – We will almost certainly be called away at $7.50 unless longer months come out that are worth a roll. This was a teaching position as we bought in at $9.10 and sold the $7.50 calls for $2 so net $7.10 and we get paid 0.12 in dividends so net $6.98 and called away at $7.50 (17.5% below our stock entry) with an 0.52 (7.5%) profit in 5 months – better than keeping it in the bank!

-

- BCS – This is one of our new ones from last month and already up $38! We paid net $650 for the $1,500+ spread (only partially covered) so we’re “on track” so far.

-

- F – Another new addition and cheaper now than our entry at net $565 on the $1,500 spread so there’s $935 (165%) upside potential if F can get back to $15 in 18 months. I’m already tempted to double down on this one.

-

- GPRO – Another new one from last month. Here we spent net $415 on the $1,000 spread that’s over $500 in the money and GPRO hasn’t gone anywhere but premium decay has worked in our favor already.

-

- SOFI – Finally took off and we already cashed out our first position so this is round 2 and already a profit. This is a $2,500 spread currently at net $735 so there’s $1,765 (240%) upside potential if SOFI can hit our $15 target! Aren’t options fun?

Seriously, it’s not a complicated idea. If I think SOFI is undervalued and I want to commit $1,000 to it – I can buy 100 shares of the stock at $10 and if we get to $15 I make $500 and if we drop to $5 I lose $500. If, on the other hand, I buy 5 $10/15 bull call spreads for $735, I risk losing $235 more at $5 (but $265 less at $0) but my upside potential at $15 is now $1,765 – 3.5 times more upside potential for essentially the same risk AND tying up $265 (26.5%) less cash!

-

- SQQQ – We doubled down on our hedges last month and, so far, they haven’t been needed. They are net $250 on the $2,000 spread and a 20% drop in the Nasdaq would be a 60% jump in SQQQ to $27.30 so really that would be $1,460 for a gain of $1,210 and that then is our protection. Looking over the options, the SQQQ 2025 $15 calls are $5.75 so it will only cost $1.27 ($254) to roll down to those and widen our spread by $1,000 so let’s do that and also buy 2 more of the 2025 $15 calls ($1,150) and sell 2 more of the 2025 $30 calls ($645). So we have spent $759 of our $1,589 gains from last month to increase our protection from $1,210 to what would now be net $3,578 of downside protection against a 20% drop in the Nasdaq – that should lock in our gains to date and give us the confidence to add more positions.

-

- TROX – Yet another one we added in the last review (we were very busy!). Already up $275 (36%) so good timing on this $2,500 spread that is still only net $1,025 so $1,475 (143%) upside potential is still nice if you missed it before.

So we have spent $1,221 and most of that was on protection. That leaves us with $3,932 to spend so let’s see what’s still on sale:

We can’t ignore NOK any longer as it’s down to $3.95 and that’s just $21.7Bn in market cap for a company that will make about $2.2Bn this year so 10x even in a down cycle. They are priced like other Telcos but, unlike other Telcos, they have $3.5Bn (15% of market cap) net of debt in cash and we’re already past their Q2 earnings (July 20th) and they are holding up. What seals the deal is that we can:

-

- Sell 2 NOK 2025 $4 puts for 0.50 ($100)

- Buy 10 NOK 2025 $3 calls for $1.22 ($1,220)

- Sell 10 NOK 2025 $5 calls for 0.30 ($300)

That is net $820 on the $2,000 spread so our upside potential is $1,180 (143%) and we’re already $1,000 in the money at $4. Since we’re tying up $1,820 in cash and margin – let’s call the upside percentage just 64%.

I think we’ll hang on to the last $3,012 in buying power as I’m still not quite sure how earnings season will go. At least we have plenty of hedges – just in case!