Futures are off their highs this morning.

That’s because AAPL’s $5 loss outweighs AMZN’s $10 gain or, really, they cancel each other out as AAPL is twice the size of AMZN but AAPL is tied to so many tech suppliers that it tends to drag the whole sector down with it.

$190 on AAPL is $3Tn in market cap (almost 10% of the S&P 500s $37.5Tn total cap) and that’s very hard to sustain when you are “only” making $100Bn per year (30x). To make a $5 (2.5%) gain on AAPL, you have to add $75Bn to the market cap – that is the ENTIRE market cap of BKNG (who are up 10% today) or Progressive Insurance (PGR) or Schlumberger (SLB). People have simply lost all sense of proportion in this market!

Trying to get your head around the size of AAPL is kind of like considering that the Titanic would be a dingy hanging off the side of Royal Caribbean’s Wonder of the Seas but RCL has a market cap of $26Bn – AAPL could buy that company with one day’s revenues and RCL has a p/e of about 14, so AAPL, at 30x, could add $52Bn to their market cap in the acquisition.

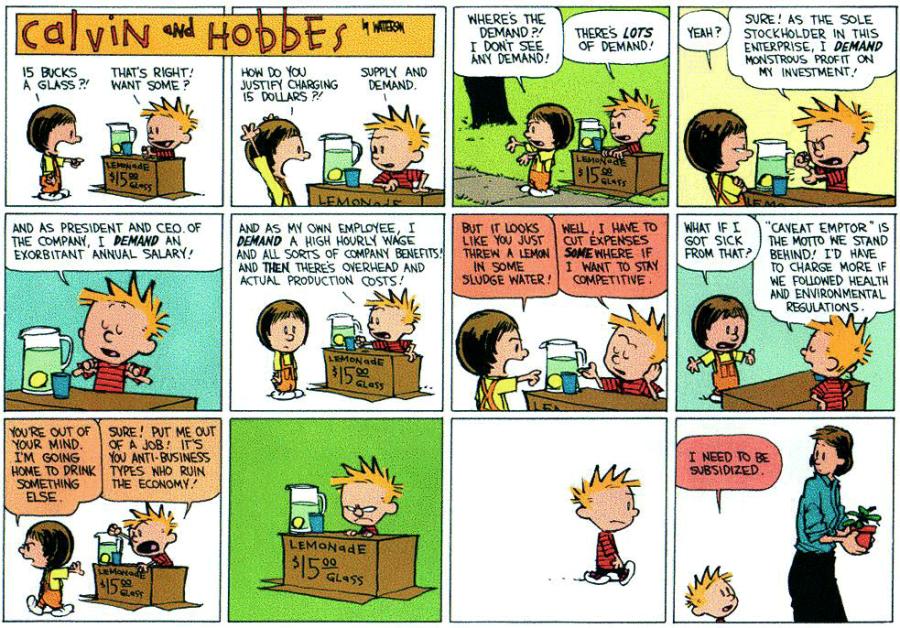

Yes, that would be silly – but it’s all just numbers. People don’t think about the real consequences of their trading actions.

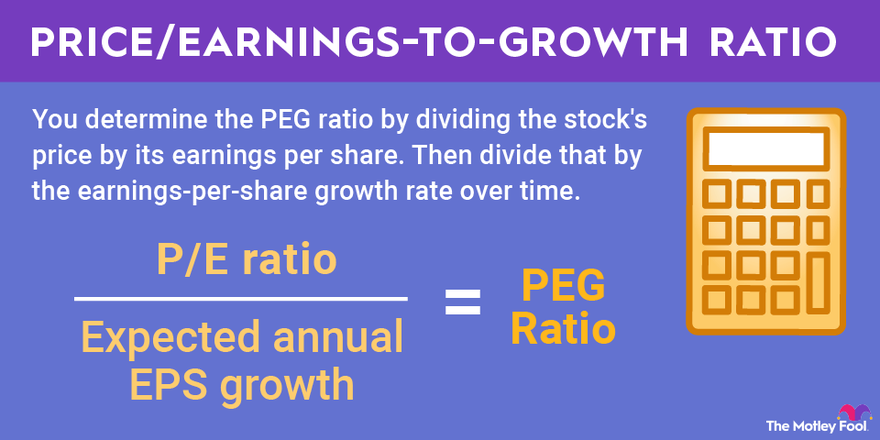

Traders are more willing to give their investment capital to AAPL, who have a Price/Earnings to Growth Ratio of 3.8 than to RCL, who have a PEG Ratio of 0.2 (lower is better). Generally, we consider stocks trading over 1.5 to be overvalued and stocks trading under 1.0 to be undervalued.

Traders are more willing to give their investment capital to AAPL, who have a Price/Earnings to Growth Ratio of 3.8 than to RCL, who have a PEG Ratio of 0.2 (lower is better). Generally, we consider stocks trading over 1.5 to be overvalued and stocks trading under 1.0 to be undervalued.

AMZN, trading at a whopping 60 time earnings, at least has good growth, so their PEG ratio is 1.0, so traders are happy to pay a premium as long as they keep beating their numbers (like today). AAPL, on the other hand, suffers from the law of large numbers – they had $365Bn in Revenues in 2021 and this year they project $385Bn. While that growth is more than the entire GDP of Jamaica ($17.5Bn) – it’s getting very hard to grow Apple’s market cap – which is now the size of Hong Kong’s entire GDP ($383Bn).

So AAPL’s $5 loss this morning as if the entire economy of Jamaica (3M people) was nothing but IPhones and they all switched to Samsung TIMES 4! You also have to keep in mind that a lot of S&P Revenues are BS anyway.

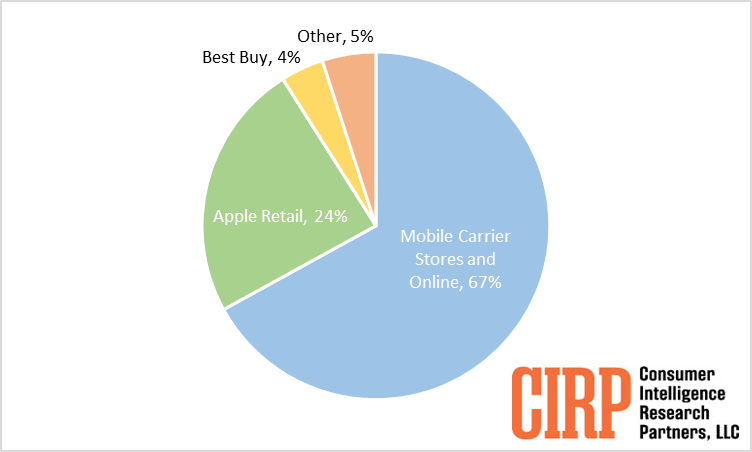

For example, since 2018, Amazon and Apple have had a deal that allows Amazon to sell and ship Apple products directly from Apple, as well as list products from some approved Apple resellers. AAPL accounts for about 10% (4 Jamaicas!) of AMZN’s $561Bn in sales (as well as BBY, T, TMUS, VZN…) yet the sale is counted twice as it’s a sale for AMZN and also a sale for AAPL, which is why you should never get too excited about Revenue Growth until you figure out exactly what it’s made of (and the same flaws are in the Retail Sales Reports).

For example, since 2018, Amazon and Apple have had a deal that allows Amazon to sell and ship Apple products directly from Apple, as well as list products from some approved Apple resellers. AAPL accounts for about 10% (4 Jamaicas!) of AMZN’s $561Bn in sales (as well as BBY, T, TMUS, VZN…) yet the sale is counted twice as it’s a sale for AMZN and also a sale for AAPL, which is why you should never get too excited about Revenue Growth until you figure out exactly what it’s made of (and the same flaws are in the Retail Sales Reports).

Considering these factors, it’s clear that the market is operating in a state of delicate equilibrium, where the mammoth size of certain companies can exert an outsized influence on indices and investor sentiment. The interplay between tech giants like AAPL and AMZN highlights the broader dynamics at play within the technology sector.

Furthermore, the disproportionate weight of AAPL in the market serves as a reminder of the potential risks associated with overconcentration. When one company becomes a significant chunk of an index’s value, any negative news or shifts in investor sentiment can send ripples throughout the entire market. It’s not just about AAPL or its competitors; it’s about the potential systemic impact of a few behemoth corporations.

This phenomenon also underscores the complexities of assessing market valuations. Traditional metrics like P/E ratios and PEG ratios, while useful, need to be interpreted in the context of a rapidly evolving business landscape. The “new normal” of tech companies with stratospheric valuations might defy the conventional rules, driven by the anticipation of future innovations and market dominance.

As the market continues to grapple with these intricate dynamics, Traders should remain vigilant about the broader implications of their actions. Short-term trading decisions can inadvertently contribute to the distortion of market perceptions and valuations, potentially leading to irrational exuberance OR unjustified panic.

In the midst of this, it’s worth keeping in mind that numbers can both enlighten and deceive. They provide valuable insights into the health and trajectory of companies, but they can also create an illusion of clarity that masks underlying complexities. This is particularly true in a world where interconnectedness and double-counting, as seen in the relationship between AAPL and AMZN, can blur the lines of what constitutes true value.

As we navigate the ebbs and flows of the market, it’s essential to recognize that each trade, each decision, contributes to the intricate tapestry of market behavior. The morning’s $5 loss on AAPL might appear inconsequential, but it’s a reminder that even the mightiest players are subject to the delicate balancing act of supply, demand, and investor sentiment.

The market’s current landscape is a testament to the power of numbers and the intricate relationships that underpin them. It’s a reminder that while markets are driven by data, they’re also influenced by psychology, perception, and the interconnectedness of the Global Economy. As we move forward, understanding the implications of each trading action – beyond the numbers themselves – will be essential for making informed decisions that contribute to a more resilient and rational market environment.

8:30 Update: 187,000 Jobs added in July is once again half of what ADP forecast and about the same as last month’s 185,000 and this is nowhere near the cooling the Fed is looking for in the jobs market.

Even worse, average hourly earnings is up 0.4% (again) and that’s over the 0.3% expected (again) by our Leading Economorons. Unemployment went down to 3.5% from 3.6% and 3.7% expected by the same gang of idiots and that means we have 9.8M unfilled jobs in the US (6%) – which would normally be considered a catastrophe but it’s really hard to apply the old metrics to the new post-Covid economy – yet.

Have a great weekend,

-

- Phil