Two months ago when both revolving credit (i.e., credit card debt) and interest charged on credit cards hit a record high, we said that this trajectory was unsustainable and it was only a matter of time before the debt-funded US consumer hit a brick wall. One month later, the first brick wall was hit, when in May US consumer credit grew by a paltry $7.24BN, down more than 50% from the downward revised $20.3BN in April; and while revolving credit posted a healthy increase of $8.5 billion, the shocker was in the non-revolving segment, also known as student and auto loans, and which unexpectedly dropped by $1.3 billion, the first negative print since April 2020

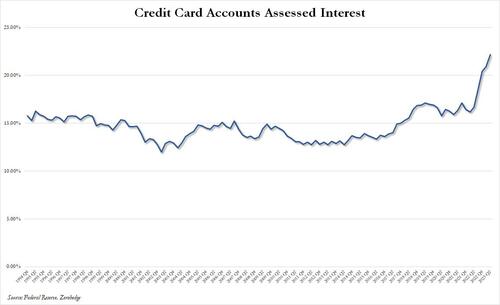

Amusingly, in our commentary last month we also said that “with non-revolving credit now shrinking, the final straw will be the reversal in (record) credit card debt. With credit card interest rates also at a record 22.16%, we won’t have long to wait.”

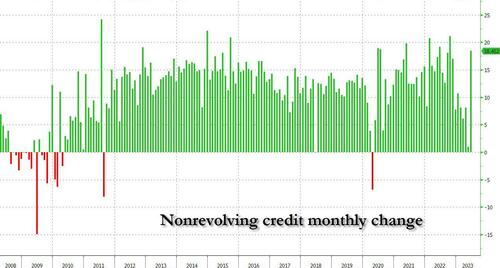

We were right: we had to wait just one month, because fast forwarding to today’s release of the latest Fed consumer credit report at 3pm ET, moments ago we had another shocker, this time on the other side of the credit spectrum, because while non-revolving credit jumped by a whopping $18.5 billion, up from last month’s drop (which was revised to a tiny positive print this time)…

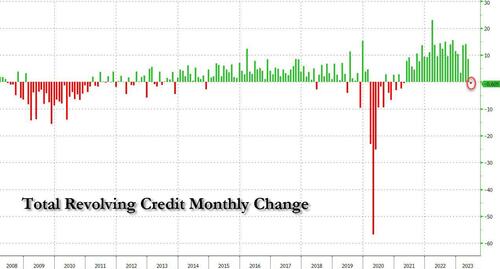

… it was the revolving credit that was the jawdropper this month, because after several months of solid increases, including a near-record $14.8 billion in April, in June credit card actually dropped by $0.6 billion – the first negative print since April 2021 when the US consumer was still in shock from the post-covid reality and was aggressively saving money, money which has now been long spent.

Needless to say, a drop in revolving credit is a stunner because outside of a crisis, this is usually indicative of an end-of-cycle recession, when US consumers – traditionally responsible for 70% of US GDP with their debt-fueled purchases – go into hibernation and start to repay their bloated credit card bills.

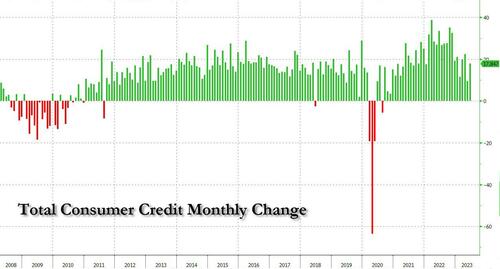

Adding across these two categories, the total June consumer credit print was +$17.85BN which as noted above, was entirely thanks to the $18.5BN increase in non-revolving (student and auto loans) credit.

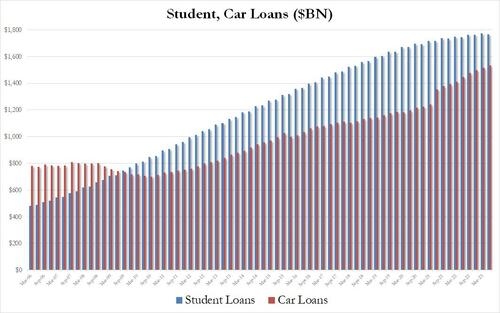

Drilling deeper into the non-revolving credit print reveals that not all is well here either, because while in Q2 auto loans increased by a healthy, if hardly, blockbuster $17.6 billion (to be expected when rates on 60-month auto loans are at all time high), student loans actually shrank by $9.1 billion, the first decline since Q2 2022, and at a time when most student borrowers are still in forebearance.

And once repayment of student loans resumes by mandate in two months, watch out below.

Meanwhile, with average credit card interest rates rising above 22% to a new record high…

… this month’s drop in credit card debt was just the beginning…