We have lots of earnings again.

We have lots of earnings again.

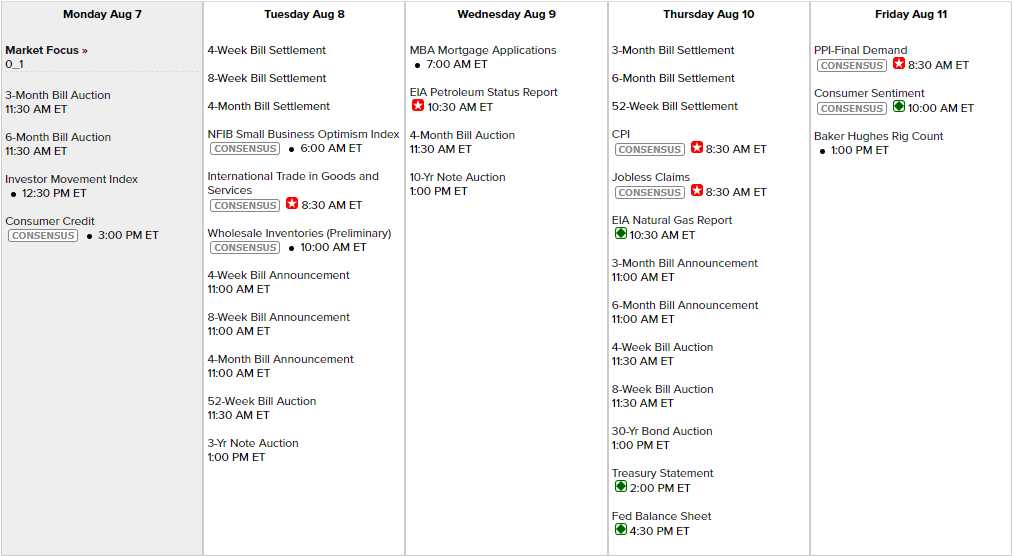

Which is good because the data is very boring. Consumer Credit and Consumer Sentiment book-end the week and we’re concerned about those but the middle of the week is pointless from a data perspective other than CPI on Thursday but the 10-Year Note Auction on Wednesday will be worth nothing as well.

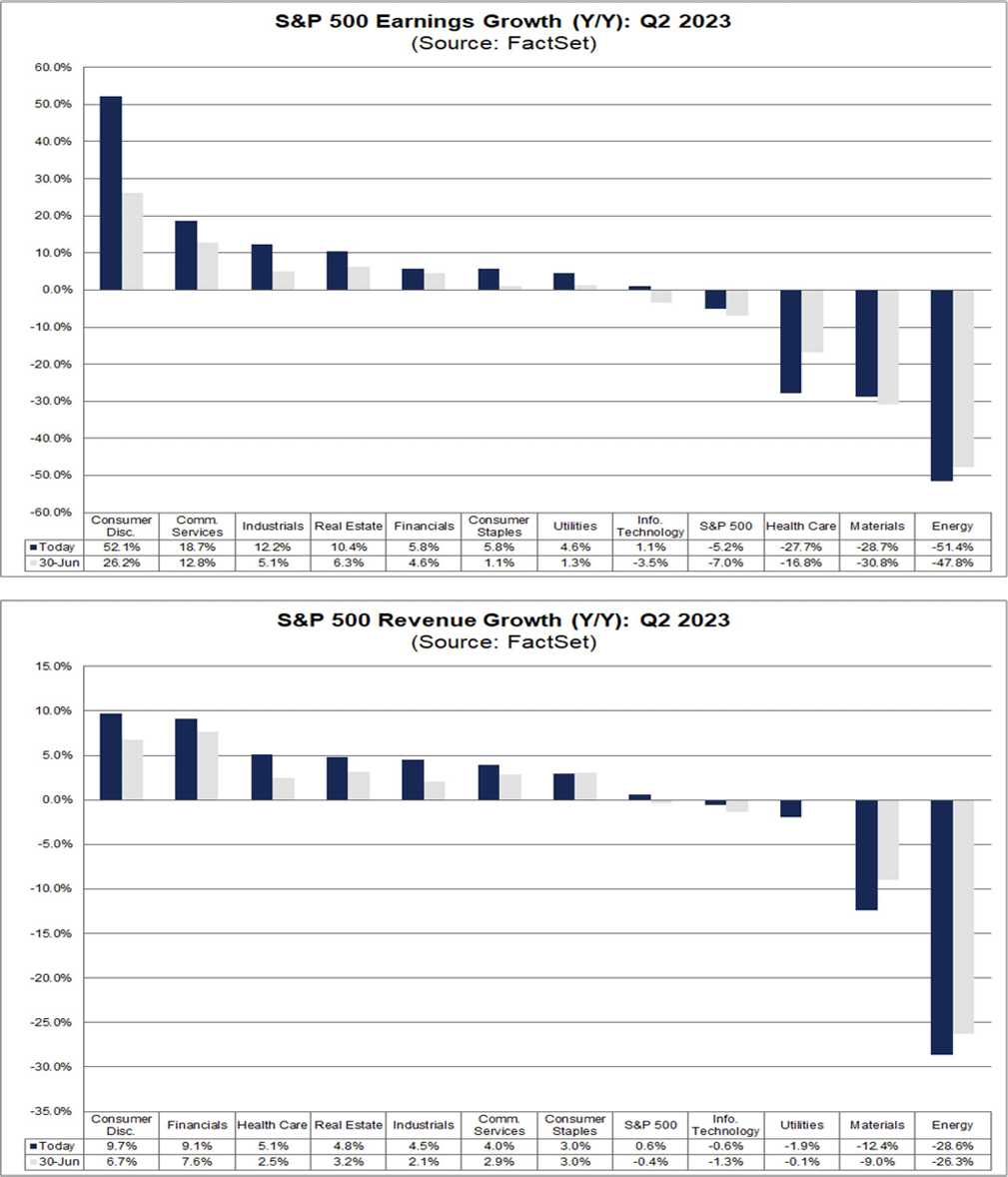

That will keep the focus on earnings and it’s our last big week for those with 84% of the S&P 500 having reported so far and, so far, they have reported a 5.2% decline in overall earnings – the biggest decline since Q3 2020 – when Covid started! Only 49 S&P 500 companies have issued negative guidance but ONLY 30 S&P 500 companies have issued positive guidance.

What’s a bit more dangerous is that they haven’t brought down guidance for 2024 and, even so, the forward p/e for the S&P 500 is 19.2 and the CAPE p/e is currently over 30 so we have a LONG way to go to get from here to there (though it mainly relies on AAPL, NVDA and MSFT and they might pull it off).

According to FactSet, analysts are projecting 7.6% earnings growth in Q4 of 2023 (it hasn’t happened yet so they keep predicting it for the next quarter) and, astoundingly, they also project 12.2% growth in 2024 – that’s more than 20% compounded while Revenue growth is projected to be less than half of that at best.

It is truly astounding how far up their asses analysts have to go to pull out these numbers. Without revenues flying higher, they are relying on some fantasy combination of lowered expenses, lower payrolls and more price hikes being passed along to Consumers with little or no pushback by Consumers – that’s the bullish expectation for stocks…

I guess we should add Berkshire Hathaway (BRK.A) to the list of earnings performers as they made $35.91Bn in Q2 (more than AAPL!) after losing $43.62Bn last year at this time. Berkshire now has $147.4Bn in CASH!!! That’s up $17Bn since Q1.

As we’ve expected but haven’t seen from other Insurance Companies (a big part of Berkshire) – they had a huge jump in Underwriting and Investment Income thanks to the higher rates. This means we should take a closer look at the Insurance Companies on our Watch List.

Allstate (ALL) is running out the clock on another negative year ($414M loss projected). ALL has been aggressive in pushing for higher rates and has been granted increases in 27 states but it takes time for the revenues to show up on the balance sheet so there is nothing unbelievable about their $3.3Bn earning target for 2024, which makes them a bargain at $110 ($28.75Bn). We’ve been watching is since November at $130 so $110 is a good place to put it on our Long-Term Portfolio (LTP):

-

- Sell 10 ALL Dec 2024 $100 puts for $8 ($8,000)

- Buy 20 ALL Dec 2024 $100 calls for $20 ($40,000)

- Sell 20 ALL Dec 2024 $110 calls for $14.20 ($28,400)

That’s net $3,600 on the $20,000 spread with $16,400 (455%) upside potential at just $110 in about 17 months. Our worst case is being assigned 2,000 shares of ALL at net $101.80, which would be 7.5% below the current price. Realistically though, if we should face danger of assignment, we would roll the puts lower before buying.

Prudential option go all the way out to Dec 2025 and the stock is a little cheaper at $96.50 but that’s $35Bn in market cap and they are making $4.4Bn this year, which puts their p/e way down below 8x. They also have $700Bn in assets they will be making more interest on – so we like them also for the LTP:

-

- Sell 10 PRU Dec 2025 $85 puts for $10 ($10,000)

- Buy 20 PRU Dec 2025 $85 calls for $19.50 ($39,000)

- Sell 20 PRU Dec 2025 $100 calls for $12 ($24,000)

That’s net $5,000 on the $30,000 spread with $25,000 (500%) upside potential and here we’re promising to buy 2,000 shares of PRU for net $102.50 if it all goes bad. More likely, we will spend a bit more money to widen the position as we get confident $100 will hold.

That’s a nice way to start the week – a couple of sensible, conservative plays with a great chance of success. We’ll see what other opportunities earnings season uncovers as we move along towards the end.