It’s going from bad to worse for Hollywood woke icon Disney, and embattled CEO Bob Iger, whose stock is unchanged over the past decade and today’s earnings release won’t help: while the company reported earnings which beat expectations (just barely) amid a massive cost-cutting effort, even as total revenue and streaming subs missed, despite continued – for now – strength at Disney parks where one can enter in exchange for at least one kidney).

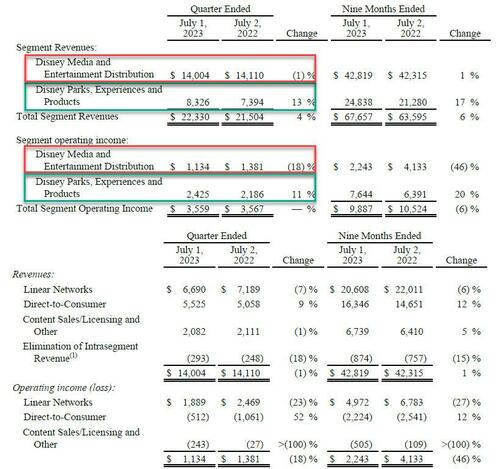

Here are the Q3 highlights:

- Adjusted EPS $1.03 vs. $1.09 y/y, beating estimates of 99c (the company recorded $2.44b charge in 3Q related to the removal of content from DTC services and termination of certain third party license agreements)

- Revenue $22.33 billion, +3.8% y/y, missing estimates of $22.51 billion

- Media and entertainment distribution revenue $14.00 billion, -0.8% y/y, missing estimates of $14.36 billion

- Parks, experiences and products revenue $8.33 billion, +13% y/y, beating estimates of $8.25 billion

- Total segment operating income $3.56 billion, -0.2% y/y, beating estimates of $3.4 billion

- Media and entertainment distribution operating income $1.13 billion, -18% y/y, beating estimates of $1.05 billion

- Parks, experiences and products operating income $2.43 billion, +11% y/y, beating estimates of $2.39 billion

- Direct-to-consumer operating loss $512m, missing estimates of loss $777.7m

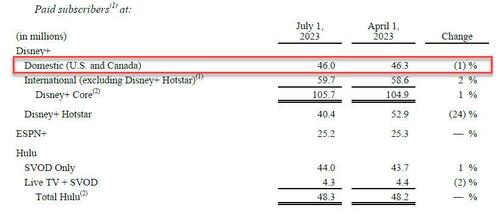

- Disney+ subscribers 146.1 million, missing estimates of 154.8 million

- ESPN+ subscribers 25.2 million, beating estimates of 25.8 million

- Hulu & Live TV subscribers 4.30 million, missing estimates of 4.40 million

- Total Hulu subscribers 48.3 million, missing estimates of 48.7 million

- ESPN+ ARPU $5.45, missing estimates of $5.69

- Hulu SVOD ARPU $12.39, beating estimates of $12.25

- Hulu Live TV + SVOD ARPU $91.80, missing estimates of $92.52

Commenting on the results, Bob Iger said that “In the eight months since my return, these important changes are creating a more cost-effective, coordinated, and streamlined approach to our operations that has put us on track to exceed our initial goal of $5.5 billion in savings as well as improved our direct-to-consumer operating income by roughly $1 billion in just three quarters.”

Despite the revenue miss, the company beat earnings after the world’s largest entertainment company launched an extensive cost-cutting effort after CEO Bob Iger returned to run the company in November. That included 7,000 job cuts and other reductions in spending.

Looking at the key driver of DIS growth, streaming, there was good and bad news:

- The good news is that Disney’s online video operation cut its loss to $512 million from more than $1 billion a year ago, an improvement to the company’s recent guidance that the direct-to-consumer business would lose more than $750 million in the quarter.

- The bad news is that Disney+ streaming subs tumbled 7.4% to 146.1 million from the previous three months, missing the 154.8 million consensus analysts had expected. While nearly all of that shortfall was borne by the company’s Disney+ Hotstar in Asia where it lost almost 25% of its customers after Disney failed to renew streaming rights for popular cricket games in the Indian Premier League, domestic Disney+ subs also dropped: subs in the U.S. and Canada dropped to 46 million subscribers, from 46.3 million in the previous quarter; marked the second time ever that the company saw Disney+ lose North American subscribers.

The company’s parks business generated $8.33 billion in revenue, a 13% increase from a year earlier. The company said growth at its international parks offset lower results domestically.

Parks and streaming aside, Disney continues to be a melting ice cube and reported a 23% decline in profit, to $1.89 billion, in traditional TV, underscoring the troubles confronting that division; the number was $100 million less than what analysts had expected. The business, which includes channels such as ABC and ESPN, has been buffeted by falling cable subscribers, lower broadcast advertising sales and higher programming costs for sports.

Once a reliable engine of profit for Disney, linear TV has seen its operating income plunge in recent years as more consumers cut the cable cord and switch to streaming video as their primary source of home entertainment.

Adding insult to injury, management is also now dealing with strikes by the Writers Guild of America and Screen Actors Guild that have effectively shut down production of new TV shows and movies across the entire media industry.

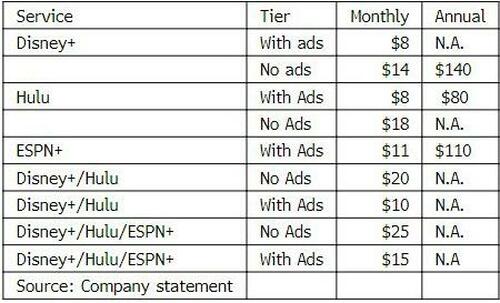

So realizing that he has to wow the street with something, or else risk losing his job again, for the second time in about a year, Iger announced a round of staggering price increases to its various streaming products, raising the cost of the ad-free versions of Disney+ and Hulu by as much as 27% each.

The company also raised prices on its Hulu Live television packages and announced the launch of a new bundle known as the Duo Premium, which pairs Disney+ and Hulu without ads for $19.99 a month. Previously, the company had offered both services as stand-alone products, or bundled with ESPN+ for the same price.

Wednesday’s price increases, which take effect in October, mean that the monthly cost of the ad-free stand-alone version of Disney+ has doubled to $13.99 from its 2019 introductory price of $6.99. The price of Disney’s ad-free Hulu service will rise to $17.99 from $14.99, making it more expensive than the most popular ad-free version of rival Netflix.

The changes come as Disney struggles to pivot from its old model of distributing content in movie theaters, on network and cable television and through the sale of physical media to a streaming-first paradigm.

Since launching Disney+ in late 2019, the company has lost more than $10 billion in its direct-to-consumer segment, which also includes Hulu and ESPN+. And for much of the past year, Disney’s shares have traded below $100 as investors have grown impatient with media companies such as Disney that have spent heavily to acquire subscribers without giving priority to profit.

In March, Iger said that in its “zeal to grow global subs,” the company had underpriced its streaming services and hinted that higher prices were coming. In December, after the company launched its first-ever ad-supported tier for Disney+ and raised prices on the ad-free version by $3, the low level of cancellations indicated that there was room to raise prices further without reducing demand, Iger said.

Disney is also in the throes of major management upheaval: Iger signaled in a July interview with CNBC that TV networks including ABC, Freeform and FX, which contributed about half of Disney’s operating income before the pandemic, “may not be core” to the company any longer. He’s also seeking to sell a stake in the ESPN sports business to a partner that can help accelerate the network’s transition to streaming. Iger recently hired former lieutenants Kevin Mayer and Tom Staggs as consultants to advise on that effort.

On Tuesday, ESPN announced a long-term agreement with casino operator Penn Entertainment Inc. to license its brand for sports betting. Penn will make cash payments totaling $1.5 billion over the 10-year term and grant ESPN $500 million of warrants to purchase Penn shares.

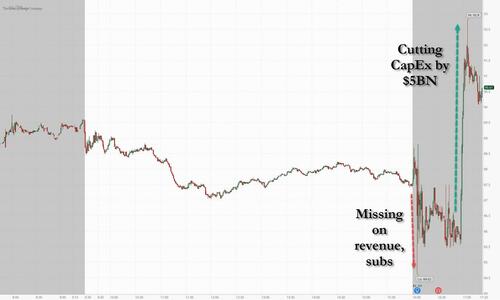

While the stock was sharply lower in after-hours trading on the revenue and subscriber miss, and not even news of the surging subscriber costs did anything to move the stock, what did send DIS stock sharply higher after hours was the flashing red Bloomberg headline from the conference call that Disney would slash its capex by $5 billion compared to prior forecast. The news of the company’s admission that it sees far fewer growth opportunities was enough to push the stock as much as 6% higher…

… before it resumed selling once again.