Japanese automakers are entering a fight for survival in China, a market they once easily held significant ground in. Instead, now, automakers based in Japan will have to take the next few years to reevaluate whether or not business is worth even continuing in China.

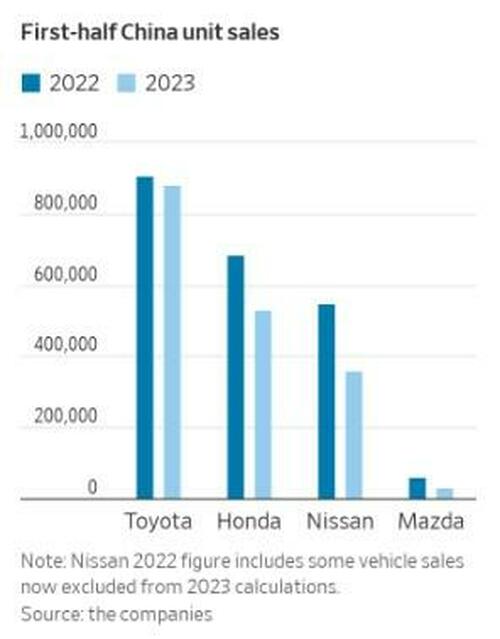

Japanese companies have “been losing long-held ground”, according to the Wall Street Journal, who notes that Nissan is “facing major challenges” in the geography. For its year ending in March, Nissan expected to sell 800,000 vehicles in China, which is 330,000 fewer than it originally intended.

Its new EV and hybrid lineup “will be the determinant of our survival,” Chief Executive Makoto Uchida said last month.

Honda is also facing challenges, according to its finance head, Masaharu Hirose. Hirose said this week that competition was making it difficult for the automaker to hit its previously announced goal of 1.4 million vehicles sold in the country this year.

Mazda has sold only about half the vehicles in China that it sold in the same period last year, WSJ writes. Its CFO said this week: “We are taking urgent action to recover” instead of withdrawing from the market. Mitsubishi has already suspended production at a joint venture it has in China, as a result of “sluggish sales”.

“For now, they’re really behind,” said Takaki Nakanishi, head of Tokyo-based automotive consulting firm Nakanishi Research Institute of Japanese automakers. “For the Japanese auto industry, which has until this point centered itself around sales in China and the U.S., it may be on a path to lose one of those cores.”

Recall just weeks ago we wrote about how Chinese automakers were dethroning competition from the West.

Local auto brands produced in China made up 54% of the wholesale car market for the first half of 2023, The Wall Street Journal noted last month. This is up from 48% a year prior and marks the second 6 month period wherein local brands have surpassed foreign ones in a row.

It’s no secret that NEVs are leading the charge for China’s home grown vehicles. We noted last month that NEV sales in China were up 25.2% YOY, totaling 665,000 units. Passenger vehicle output fell 0.5% YOY but was up 10.3% sequentially, coming in at 2.2 million units.

It’s no secret that NEVs are leading the charge for China’s home grown vehicles. We noted just days ago that NEV sales in China were up 25.2% YOY, totaling 665,000 units. Passenger vehicle output fell 0.5% YOY but was up 10.3% sequentially, coming in at 2.2 million units.

9 of China’s 10 best selling electric vehicles makers were local companies, led by BYD, the Journal reported. Tesla was the only foreign automaker on the EV Top 10. The country’s focus on EVs since 2009 has turned it from a global “follower” to a global “leader” in the industry.

Stephen Dyer, a Shanghai-based auto consultant at AlixPartners, told WSJ other other automakers would have to learn from China’s developing trend if they want to find success in the market.

Many Western companies started to step away from China after its auto market peaked in 2017. ICE vehicle sales had fallen by about 8 million vehicles by 2022, following this peak and as a result of demand compression from Covid amid a shift to NEVs.

Ford has since reduced investments in China since its Mach-E wasn’t as successful as originally planned in the country.

And Honda’s Chief Operating Officer Shinji Aoyama commented earlier this year: “Japanese, American and European automakers all have this sense that they were too late to make the initial moves. We’re now in a phase of trying our best to catch up.”