Ruh-Roh!

Ruh-Roh!

You might have noticed that Regional Bank stocks were soaring lately, frolicking in green pastures and making us wonder if they’ve discovered the secret to financial euphoria. But the bond have been stalking them like a wolf in the woods and now Moody’s is the first to cry “wolf“ with a whole pack of downgrades.

Out of those 27 banks, the credit ratings of 10 (37%) were slapped with a “Could Do Better” sticker. And, just in case that wasn’t enough, others were put under review or handed negative outlooks. For banks, credit ratings are like a Yelp review – crucial for attracting deposits and selling those snazzy bonds.

Let’s not act surprised at the reasons behind this financial slap on the wrist. Rising deposit costs? Check. Risks to commercial property and construction loans due to the great remote work experiment? Check, check, and check. These reasons might seem like old news, but it’s news that isn’t going away just because you stop paying attention to it. Remember high interest rates? We still have them. Long-term interest rates keep on climbing.

Moody’s gives a tip of the hat to the Federal Reserve for proposing tougher capital requirements for the big banks. This regulation could be better for credit risk, like handing out helmets at a bicycle convention – but Moody’s isn’t swayed that easily – they see cracks in the pavement, holes in the road, and you can make up your own metaphors for other unaddressed issues…

Banks don’t just run on fairy dust and good intentions, they are fueled by deposits AND selling bonds to Investors. Without great credit ratings, the banks have to pay more for the debt they sell and pay depositors more for the money they hold – a double loss.

Moody’s downgrade also highlights the divergence between the US banks and their global peers, especially in Europe and Asia. While Moody’s has lowered its outlook on most US banks, it has upgraded or affirmed its ratings on several European and Asian banks, citing their stronger capital buffers, lower asset risks, and more stable funding sources. The contrast reflects the different economic and regulatory environments that the banks operate in. The US economy is recovering faster than most other developed countries, thanks to its massive fiscal stimulus and rapid vaccination program. However, this also means that the US faces higher inflationary pressures and faster monetary tightening, which pose challenges for the banks.

The financial world is a complex tapestry woven with threads of interest-rate risk and liquidity risk. Moody’s is warning that the proposed regulations might not have all the answers, especially when it comes to the intricacies of rate risks as well as the diminished value of loans and, unfortunately, banks tend to lend out 10x more money than they actually have (see: “Fractional Reserves – Friend or Foe“).

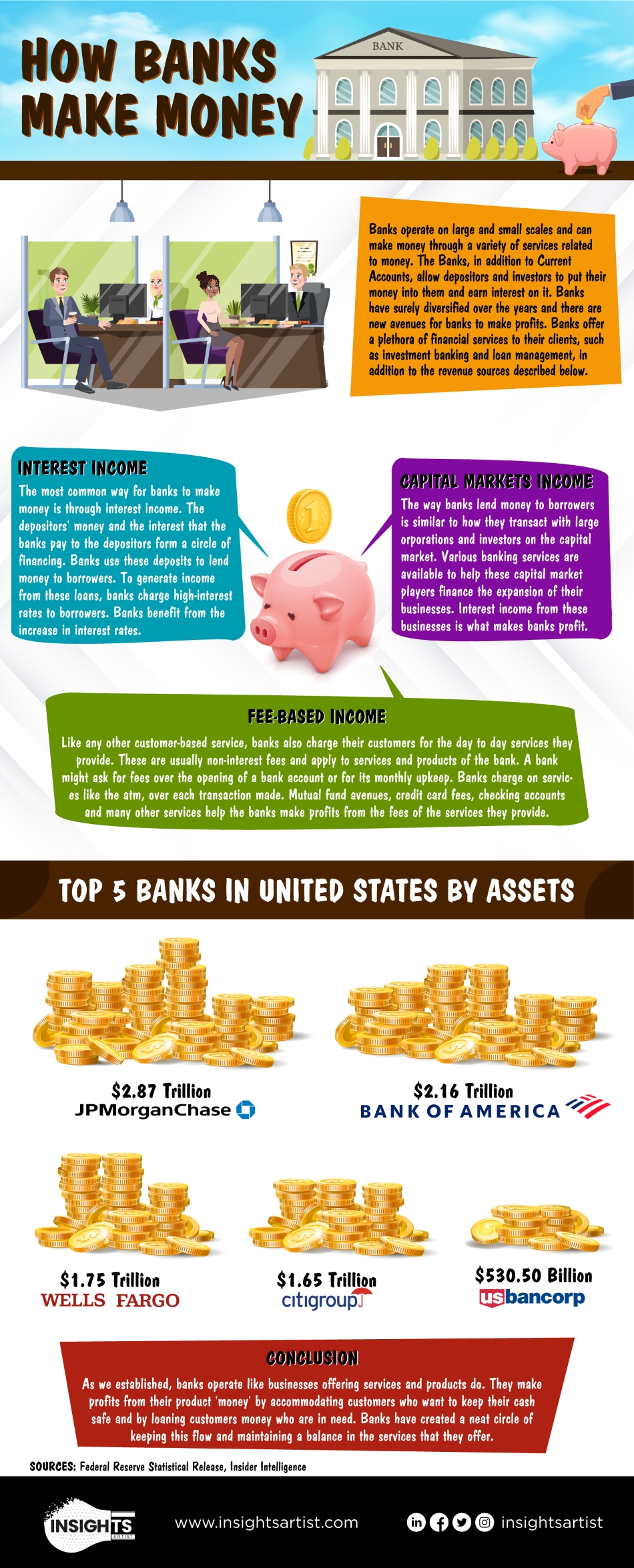

Now, let’s consider how banks make money from mortgages. Banks lend money to borrowers who want to buy or refinance their homes. The borrowers pay interest on the loan, which is the main source of income for the banks. The interest rate that the borrowers pay depends on various factors, such as their credit score, loan term, loan amount, and market conditions.

The banks also borrow money from other sources, such as the Fed, other banks, or bond investors. The banks pay interest on the borrowed money, which is the main cost for the banks. The interest rate that the banks pay also depends on various factors, such as the Fed funds rate, the bank’s credit rating, the maturity of the debt, market conditions…

The difference between the interest income and interest expense is called the net interest margin (NIM). The NIM is a key measure of bank profitability. The higher the NIM, the more profitable the bank is.

Now, let’s see how the low mortgage rates and high Fed funds rate affect the NIM over time. Suppose a bank has a portfolio of 3% mortgages that it originated a few years ago when the Fed funds rate was lower. These mortgages have fixed rates and long terms, which means that the bank cannot change the interest rate or duration of these loans.

If the Fed raises its funds rate to 5%, as it did in 2023, the bank will face two problems:

- First, its interest expense will increase, as it will have to pay more to borrow money from the Fed or other sources. This will reduce its NIM and profitability.

- Second, its interest income will decrease, as it will face lower demand for new mortgages or refinancing from borrowers. This is because borrowers will be reluctant to take out new loans or refinance their existing loans at higher rates. This will also reduce its NIM and profitability.

The bank can try to mitigate these problems by:

- Increasing its fees or charges on other products or services, such as checking accounts, credit cards, or wealth management.

- Reducing its operating costs or overheads, such as salaries, rent, or marketing.

- Selling some of its mortgage portfolio to other investors who are willing to accept lower returns.

- Diversifying its revenue streams by offering more non-interest income products or services, such as advisory, trading, or insurance (ie. taking on more risk).

However, these solutions may not be enough to offset the negative impact of low mortgage rates and high Fed funds rate on the bank’s NIM and profitability over time. The bank may also face regulatory constraints or competitive pressures that limit its ability to implement these solutions.

And banks don’t borrow money for 30 years, they borrow short-term money so the new money they are borrowing is costing them more than the old money they have lent out is collecting and, if new loans aren’t being taken at 9%+, the banks NIM begins to erode – quarter by quarter.

Therefore, low mortgage rates and high Fed funds rate can be a slow poison for the banks over time. They can erode their NIM and profitability gradually and steadily. They can also impair their capital adequacy and liquidity position. They can ultimately affect their credit rating and stock price.

The banks Moody’s Downgraded are:

- Commerce Bancshares (CBSH): The NIM for Commerce Bancshares was 3.05% in the fourth quarter of 2022.

- BOK Financial Corporation (BOKF): The NIM for BOK Financial Corporation was 2.88%

- M&T Bank Corporation (MTB): The NIM for M&T Bank Corporation was 3.07%

- Old National Bancorp (ONB): The NIM for Old National Bancorp was 3.14%

- Prosperity Bancshares (PB): The NIM for Prosperity Bancshares was 3.23%

- Amarillo National Bancorp (ANB): The NIM for Amarillo National Bancorp was 4.01%

- Webster Financial Corporation (WBS): The NIM for Webster Financial Corporation was 2.97%

- Fulton Financial Corporation (FULT): The NIM for Fulton Financial Corporation was 3.24%

- Pinnacle Financial Partners (PNFP): The NIM for Pinnacle Financial Partners was 3.43%

- Associated Banc-Corp (ASB): The NIM for Associated Banc-Corp was 2.77%

The banks that are under review for possible downgrades are:

- Bank of New York Mellon Corporation: The NIM for Bank of New York Mellon Corporation (BK) was 0.95%

- Northern Trust Corporation: The NIM for Northern Trust Corporation (NTRS) was 1.13%

- State Street Corporation: The NIM for State Street Corporation (STT) was 0.97%

- Cullen/Frost Bankers: The NIM for Cullen/Frost Bankers (CFR) was 3.45%

- Truist Financial Corporation: The NIM for Truist Financial Corporation (TFC) was 3.17%

- U.S. Bancorp: The NIM for U.S. Bancorp (USB) was 2.40%

The banks where the outlook has shifted from stable to negative are:

- PNC Financial Services Group (PNC): The NIM was 2.92%

- Capital One Financial Corporation (COF): The NIM was 3.14%

- Citizens Financial Group (CFG): The NIM was 2.90%

- Fifth Third Bancorp (FITB): The NIM was 3.35%

- Huntington Bancshares (HBAN): The NIM was 3.22%

- Regions Financial Corporation (RF): The NIM was 3.33%

- Cadence Bank (CADE): The NIM was 3.33%

- F.N.B. Corporation (FNB): The NIM was 3.15%

- Simmons First National Corporation (SFNC): The NIM was 3.15%

- Ally Financial (ALLY): The NIM was 2.84%

- Bank OZK (OZK): The NIM was 4.05%