When the Treasury issued its latest refunding schedule last week and yields blew up on the ominous TBAC forecast of a lot more issuance on deck, few expected this week’s auctions to be outstanding. Yet yesterday’s 3Y auction was nothing short of stellar, and despite fears that we would see some blow up in today’s sale of $38BN in benchmark 10Y paper, not only was today’s just concluded auction strong but it was in fact one of the strongest 10Y auctions this year.

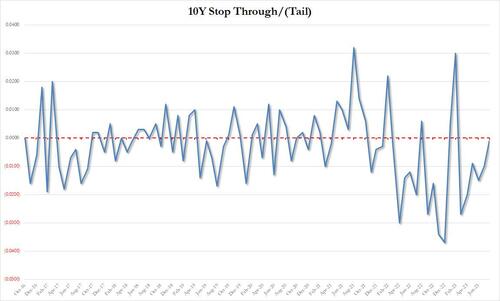

Pricing at a high yield of 3.999% (almost as if someone would have been stopped out at 4.000%), this was above last month’s 3.847% and only below the Nov 2022 4.106% which was the cycle high. It also tailed the When Issued 3.998% by 0.1bps, which while the 6th consecutive tail for the 10Y tenor, was also the smallest tail since February when we saw the last stop through.

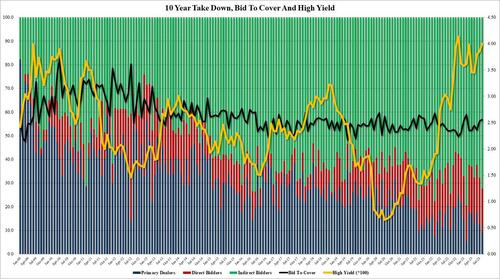

The Bid to Cover was 2.56, slightly above last month’s 2.53 and above the recent average of 2.45; in fact it was the highest BtC since February’s 2.66.

The internals were the most impressive, however, with Indirects awarded 72.2%, up sharply from the 67.7% last month, the most since February and well above the six-auction average of 67.0%. And with Directs taking 18.3%, which was just below the recent average of 19.1%, Dealers were left holding 9.5%, the lowest since February.

The market expected worse, and yields which earlier rose as high as 4.04%, slid to session lows just below 3.99% as fears that the coming treasure issuance deluge have so far failed to spook primary buyers…