Has the Fed done enough?

Has the Fed done enough?

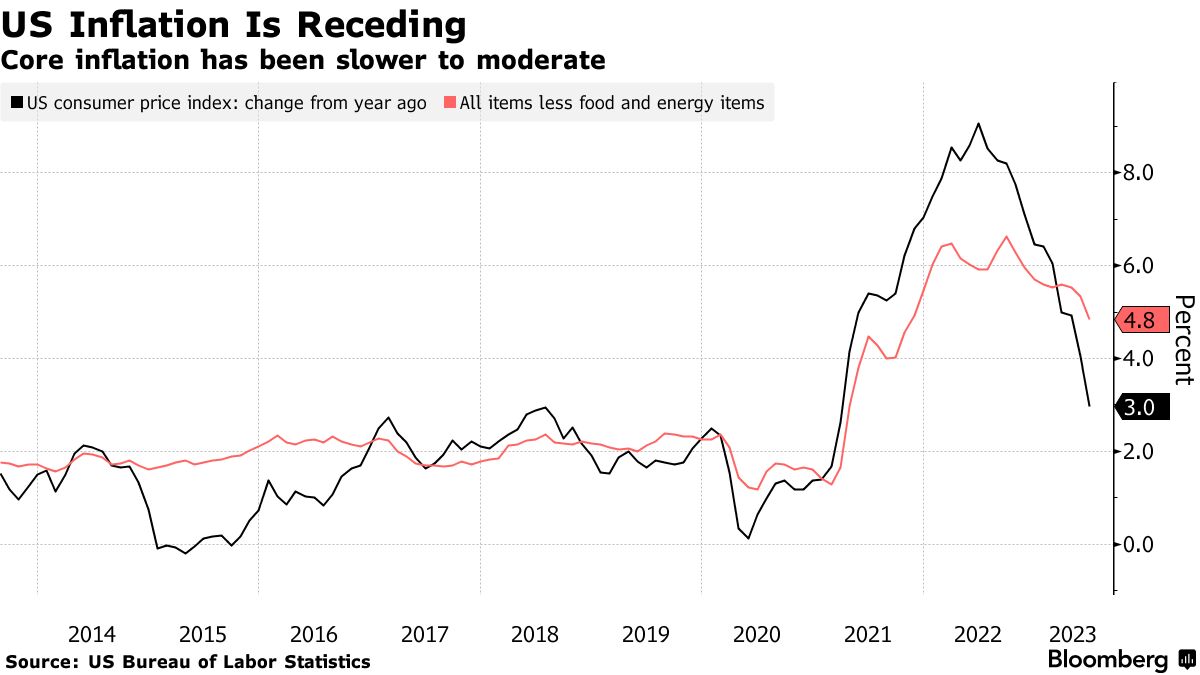

The US report on consumer prices will be critical for investors trying to determine whether the Fed will stop raising interest rates. It’s expected to show a second straight reading for so-called core inflation that is consistent with the Fed’s 2% target on an annualized basis, according to a preview from Bloomberg Economics. The Core Consumer Price Index, excluding food and energy, probably rose 0.2% last month, following a similar increase in June, they said.

One potential pressure point could be commodities, which are rising after a year of falling. Oil traded near the highest level in almost nine months, with West Texas Intermediate futures above $84 a barrel after climbing 3% over the previous two sessions.

Overall, I don't see any evidence that prices have gone down in July. Food carries the heaviest weighting (13.7%) on the CPI and that certainly has been going higher (anyone who's been to a grocery store knows that) and Energy (6.1%), as you can see, has gone up 20% since July started but those are the two things they EXCLUDE from the Core CPI reading - because who actually uses food or energy, right?

In fact, when they talk about the "Core" CPI: Food (13.7%), Food at Home (7.4%), Food Away from Home (6.3%), Energy (6.1%), Energy Commodities (3.4%), Gasoline (3%), Fuel Oil (0.1%), Energy Services (2.7%) and Natural Gas (0.6%) are excluded from the Fed's consideration - leaving a very narrow view of inflation in Clothing, Cars, Medical Care, Drinks, Housing (32.8%) and Airfare.

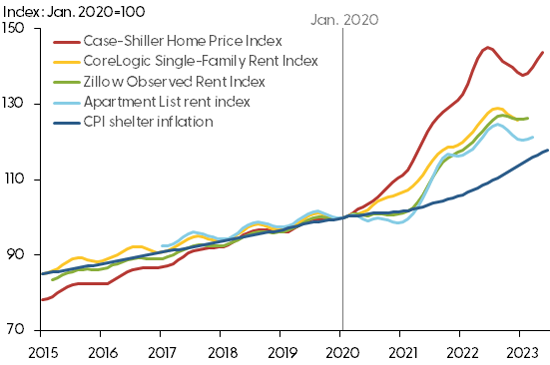

So, without Food and Energy, the Core CPI pretty much just measures housing and 23.9% of Housing's 32.8% is Owner's Equivalent Rent - and we discussed what utter BS that was back in May.

So, without Food and Energy, the Core CPI pretty much just measures housing and 23.9% of Housing's 32.8% is Owner's Equivalent Rent - and we discussed what utter BS that was back in May.

As you can see from this chart, OER is massively understated by the Fed - by 20-50% - depending on who you trust (trust no one!).