The S&P 500 opened at 4,450 on July 3rd.

This morning we’re at 4,468 – that’s a wasted month! As we’ve now seen most of the Q2 earnings reports – it doesn’t take a genius to figure out they haven’t been that good and, since we’ve been going straight downhill since Aug 1st, we can conclude that the bulk of the reports have simply highlighted what a dangerously narrow rally this has been.

And, of course the July rally came around low-volume holiday trading – when it’s a lot easier to pump up the markets and don’t forget the Dollar dropped 2.5% – so the whole thing was complete and utter BS that had nothing at all to do with good earnings and a lot to do with coordinated manipulation to give you the IMPRESSION that earnings must have been good because the market was reacting so well.

And, while we’ve been pretending Corporate Profits were great and Inflation “under control” – oil prices shot up 20% since early July. Now I’m not sure where you went to school but I head the price of oil is a big input cost for American manufacturers and also a big drain on consumers.

We consumer 16M barrels of oil a day in the US and, even if we pretend there are no other mark-ups – $14 more dollars a barrel is costing SOMEONE $224M a day or $6.7Bn per month. That’s either going to put a damper on Consumer Spending or Corporate Profits or both, right? We’ll see later this morning as we’re about to get the PPI at 8:30 and Consumer Sentiment at 10 and, judging by oil prices – PPI should be up and Sentiment should be down.

8:30 Update: As expected, PPI was up 0.3% in July vs 0.2% expected by leading Economorons who can’t seem to be bothered to consider what has actually, FACTUALLY, happened to the components before making their “predictions” (really should just be called guesses or, more accurately, random BS they simply spew out for a paycheck).

Even worse, Core PPI (same BS as core CPI) was also 3% – a huge reversal from last month’s probably incorrect -0.1%, which led to all this “inflation is dead” nonsense we’ve been subjected to for the past month. Keep in mind these are the July input costs – so we’re looking at squeezed Corporate Margins in the first 30 days of Q3 and it’s also going the opposite way of what the Corporate Guidance has been saying about Q3 (which was not looking exciting anyway).

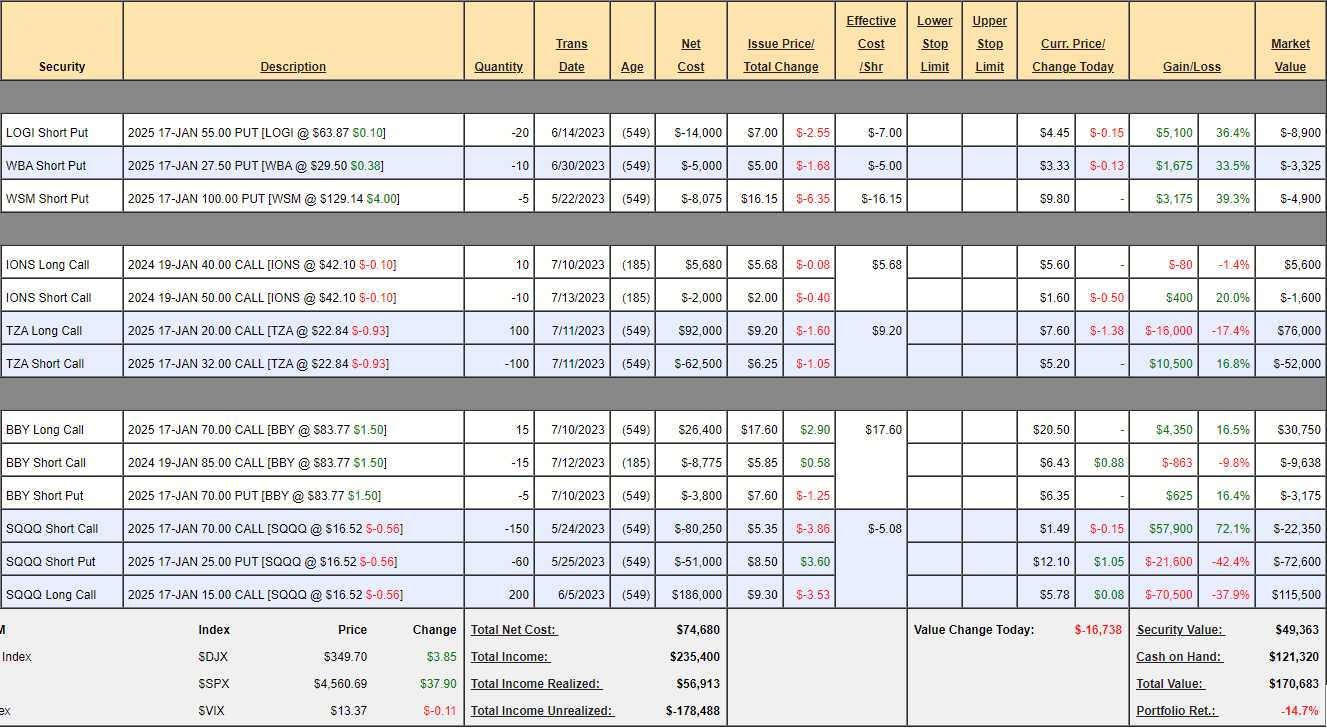

We made no changes to our Short-Term Portfolio (STP) in last month’s review(or since) as we felt we were properly covered – even though we were down $29,317 (14.7%) at the time. That was fine because our longs had gained much more than that and the portfolio is there to provide protection to lock in those gains:

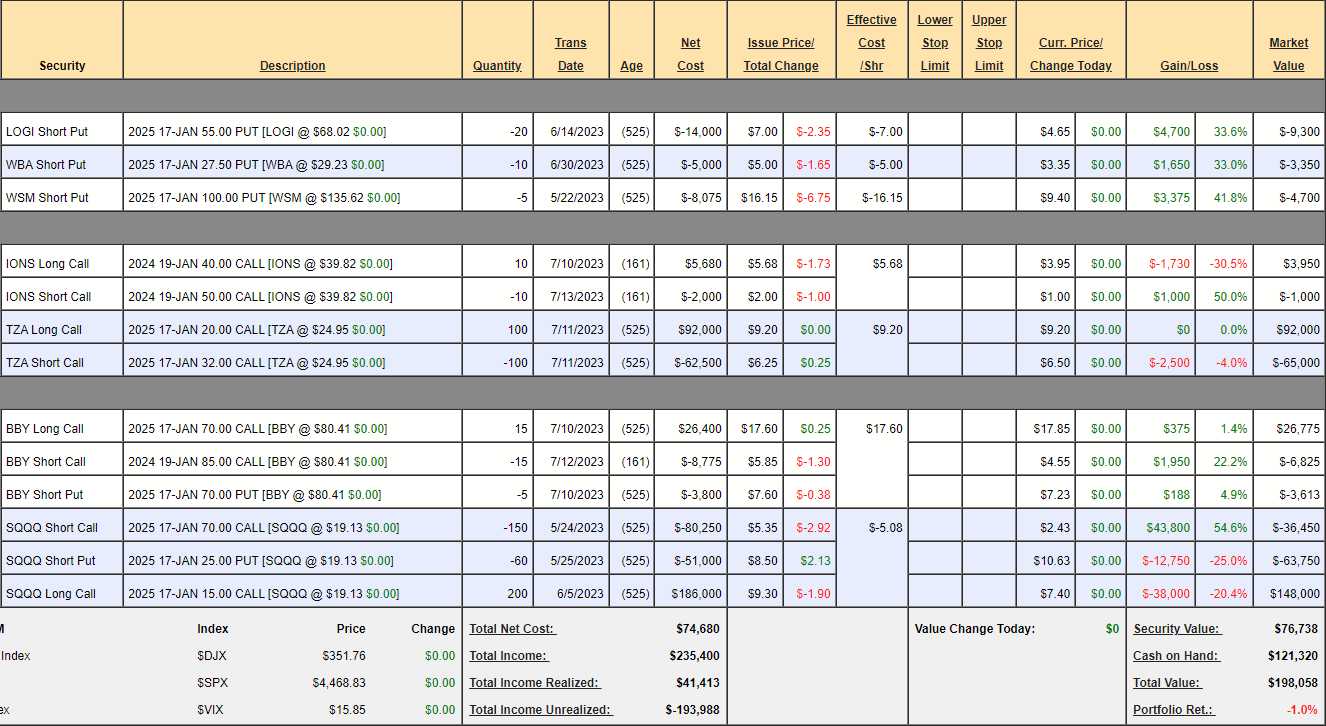

As of this morning, the STP is back to $198,058 (-1%) – a gain of $27,375 since July 18th (and we were had net $49,363 in positions to make that money!) and that has more than offset the pullbacks in our long positions and that’s what I mean when I say we want to “LOCK IN OUR GAINS” by putting 25-35% of our winnings into our hedges.

It’s been a while (2019) since we had new portfolios and I’m sure a lot of our Members have forgotten how powerful these hedges can be. For new Members, however, keep in mind that learning to use hedges is like buying a chain saw – it’s an amazing tool once you put your 10,000 hours in but you can lose a finger in the first 1,000 hours very easily!

Portfolio management is all about BALANCE! Balance is the key to everything, as Mr. Miyagi taught us. If your portfolios are balanced, then you can easily ride out the ups and downs of the markets and take advantage of opportunities – up or down – as they present themselves. If you are off-balance, then a single wave coming from the wrong direction can upend all of your plans. BALANCE IS KEY!

Portfolio management is all about BALANCE! Balance is the key to everything, as Mr. Miyagi taught us. If your portfolios are balanced, then you can easily ride out the ups and downs of the markets and take advantage of opportunities – up or down – as they present themselves. If you are off-balance, then a single wave coming from the wrong direction can upend all of your plans. BALANCE IS KEY!

That brings us back to China which President Biden, after reading my report from yesterday, called “A ticking time bomb” and the Hang Seng fell 2% early this morning (sorry China). I don’t want to rehash the issue into the weekend as I’m starting to get 2007 flashbacks – thank God for our hedges. So happy thoughts people!

- Biden Walks a China Tech Tightrope

- Chinese Property Giant’s Problems Continue to Mount

- China’s Options for Retaliation Are Few After U.S. Investment Ban

- China’s Deflation Danger Isn’t What You Think

- Startups Are Dying Amid Drought in Venture Funding

- Covid-19 infections are rising in the U.S

-

It Took $1.7 Billion to Fix Fire Island’s Beaches. One Storm Wrecked Them.

“How can we dance when our earth is turnin’?

How do we sleep while our beds are burnin’?

How can we dance when our earth is turnin’?

How do we sleep while our beds are burnin’?”

Have a great weekend,

-

- Phil