By John Kemp, Reuters Senior Market Analyst

Prices for diesel and other distillate fuel oils have surged as expectations for a soft landing and an improving economic outlook in the United States threaten to deplete already low inventories even further.

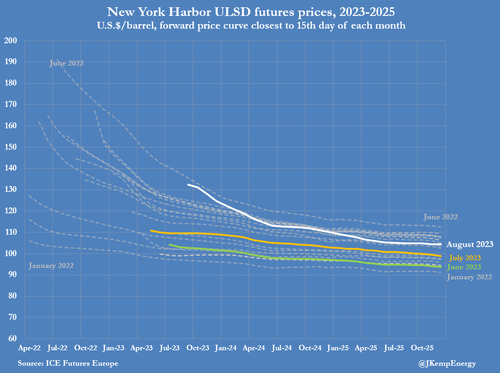

Futures prices for ultra-low sulphur diesel delivered in New York Harbor in September climbed to $135 per barrel on August 9, up from $95 on May 31.

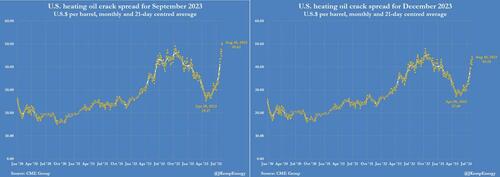

Prices for diesel and other distillate fuel oils have been rising much faster than for crude petroleum, widening margins for refiners.

The crack spread for making diesel from U.S. crude, with both delivered in September 2023, has doubled to $50 per barrel from $25 at the end of April. The crack for making diesel from U.S. crude, with both delivered in December 2023, has climbed to $43 per barrel from $27 at the end of April.

Diesel prices are rising as traders anticipate that shortages will quickly re-emerge if the economy avoids falling into a recession later in 2023.

DEPLETED INVENTORIES

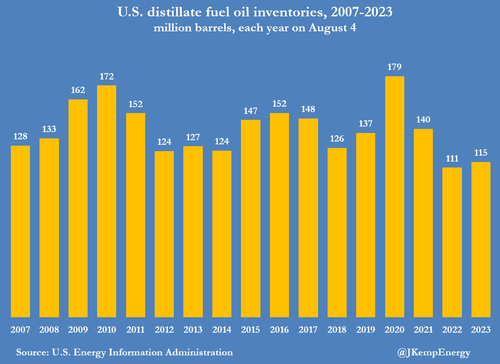

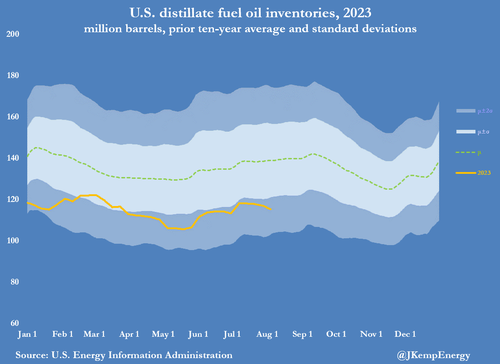

Distillate inventories have not recovered significantly despite the slowdown in manufacturing and freight activity evident since the middle of 2022.

U.S. inventories amounted to 115 million barrels on August 4, up from 111 million a year ago, but otherwise the lowest for the time of year since 2000.

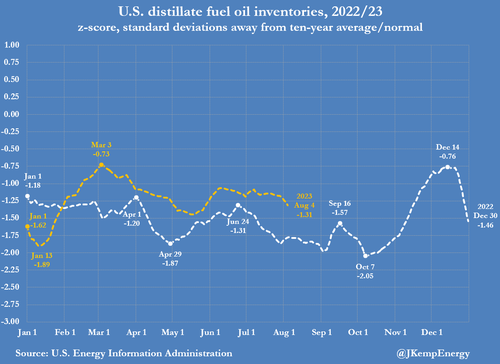

Inventories were 24 million barrels (-17% or -1.31 standard deviations) below the prior ten-year seasonal average on August 4, based on data from the U.S. Energy Information Administration (EIA).

The deficit has widened rather than narrowed over the last five months from 12 million barrels (-9% or -0.73 standard deviations) on March 3 (“Weekly petroleum status report”, EIA, August 9).

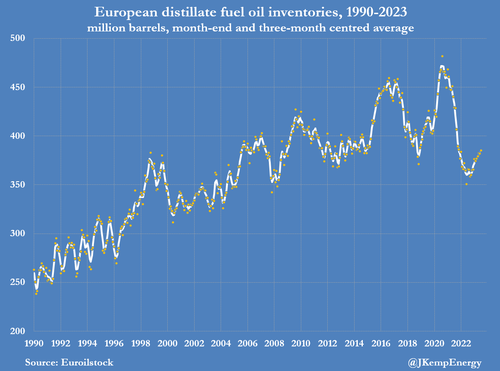

The distillate shortage is a worldwide phenomenon, with inventories also 33 million barrels (-8% or -1.11 standard deviations) below the 10-year average in Europe at the end of July.

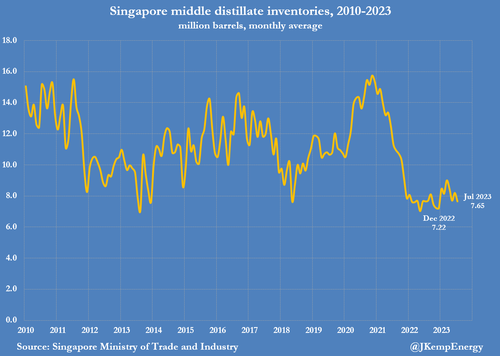

Singapore stocks were 3 million barrels (-30% or -1.79) below the 10-year average in the course of July, so there is limited scope for resolving the deficits by moving inventories from one region to another.

REFINERY CAPACITY LIMITS

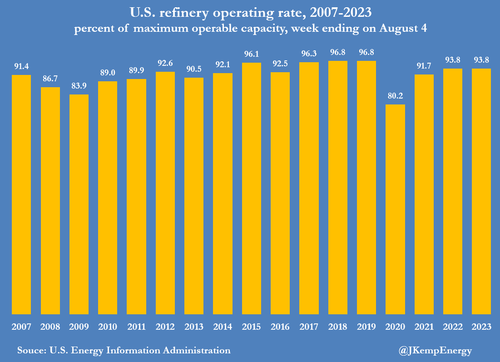

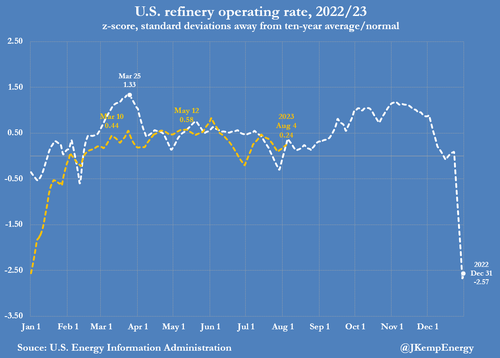

U.S. refineries are operating close to their maximum capacity and are also under pressure to maximise production of gasoline given low inventories of that fuel as well.

U.S. refineries were running at 93.8% of their maximum operable capacity over the seven days ending on August 4, which was just 1.1 percentage points below the average over the last decade.

Technically, refiners might be able to boost crude processing by another 200,000 to 300,000 barrels per day but that would yield no more than an extra 60,000 to 120,000 barrels per day of distillate fuel oil.

In any event, refiners are under pressure to maximise gasoline output as well, where inventories are at the lowest season level since 2015, and 12 million barrels (-5% or -1.23 standard deviations) below the 10-year average.

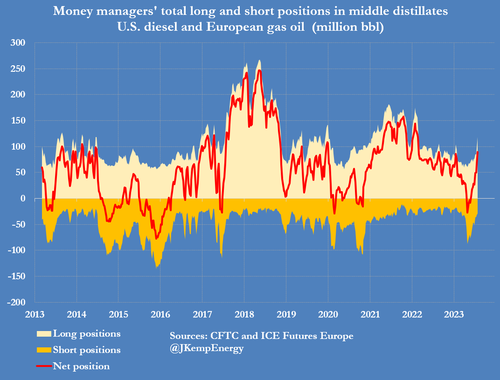

Until three months ago, portfolio investors had become increasingly bearish on the outlook for distillate prices, anticipating a recession would cut consumption and cause inventories to accumulate.

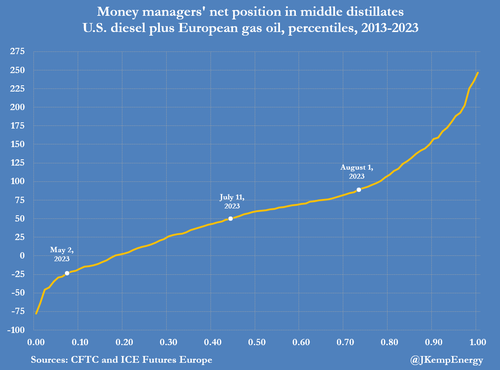

By May 2, hedge funds and other money managers had amassed a combined net short position of 27 million barrels in U.S. diesel and European gas oil futures and options (6th percentile for all weeks since 2013).

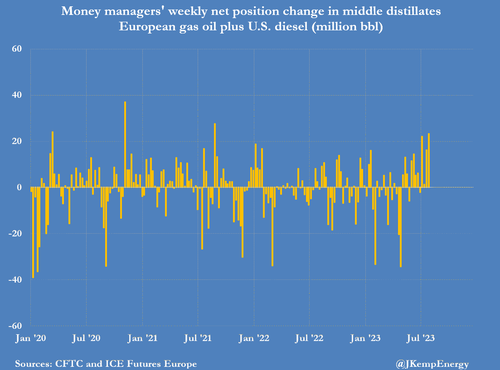

Since then, however, fund managers have been purchasers in 11 out of the last 13 weeks, purchasing a total of 116 million barrels, as the threat of recession has receded and the risk of fuel shortages has re-emerged.

By August 1, the combined position had been transformed to 89 million barrels net long (73rd percentile), according to records filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

Position-building by hedge fund managers has anticipated, accelerated and amplified the rise in distillate prices and crack spreads and is speeding up the adjustment to the next phase of the cycle.

With much of the position-building concentrated in nearby futures contracts, where both liquidity and volatility are highest, futures contracts have already swung into a steep backwardation.

For U.S. diesel, the futures spread between September and December has moved into a backwardation of $8 per barrel up from a small contango at the start of May.

CANARY IN THE MINE

Diesel often acts as the canary in the mine for broader inflationary pressure in the economy because it is overwhelming consumed by trucking firms, railroads, manufacturers and construction firms.

The negligible accumulation of diesel and other distillate inventories implies the industrial recession may not have been as deep as other indicators such as business surveys have suggested since the middle of 2022.

As a result, the industrial economy is likely to emerge from the current business cycle slowdown with a relatively small amount of spare production capacity and working inventories.

The rapid escalation in diesel prices and hedge fund position building is a warning that capacity constraints and upward pressure on goods prices are likely to re-emerge relatively quickly later in 2023 and in 2024.

Depleted diesel inventories are a sign that if the economy achieves a mid-cycle soft-landing the second phase of the current expansion could prove short and inflationary.