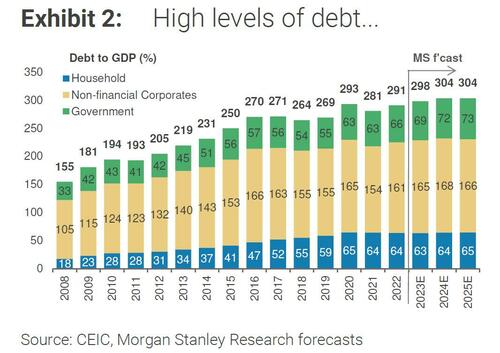

No surprises here: those who have warned for the past 15 years that the relentless increase in China’s debt to new record highs – now at ~300% of GDP – month after month and quarter after quarter would lead to catastrophic results, were of course right, and while Beijing’s debt crisis “can-kicking” over the past decade has been admirable, the countdown to D-day has begun.

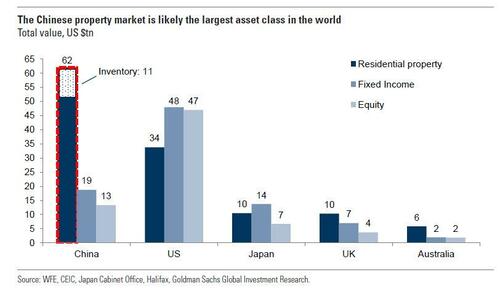

Just a few days after we reported that China is facing a “bigger debt crisis than Evergrande” in less than 30 days now that the country’s formerly largest property developer, Country Garden, has entered a grace period on two of its bonds, overnight we got the latest Chinese crisis bombshell: one of the country’s biggest private wealth managers missed payments on multiple shadow banking (i.e. high-yield investment) products, stoking fresh worries about contagion amid the deflationary pressures discussed last night and, of course, a tottering real estate sector, which as a reminder is the largest asset class on earth.

The turmoil at Zhongzhi Enterprise Group, which Bloomberg describes as a “secretive financial conglomerate that manages about 1 trillion yuan ($138 billion)” has emerged as the latest debt-crisis trigger after several of its corporate clients disclosed overdue payments by a trust unit. And in a sign that Chinese authorities are worried about potential contagion, the banking regulator has set up a task force to examine risks at Zhongzhi.

While little known outside China, Zhongzhi is among the biggest players in the country’s $2.9 trillion trust industry, a key anchor of the country’s troubled shadow banking sector, which combines characteristics of commercial and investment banking, private equity and wealth management. Firms in the sector pool savings from wealthy households and corporate clients to offer loans and invest in real estate, stocks, bonds and commodities. As a result, they are usually the first to blow up any time the country’s enters into one of its trademark economic and debt market “turbulence” phases.

While Chinese trusts had been under pressure for years after regulators began clamping down on the nation’s shadow-banking excesses in 2017, Zhongzhi’s difficulties have only emerged now – at a particularly sensitive time for investors, many of whom are already worried about the state of the world’s second-largest economy and its property market.

A total of 106 trust products worth 44 billion yuan defaulted this year through July 31, according to data provider Use Trust. Real estate investments accounted for 74% by value.

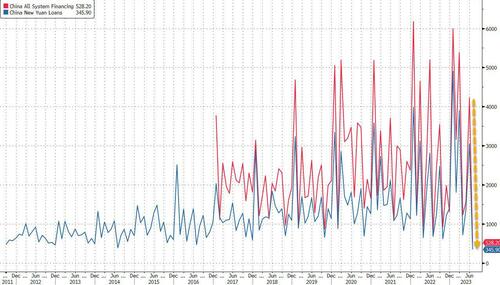

With both Country Garden and China’s shadow banking sector on the verge, it’s no surprise that China’s credit machinery has ground to a halt, and as we reported last night, loans extended by Chinese banks fell to the lowest level since 2009 last month in a sign of waning demand from businesses and consumers, and also a clear sign that China is facing a brutal period of debt deleveraging-driven deflation.

What appears to have sparked the crisis Zhongzhi’s trust unit is its purchase in stakes in real estate projects last year, betting on a market rebound that has so far failed to materialize.

“The biggest problem now is how to isolate the risks associated with Zhongzhi group so that it doesn’t cause confidence of the entire trust industry to collapse,” said Shen Meng, a director with Beijing-based Chanson & Co. “If the situation continues to worsen, expect the scale of the risks to be no less than when a leading property developer defaults.”

Zhongzhi is the second-largest shareholder of Zhongrong Trust, with its ownership at around 33%. The conglomerate also holds stakes in five other licensed financial firms, including a mutual fund manager and two insurers, and invested in five asset management companies and four wealth units, according to its website. It also controls listed companies and owns 4.5 billion tons of coal reserves among its industrial operations.

Three firms said late Friday they failed to receive payments on products issued by companies linked to Zhongzhi, including Zhongrong International Trust.

The missed payments show “how the real estate’s liquidity problem can create a domino effect on other sectors, including the trust industry,” said Gary Ng, senior economist at Natixis. “It would not be surprising to see more trusts with a high asset allocation towards real estate face payment issues.”

Beijing-based Zhongzhi was founded in 1995 by Xie Zhikun, who built the firm into a sprawling empire. Xie died of a heart attack in 2021, just as Covid-19 and pandemic lockdowns slowed China’s economy and increased volatility in its capital markets. While his replacement Liu Yang vowed to keep the company’s strategic focus on industrial and asset management businesses unchanged, the economic slowdown and the property-market slump have weighed on its operations.

Zhongrong Trust alone has 270 products totaling 39.5 billion yuan due this year, Use Trust data showed. The average yield on those products amounted to 6.88%, compared with the benchmark 1.5% one-year deposit rate paid by banks. Real estate accounted for 11% of Zhongrong Trust’s trust assets, following 42% in industries and 33% in financial institutions, according to its annual report. The company was previously fined 200,000 yuan by regulators for investing in a property project that lacked relevant approvals, and pledged to improve compliance.

According to Bloomberg, the trust company has disclosed little to the public about its situation, though it has said it’s aware of forged letters being shared on social media saying the company is no longer able to operate. The firm has reported them to authorities, according to a statement on its website.

In one unverified letter being circulated on social media, a wealth manager at Zhongzhi apologized to his clients, saying the group’s wealth arms have decided to delay payments on all products since mid July. The incident involves more than 150,000 investors with outstanding investments totaling 230 billion yuan, according to the letter.

* * *

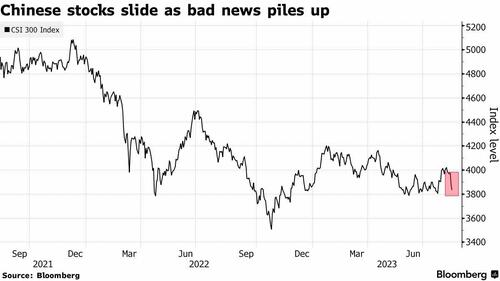

Following the combination of both that Country Garden and Zhongzhi news, Chinese stocks slumped on Monday, with the CSI 300 Index falling for the fifth time in six sessions, and the yuan depreciated toward its weakest level this year. While markets took some solace from news of the Zhongzhi task force, analysts at JPMorgan warned that the turmoil may contribute to a “vicious cycle” for real estate financing in China.

Yet despite the growing domestic turmoil which is starting to impact broader markets, the shock has been isolated so far and failed to spread offshore, not as Bloomberg’s Lisa Abramowicz writes, “what might be expected upon feeling tremors in the world’s second-largest economy.”

“For the the very first time in a long while we are seeing this global divergence,” ING’s Carsten Brzeski said, contrasting the strength of the US recovery with weakness in Europe and China bringing up the tail of the global growth train.

RBC’s Elsa Lignos suggested that investors are probably waiting to see if this is, at last, when the China dominos start toppling.

Elsa Lignos of RBC says investors have “shut up shop” for the summer. “They’re just not seeing the opportunities out there.” https://t.co/BGySwfFM2c pic.twitter.com/oDTY8HMeBF

— BSurveillance (@bsurveillance) August 14, 2023

“There have been people that have cried wolf one too many times,” she said. “Markets are just naturally reluctant to believe that this time it could be happening for real.” Of course, with nobody paying attention now, it’s just a matter of time before China does blow up.

Truist Advisory Services’ Keith Lerner nodded to once-dominant China narratives that are now being shredded by reality, like the idea of a roaring, post-Covid rebound or the certainty behind an inevitable intervention by Beijing.

“You talk about the stimulus, and you had this big rally on hope,” Lerner said. “You’ve given all of that back.”

And at Truist, at least, there was some satisfaction at getting the China call right. “From an asset allocation perspective we’ve been very negative on China, and that’s one of the reasons why we’ve been basically zero allocation on our global portfolios to EM since last year,” Lerner said.