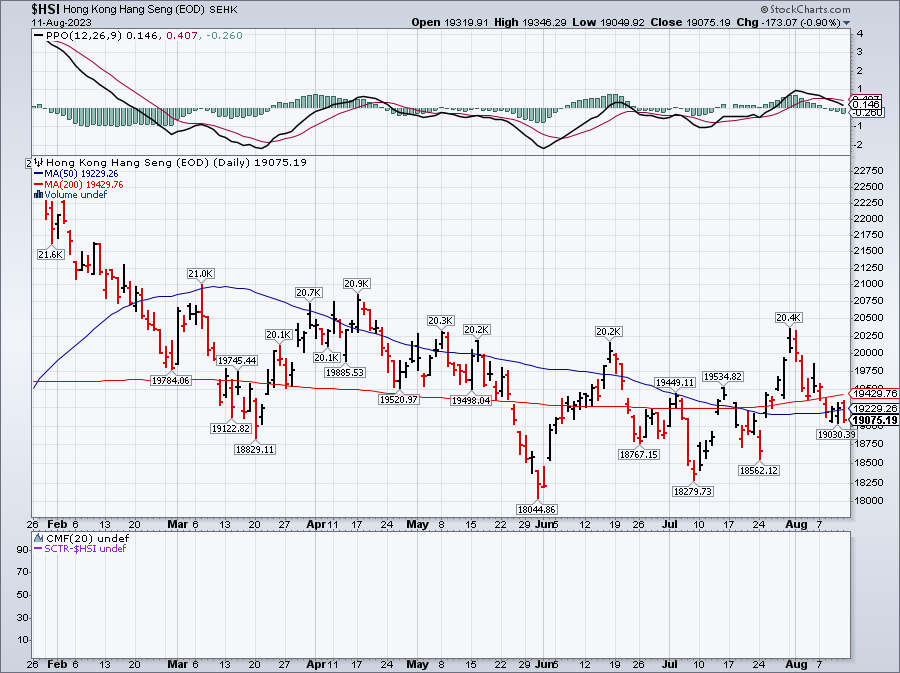

The Hang Seng is having a very bad month.

The Hang Seng is having a very bad month.

Down another 1% this morning makes -6.5% in two weeks for China Stocks. Renewed concerns about the property sector, missed payments by one of the nation’s largest private wealth managers, unprecedented losses at China-focused hedge funds and the threat of deflation have all combined to deal a blow to investor sentiment. A gauge of Chinese stocks listed in Hong Kong slumped again on Monday and is now the worst performer this month among 92 global equity measures tracked by Bloomberg. The offshore yuan fell toward its weakest level this year.

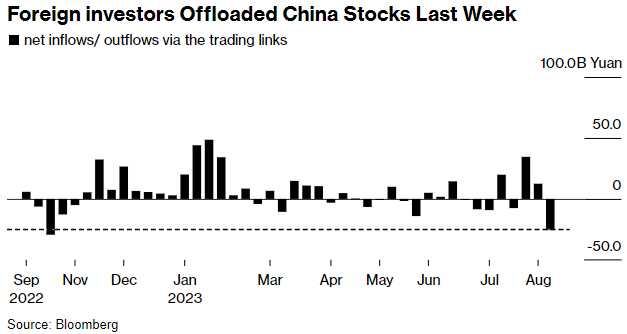

Global funds were net sellers of onshore Chinese equities for a sixth straight session on Monday, helping put the benchmark CSI 300 Index on track to erase all the gains seen since the nation’s top leaders promised pro-growth policies at the Politburo meeting on July 24. Economic data since has shown that the recovery is losing traction, with investors concerned that Beijing’s steps to counter the slowdown have proved too little, too slow.

“The market sentiment is ultra weak and the Politburo boost looks like it was just an interlude amid the pessimistic theme that has prevailed over the past months,” said Wang Mingli, executive director at Shanghai Youpu Investment Co. “After a brief round of optimism, investors are again disappointed as they realize that policies are still not concrete enough to offer a real lift to the economy.”

Country Garden is still ground zero for China’s melt-down, after suspending trading on 11 offshore bonds and dropping yet another 18%, below HK$1 for the fist time ever. Signs of stress in China’s shadow banking industry also fueled the selling on Monday. Three firms said late Friday they failed to receive payments on products issued by companies linked to Zhongzhi Enterprise Group Co., one of the nation’s top private wealth managers.

Country Garden is still ground zero for China’s melt-down, after suspending trading on 11 offshore bonds and dropping yet another 18%, below HK$1 for the fist time ever. Signs of stress in China’s shadow banking industry also fueled the selling on Monday. Three firms said late Friday they failed to receive payments on products issued by companies linked to Zhongzhi Enterprise Group Co., one of the nation’s top private wealth managers.

- China Deflation Dims Hopes of an Earnings-Driven Stock Rebound

- China’s Economic Woes Deepen With Housing Market Slump

- China’s Housing Problems Spook Investors

- China Hedge Funds in Crisis After Losses, US Investor Retreat

- Country Garden Woes Deepen as Yuan Bonds Halted, Shares Slide

- Plunging Loans Show Risk of Beijing Acting Too Late: China Today

I know this is not a fun way to start a Monday but ignoring China’s problems and acting like they would not affect the US is how investors got in trouble in 2008, when Hugh Hendry and I used to warn people about all those empty cities in China and no one paid attention…

From this season’s earnings we can already see the deepening economic slump is starting to a toll on big American companies with substantial operations in China. There’s a growing sense of pessimism about the long-awaited post-pandemic economic boom and this is having direct repercussions on American enterprises. Heavyweights like DuPont, Dow, and Caterpillar are all grappling with the aftermath of China’s economic slowdown. Some companies are even revising their sales outlook for China for the rest of the year, expressing disappointment in Beijing’s stimulus measures.

And REMEMBER: Companies doing business in China are not able to point fingers at China or even to discuss failures in Chinese Government Policy for fear of repercussions. Remember what happened when John Cena accidentally called Taiwan a country? Imagine what would happen to CEOs who try to blame the Chinese Government for their poor sales!

And REMEMBER: Companies doing business in China are not able to point fingers at China or even to discuss failures in Chinese Government Policy for fear of repercussions. Remember what happened when John Cena accidentally called Taiwan a country? Imagine what would happen to CEOs who try to blame the Chinese Government for their poor sales!

Companies entrenched in China’s struggling Manufacturing, Construction, and Export industries are facing weaker sales. The economic slowdown is evident in these sectors, leading some companies to sound warnings about further difficulties ahead. The growth momentum seems to be grinding to a near halt.

It’s not all terrible, Marriott (MAR) had a surge in room demand now that the lockdown is lifted (duh!), Starbucks (SBUX) continues to expand rapidly with 51% growth in revenue (but also compared to lockdown) and Apple (AAPL) had record revenues in China, Hong Kong and Taiwan – which is fine as long as they list them all under CHINA!!!

Despite initial hopes of a rebound after China’s post-pandemic reopening, the economic readings of the world’s second-largest economy have soured. Manufacturing activity is contracting, Exports are declining, Consumer Confidence remains shaky, and Youth Unemployment has hit record highs. Recent data indicating an unusual drop in consumer prices have raised concerns about China potentially entering a Deflationary Spiral of Weakening Demand. This adds a layer of complexity to the economic challenges China is facing.

Companies reliant on China exports are experiencing a knock-on effect in other parts of the World. Some European companies are being impacted due to their dependence on exports to China. Companies like LyondellBasell Industries (LYB) and Parker Hannifin (PH) have reported little positive impact from the initial stimulus. This echoes concerns that the efforts haven’t yielded substantial results on the ground.

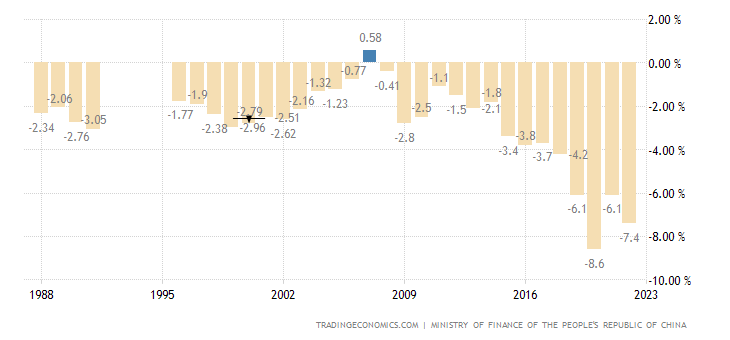

I know many investors believe China was running a surplus or some such nonsense but that has not been the case at all and China’s debt situation is almost as bad as the US’s (who are running a 6% deficit this year) so neither country can afford to just keep throwing stimulus at their problems. That doesn’t mean they won’t – just like they can’t afford to!

We will keep our ears open for more China commentary this week as we still have plenty of earnings reports to sift through. Here are some that are of interest:

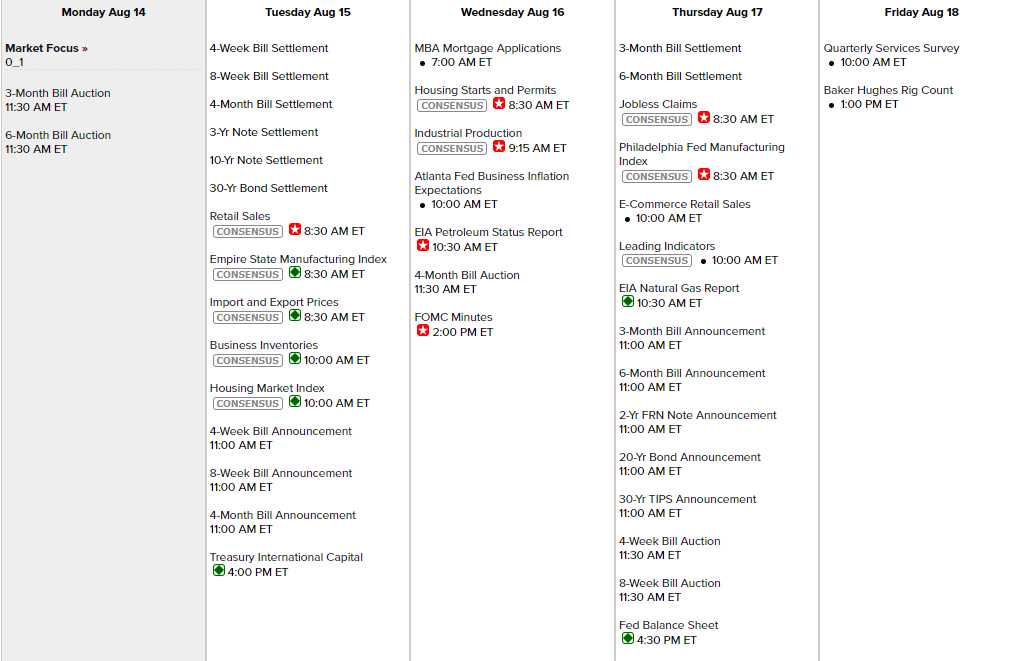

On the Economic Calendar, we have Retail Sales, Empire State Manufacturing (a rolling disaster) and Housing tomorrow, Industrial Production and the Atlanta Fed on Wednesday along with the Fed Minutes then, on Thursday, we have the Philly Fed, On-Line Sales and Leading Economic Indicators and the Services Report on Friday.

Be extra careful out there – things are getting messy!

“I’m a mess without my little China girl

Wake up in the morning, where’s my little China girl?

I hear her heart’s beating loud as thunder

I saw the stars crashing down

I’m feeling tragic like I’m Marlon Brando

When I look at my China girl

I could pretend that nothing really meant too much

When I look at my China girl” – Bowie