Three months ago, when looking at Michael Burry’s Q1 13F which in turn followed just a few months after the famous permabear admitted he had been wrong to urge his followed to sell…

… we found that the Big Short had continued the trend of rapidly rotating his entire portfolio and in the first quarter, Burry liquidated the rest of his legacy 2022 holdings, dumping his entire stake in companies like Black Knight, Wolverine World Wide, MGM Resorts and Qurate, and also trimmed his formerly largest holding, private prison operator GEO group, and had reallocated the proceeds in three ways:

-

Adding to his Chinese exposure, making JD.com and Alibaba his top stocks (a move which appears to have been driven by the Q4 momentum and which has since fizzled, leading to substantial losses in Chinese names).

-

Launching a handful of new positions in energy names such as Coterra, NOV and Devon

-

Most notably, a third – or seven of the fund’s total 21 positions – were bank names, and with the exception of Wells, they were mostly distressed, regional, small banks and/or credit card companies, such as CapitalOne, Western Alliance, Pacwest, First Republic, and Huntington Bancshares, all of which had been hammered significantly during the March bank crisis.

In other words, as we put it then, “Burry appears to have enough of being called the “big short” and in this particular twist of the liquidity cycle is positioning himself to be the next “big long.”

Fast forward another three months, when moments ago Burry’s Scion Asset Management published its latest 13F, and which shows even more dramatic changes in Burry’s personal portfolio.

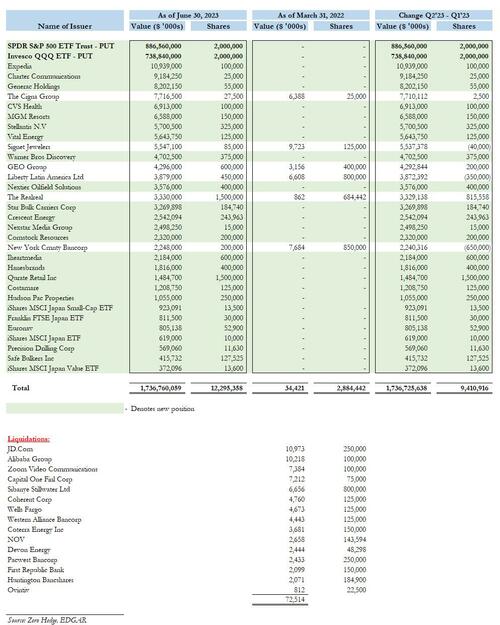

First and foremost, we find that once again, Burry liquidated the bulk of his Q1 holdings, liquidating not only his previous top two positions, JD.com and Alibaba but also another 13 names of the 21 names that made up Burry’s Q1 holdings, among which were Zoom, Sibanye, Coherent, energy names such as Coterra, NOV and Devon, as well as all the banks he had acquired during the March crisis including Capital One, Wells Fargo, Western Alliance, Pacwest, and First Republic.

So what did he buy? Quite a few things as it turns out.

Let’s start with Burry’s largest cash holdings which as of June 30, were Expedia ($10.9MM), Charter Communications ($9.2MM) and Generac ($8.2MM, which however is surely worth much less after the company’s catastrophic Q2 earnings which wiped out almost a third of its value).

Other names Burry added were Cigna, CVS, MGM, Stellantis, Vital, all of which represented new mid-to-high single digit million positions (the full list is below).

But what was the most interesting new development, was not the single names Burry bought or sold, but his ETF and derivative trades.

Starting at the top, as of June, Burry owned two 2 million notional-equivalent blocks of SPY puts (for a notional-equivalent value of $887 million) and QQQ puts (a $739 million notional equivalent). In total, Burry owned puts on both the S&P and Nasdaq 100 for a notional-equivalent of $1.625 billion (which of course is not the capital at risk, but rather the premium Burry paid for those puts, and which are both deeply underwater as of this moment since both the S&P and Nasdaq are trading high above where they were on June 30.

And while Burry is clearly souring again on broader US markets (while going long specific single names), he is far more bullish vis-a-vis Japanese stocks, where he is long via 4 Japan-focused iShares and Frankling ETFs to the tune of $2.725MM, a trade which is certainly predicated by the recent collapse in the yen which has sparked aggressive buying in Japanese stocks on hopes that the BOJ will allow the yen to keep sliding.

Burry’s full 13F summary is below.