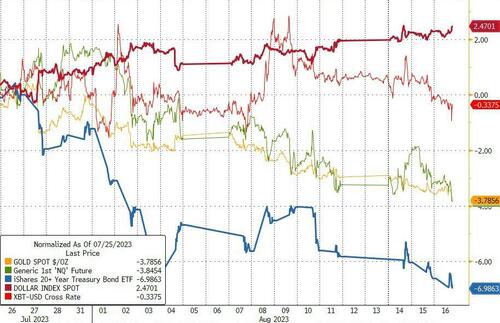

Since the last FOMC meeting (on July 26, when The Fed delivered the expected 25bps hike and almost unchanged statement), the dollar has rallied aggressively while bonds, bullion, and big-tech have been battered. Bitcoin is basically unch…

Source: Bloomberg

Most notably, in equity-land, after an initial rise, we have seen cyclicals underperform defensives since the last FOMC meeting…

Source: Bloomberg

The market’s expectations for The Fed are basically unchanged since the last FOMC meeting, having initially dropped dovishly, they have recently revived hawkishly…

Source: Bloomberg

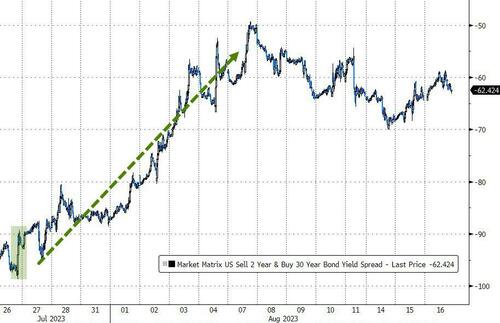

But bond yields have been hammered higher, led by the long-end…

Source: Bloomberg

…as the curve has steepened (de-inverted) dramatically

Source: Bloomberg

So what can we expect to see in today’s FOMC Minutes? Not much, to be frank; however traders will be looking for any commentary on how the Fed assesses growth dynamics; given that inflation is slowly inching back down towards target, many expect the Fed to pivot policy, and eventually begin cutting rates to support the economy.

Fed signals it’s likely not finished raising interest rates with this key quote:

“Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy”

But, there are Downside risks:

“In discussing downside risks to economic activity and inflation, participants considered the possibility that the cumulative tightening of monetary policy could lead to a sharper slowdown in the economy than expected, as well as the possibility that the effects of the tightening of bank credit conditions could prove more substantial than anticipated.”

Minutes don’t give a definitive steer on the next rate decision in September, saying future moves “should depend on the totality” of incoming information and its implications for the outlook.

On Inflation:

Participants noted the recent reduction in total and core inflation rates. However, they stressed that inflation remained unacceptably high and that further evidence would be required for them to be confident that inflation was clearly on a path toward the Committee’s 2 percent objective.

…

Although inflation had moderated since the middle of last year, it remained well above the Committee’s longer-run goal of 2 percent, and participants remained resolute in their commitment to bring inflation down to the Committee’s 2 percent objective. Amid these economic conditions, almost all participants judged it appropriate to raise the target range for the federal funds rate to 5¼ to 5½ percent at this meeting.

Participants noted that this action would put the stance of monetary policy further into restrictive territory, consistent with reducing demand–supply imbalances in the economy and helping to restore price stability.

On ‘core’ inflation (ex-food, energy and housing), a key sector they’re watching:

“Nonetheless, several participants commented that significant disinflationary pressures had yet to become apparent in the prices of core services excluding housing.”

On Economic activity:

Participants continued to view a period of below-trend growth in real GDP and some softening in labor market conditions as needed to bring aggregate supply and aggregate demand into better balance and reduce inflation pressures sufficiently to return inflation to 2 percent over time.

Which is odd given that The Atlanta Fed’s GDPNOW forecast is now at +5.8% for Q3 GDP.

No more recession:

The economic forecast prepared by the staff for the July FOMC meeting was stronger than the June projection. Since the emergence of stress in the banking sector in mid-March, indicators of spending and real activity had come in stronger than anticipated; as a result, the staff no longer judged that the economy would enter a mild recession toward the end of the year.

However, the staff continued to expect that real GDP growth in 2024 and 2025 would run below their estimate of potential output growth, leading to a small increase in the unemployment rate relative to its current level.

On the Labor Market:

The labor market remained very tight, though the imbalance between demand and supply in the labor market was gradually diminishing.

On the Banking system:

… while the overall banking system retained ample loss-bearing capacity, some banks experienced sizable declines in the fair value of their assets as a consequence of rising interest rates.

Vulnerabilities associated with funding risks were also characterized as notable. Although a small number of banks saw notable outflows of deposits late in the first quarter and early in the second quarter, deposit flows later stabilized.

Finally, we note that only 2 of the 18 members wanted to hold rates…

A couple of participants indicated that they favored leaving the target range for the federal funds rate unchanged or that they could have supported such a proposal.

They judged that maintaining the current degree of restrictiveness at this time would likely result in further progress toward the Committee’s goals while allowing the Committee time to further evaluate this progress