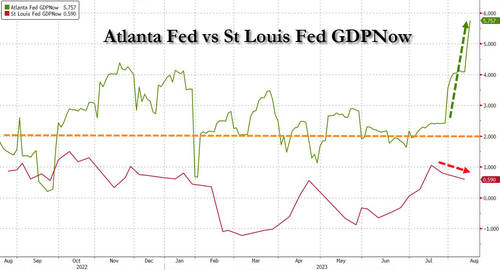

Better than expected industrial production and a bigger than expected rise in housing starts lifted the Atlanta Fed’s GDPNOW forecast for Q3 growth to 5.8% (but the St.Louis Fed’s GDPNOWCast is not at all impressed)…

Source: Bloomberg

Is that what The Fed is hoping for from its tightening? While September odds were unchanged today, the market’s expectations for year-end are hawkishly on the rise…

Source: Bloomberg

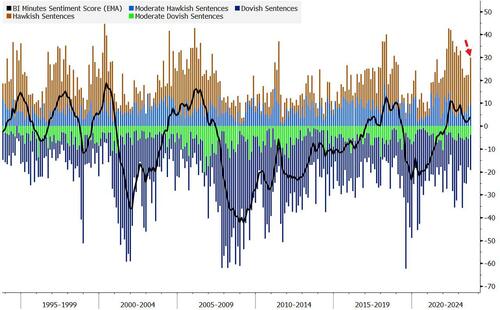

The Fed’s Minutes were decidedly hawkish (with the most hawkish sentences since January according to Bloomberg’s NLP model)…

Source: Bloomberg

And that weighed on everything with stocks, bonds, and commodities lower while the dollar rallied.

Nasdaq and Small Caps were the day’s biggest laggards but all the US majors were ugly with the market’s negative gamma very evident into the close…

The Nasdaq 100 broke below 15,000 to its lowest since June (almost 7% off the highs)…

The S&P, Nasdaq, and Russell 2000 all closed below their 50DMAs (The Dow remains above its)…

Cyclicals continued to underperform Defensives as the ‘overshoot’ in growth expectations is reversing fast (but has a long way to go)…

Source: Bloomberg

Regional bank stocks extended their recent losses…

Is it catch down time for stocks to credit…

Treasury yields were higher on the day across the curve with the longer-end underperforming (2Y +2bps, 10Y +6bps)…

Source: Bloomberg

The 30Y Yield closed at its highest since Oct ’22…

Source: Bloomberg

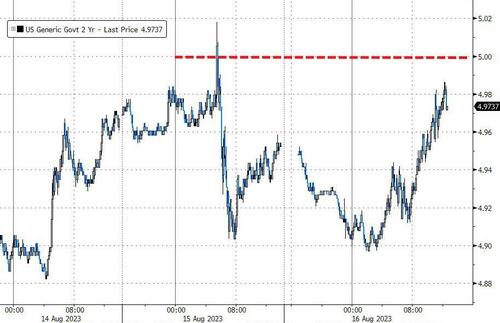

The 2Y yield pushed up towards 5.00% today…

Source: Bloomberg

The dollar extended its recent gains today (the 5th straight day higher) to its highest close since May 2023…

Source: Bloomberg

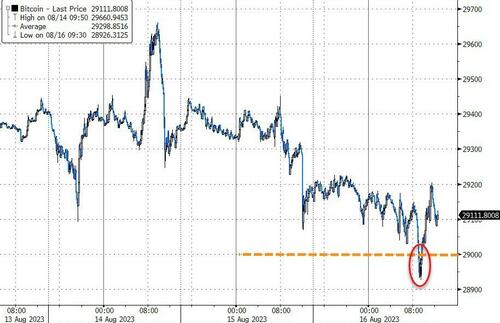

Bitcoin puked back below $29k intraday but found support and got back above…

Source: Bloomberg

Oil (WTI) fell back below $80 to two-week lows, but remains well off the June lows…

Gold (spot) broke below $1900 to its lowest close since March….

Source: Bloomberg

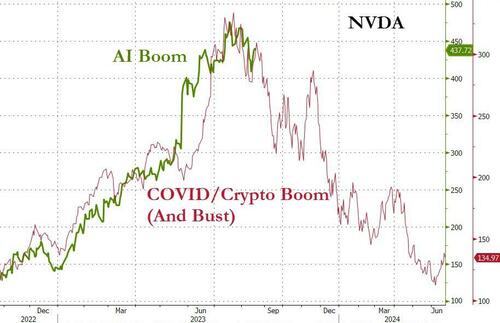

Finally, NVDA bounced (as expected) and stalled today (as expected)… what’s next?

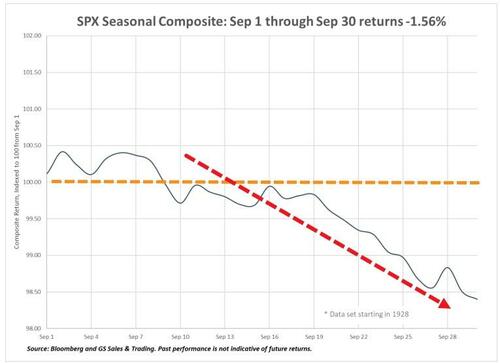

And September is coming…

The median return for S&P since 1928 is -1.56%, September is the worst month of the year.