First, the good news:

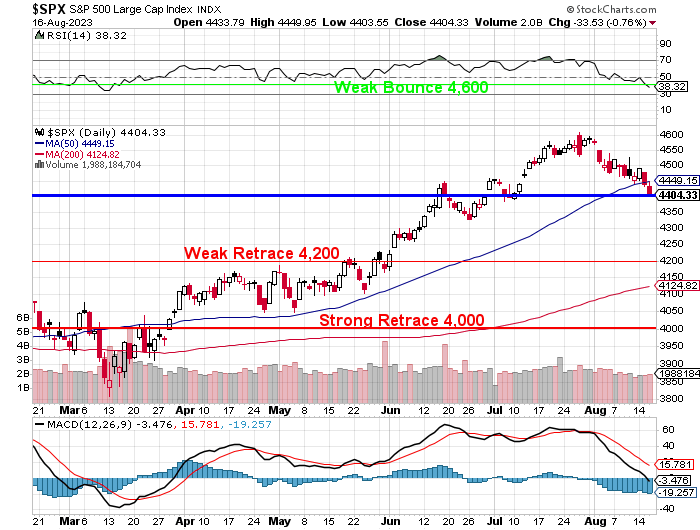

When I warned you the S&P 500 was overbought back at the end of July, the RSI was at 70 and the MACD was at 60 - both very overbought. Just 3 weeks later, with a 200-point (4.4%) pullback, we're already getting back to oversold territory so, IFF the S&P 500 can stay above that 4,400 line through the next week (closing out Earnings Season and basically August), then we will have a very good case for keeping our aggressive chart, where 4,400 is the mid-point and not the top of the range.

Unfortunately, charts don't decide where the market is going - they only tell you where it's been and FUNDAMENTALS tell us that we're more likely to hit 4,200 around the same time the S&P's 200-day moving average (now 4,124) also hits 4,200 and that will happen in just about 30 days.

See, isn't in nicer to know what is going to happen rather than what has happened? Based on earnings reports, economic data and investor sentiment, we expect the 50-day moving average (now 4,450) to stop any kind of bounce off 4,400 this week and then we'll break below 4,400 next week and have a miserable August that drops us another 5% where HOPEFULLY we'll get some proper support.

A 10% correction is what we expected and 4,200 would be right about there so, if nothing else goes wrong, that's what we can expect and that means we'll be doing a lot of buying later in September, so make sure you are familiar with our Watch List.

For example, Disney (DIS) is back to where we liked it in December at $88 (now $86.35) and we didn't pull the trigger then due to the BS with Desantis and that BS is still going on but Iger is back Desantis is done politically.