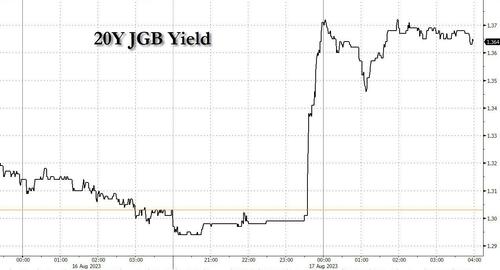

This morning global bond yields hitting a 15 year high, a move that was catalyzed by what Bloomberg dubbed a “miserable” 20 year auction, which priced with the longest tail – or the difference between average and cut-off prices – since 1987, while the bid-to-cover ratio fell to the lowest since September.

The Ministry of Finance sold about 992.5 billion yen ($6.78 billion) of the bond at an average yield of 1.322%, with the yield at 1.385% for the lowest accepted price. The dismal reception promptly sent yields to the highest level since January.

Traders pointed to huge tail as well as the low 2.8 bid-to-cover ratio for this bond, compared with the strong 3.5 ratio at last week’s 30-year auction as the reason for the rise in yields.

The results of the auction came as a “surprise,” said Shoki Omori, chief desk strategist at Mizuho Securities, with demand coming in extremely weak. Omori said the 20-year bond was an outlier because of the absence of a defined buyer profile and that most people with short positions in JGBs had bought before the auction.

“The buyers for the 30-year bonds were mainly life insurers, which had been steadily buying 30-year bonds (before the auction,” said Kaoru Shoji, Japan rates strategist at SMBC Nikko Securities.

“On the other hand, banks and pension funds were the main players in the 20-year bond auction. For them, the current level might not be cheap enough as yields may rise further as U.S Treasury yields are rising, and there is speculation that the BOJ may end its negative-rate policy.”

Yields on other tenors inched up too. The five-year yield rose 2 bps to 0.225%. While still far from the defacto upper bound of 1% that the Bank of Japan has set, the 10-year JGB yield hit 0.655%, up from a low of 0.565% last week.

Since the BOJ’s monetary policy meeting at the end of July, when the central bank tweaked its YCC to allow the 10Y to rise as high as 1%, investors have been carefully testing to see how much the BOJ will allow yields to rise. The last time the 10-year yield hit 0.655 the central bank stepped in with an emergency bond-buying operation.

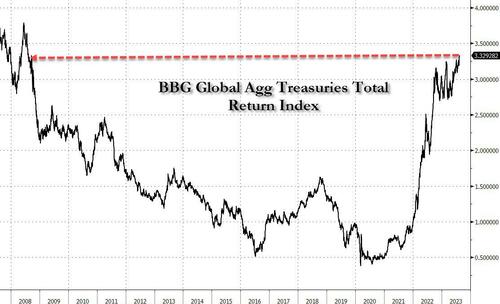

As Bloomberg’s Tommi Utoslahti writes, the “miserable” auction may well reflect mounting bets the Bank of Japan’s YCC will soon be loosened. But it’s also a significant warning sign for global government debt at a time when yields are already at 15-year highs. Soaring JGB yields would put further upward pressure on the rest of the world, and also mean tougher fiscal budget challenges.

Commenting on the auction, Saxo’s Althea Spinozzi wrote that “rising JGB yields threaten bonds worldwide, so we see EU and US sovereign yields accelerating their rise this morning.”

🇯🇵 An horrible 20-year JGB auction today tailed the most since 1987, showing that investors require a higher yield to buy JGBs.

Rising JGB yields threaten bonds worldwide, so we see EU and US sovereign yields accelerating their rise this morning.@saxobank @SaxoUK pic.twitter.com/He6NOo6IFr

— Althea Spinozzi (@Altheaspinozzi) August 17, 2023

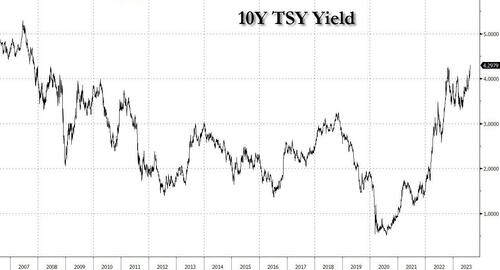

As noted earlier, global government bond yields extended their climb to the highest levels since the financial crisis after hawkish FOMC comments and resilient economic data challenges the view that central banks rates are peaking.

The 10-year TSY yield approached 4.31%, within a few basis points of its 2022 peak. The equivalent UK yield jumped to a 15-year high, while its German counterpart approached the highest since 2011.