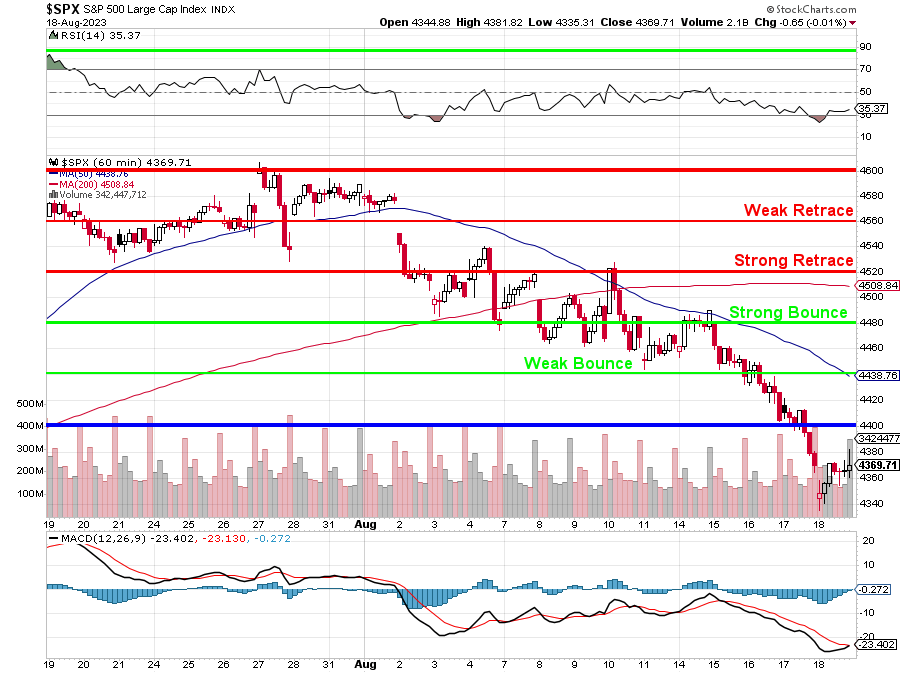

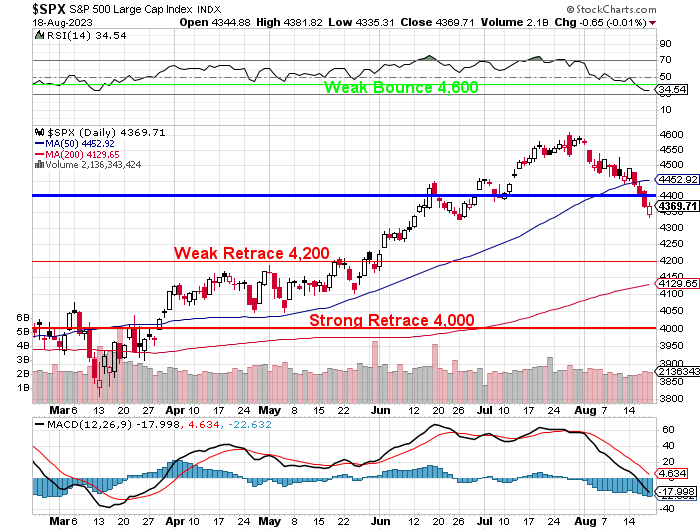

We have a lot of work to do to repair the index damage:

This is the hourly chart for the S&P 500 for the past month and it's been a pretty constant descent for the month of August. Using our Fabulous 5% Rule™, we know we can expect 40-point lines of resistance (coming from when we were basing at 4,000) but also, for this short-run, very simply, a 5% drop from 4,600 takes you to 4,370 and 4,360 is also the overshoot line (if you are making bullish assumptions) - so all is forgiven IF we can get back over 4,400 as fast as we fell below it.

That did not happen Friday so today is the last chance and, if not, then it's much more likely that we're consolidating for another 5% move down - hopefully at a slower pace towards 4,200 and a 10% overall correction. Here's the bigger picture:

So you are going to have those same 40-point segments within each 200-point segment on the daily chart and, now that we know where all our support and resistance lines are going to be, we just have to figure out what's likely to trigger a move above or below over the next few weeks.

We don't have the Fed until Sept 20th - so not a big consideration yet. China cut rates yet again (-0.1% to 3.45% for the one-year, 4.2% for a 5-year) and that's given us a boost this morning but it's never going to be enough to fix their rolling Commercial Real Estate Disaster because it doesn't matter how low the rates are if there are entire cities worth of empty buildings on the books.

The latest batch of disappointing economic data for July, alongside the underwhelming policy response, has prompted many global Investment Banks to lower forecasts on China’s full-year growth rate to below 5%.