No US macro today but China’s disappointingly smaller-than-expected cut to the one-year prime lending rate, confused markets and traders after last week’s unexpected rate cut.

Europe saw sentiment suddenly improve (for no good reason).

One thing of note was Jason Furman and Paul Krugman both pushing for The Fed to raise its inflation target (an arguably bullish – less higher for longer – policy shift). Who could have seen that coming…

At some point Fed will concede it has no control over supply. That’s when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Interestingly though, market expectations for The Fed continued to drift hawkishly…

Source: Bloomberg

…and then the US cash open – juiced by several NVDA upgrades – saw growth explode higher relative to growth… and keep going.

Today was the biggest ‘growth’ outperformance of ‘value’ since March 2023…

Source: Bloomberg

NVDA rallied back near recent record highs – ripping 7.5% on the day – after getting three more upgrades (BMO upped Px target from $450 to $550/share, KeyBanc raise to $620 from $550; HSBC raises to $780). This was NVDA’s best day since the earnings-day surge in May…

The options-tail wagged the NVDA dog’s body today with what looks like a ‘gamma squeeze’ engineering a constant bid. However, we do note that options traders were also buyers of puts in modest size…

Bear in mind that this bounce is ‘right on cue’…

Source: Bloomberg

All of which meant that Nasdaq outperformed dramatically. Dow and Small Caps lagged with the S&P managing decent gains…

Interestingly, UBS traders noted that:

The desk continues to see outflows in Mega Cap Tech (excluding Nvidia and Microsoft) into strength today as investors worry that Tech is broadly overvalued.

Nvidia has taken a recent leg higher on renewed faith that company beats on Wednesday’s print, driven by Data Center revenue.

Positioning is max long though the desk is not yet seeing investors cutting there or in Meta.

0-DTE traders pushed the market lower into lunch then tried to fade the bounce… and failed. Which led to 0-DTE call-buyers (not put unwinds) sending stocks soaring…

While VIX fell back below 17 today (and vol of vol collapsed)…

Source: Bloomberg

…traders remain anxious in the short-term for this week’s ‘events’ – NVDA on Weds night and Powell at Jackson Hole Friday morning…

Source: Bloomberg

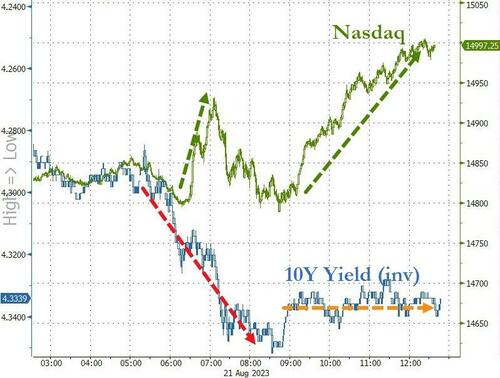

Nasdaq completely decoupled from bond yields today…

Source: Bloomberg

Bonds were sold across the whole curve today with the longer-end lagging (10Y +8bps, 2Y +5bps). Most of the selling pressure occurred between the US open and European close but we also note selling at China’s open and China’s post-lunch open (selling TSYs for USDs to buy yuan?)

Source: Bloomberg

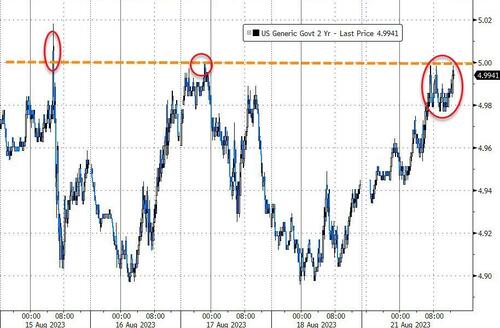

The 2Y Yield ripped right back up to 5.00% but failed to break it – on 3 attempts…

Source: Bloomberg

10Y Treasury yields broke above the Oct ’22 highs, back to its highest yield since Oct 2007…

Source: Bloomberg

Real rates (10Y) hit 2.00% for the first time since March 2009…

Source: Bloomberg

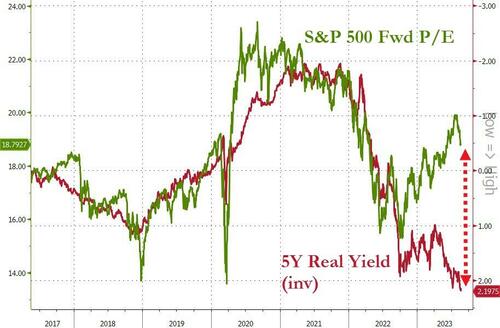

And growth stocks have completely decoupled from real yields…

Source: Bloomberg

And the S&P 500 is trading 5 turns too rich compared to real yields…

Source: Bloomberg

The dollar went nowhere on the day.

Crypto was modestly lower but no major pukes.

Oil prices fell, with WTI finding support at $80…

Gold tried – and failed – to get back up to $1900 (spot)…

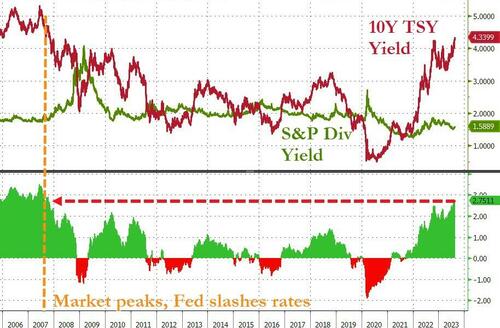

Finally, the last time 10Y yields were this far above dividend yields was sept/oct 2007 – BNP Paribas funds liquidate, Fed slashes rates, market peaks…

Source: Bloomberg

It’s different this time though.