Rates Rule Everything Around Me

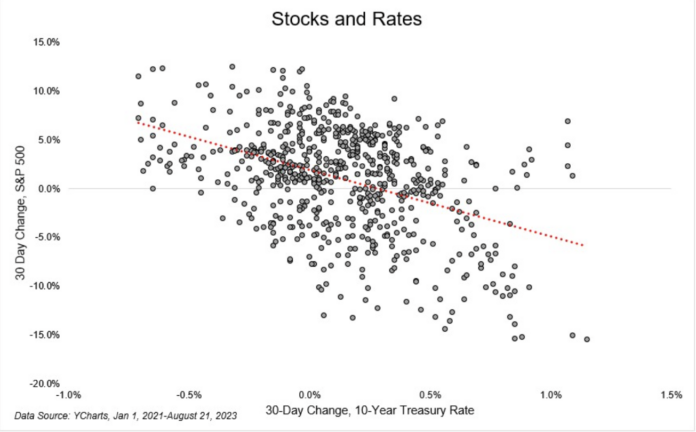

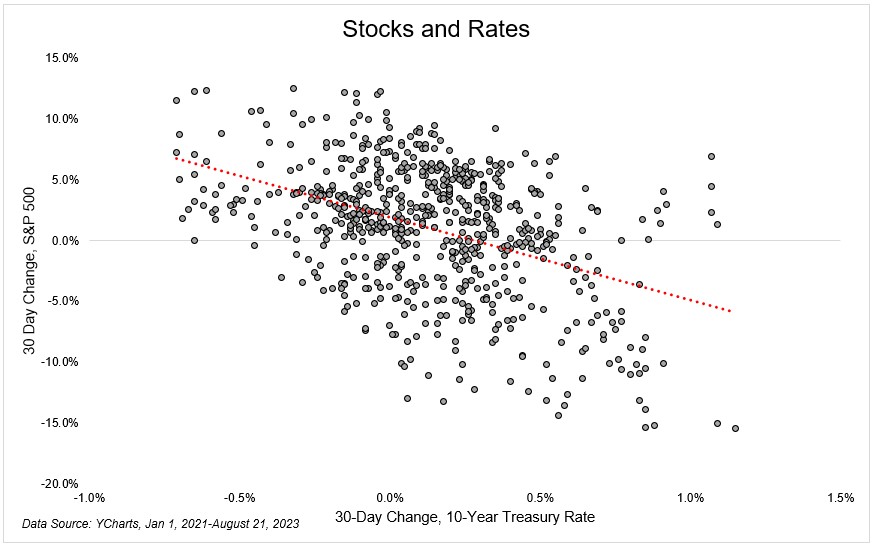

Courtesy of Michael Batnick

It’s hard to take advantage of what everyone already knows. This is one of many reasons that index returns cannot be explained by valuations, especially in the short term. If everybody is aware of something, it’s hard to derive an edge from it. It’s what you can’t predict that drives excess returns.

One of the most important things to the stock market right now is interest rates. If you knew where interest rates would go, you’d have a good chance of beating the market. This chart shows the 30-day change in the 10-year treasury rate and how stocks performed over the same time. From 2021-today, if the 10-year treasury rate was up, which it was 64% of the time, stocks fell 0.15% on average over the same time. If 10-year rates were down over a 30-day period, the S&P 500 gained 3.1% over the same time.

If you knew that rates would rise, you’d have sat in cash. If you knew that rates would fall, you’d have levered up. But of course you couldn’t know what rates would do, which gets back to the point of what drives alpha; things you cannot consistently predict.

This relationship won’t hold forever, but it’s been one of if not the most important variables that have driven stock market returns since the rate hiking cycle began.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?