As RetailDive notes, in a fraught economic environment that has undermined discretionary spending all year, credit card delinquencies took a bite out of Macy’s results in the second quarter. “Other revenue,” which includes credit card revenues, was down by $84 million to $150 million and was just 2.9% of net sales, down from 4.2% last year, according to the company’s press release.

That could deteriorate further as student loan payments resume, executives warned in a conference call with analysts.

“This is about credit card balances. This is about student loans, which we know is going to come into focus in the next month or two, auto loans, mortgages,” said Adrian Mitchell, who is Macy’s chief financial officer and chief operating officer. “So we just believe that the customer is coming under pressure because these are new realities that they have to continue to deal with as we get through the back half of this year and move into next year.”

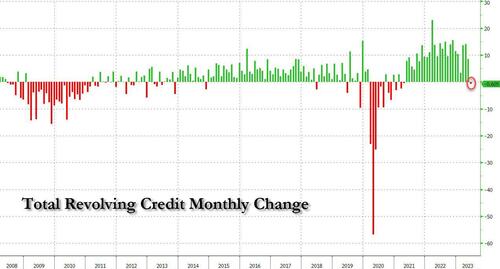

Macy’s also confirmed what those who were watching with trepidation the recent sudden collapse in credit card borrowings…

… already knew: “we experienced an increased rate of delinquencies, the speed at which the increase occurred for us and the broader credit card industry since our first quarter earnings call was faster than planned. We’re working closely with our bank partner Citibank to mitigate the rising bad debts by adjusting underwriting strategies.”

More from the Macy’s CFO here:

“But what we did see is that the speed of those delinquencies across all age balances or age balances actually accelerated after Q1, and that occurred primarily in June and July” $M pic.twitter.com/IvDkeATZbc

— The Transcript (@TheTranscript_) August 22, 2023

Still, executives expressed optimism that its customers will come through during the all-important back-to-school and holiday shopping seasons, noting tie-ups with Disney and Toys R Us, strong wholesale partnerships and a new private label push. Outgoing CEO Jeff Gennette announced a new deal with Under Armour, just weeks after reintroducing Nike.

“The return of Nike and Under Armour speaks to the strength and reach of Macy’s, and our ability to attract sought-after wholesale partners,” he said. “Looking ahead, we’re working with both brands as well as potential new partners on how to expand further.”

Gennette also noted that 80% of product reviews for the recently unveiled On 34th store brand have received four or more stars. GlobalData Managing Director Neil Saunders said the brand has a noticeble attention to detail that surpasses many of the company’s other labels.

“To date, standards of presentation in store are relatively strong and we hope they remain that way,” Saunders said in emailed comments. “While On 34th cannot in and of itself pull Macy’s out of the mire, it is an example of the type of initiative that is needed to start moving the dial. All that said, we are not holding our breath as too many previously hopeful ideas have been squandered and sullied.”

Macy’s is dropping the “Market by Macy’s” moniker for the latest locations of its small-format fleet and “will bear just the iconic Macy’s nameplate,” per that release. The first eight locations will continue to be known as Market by Macy’s. The company is looking to accelerate its expansion of small stores in the next six to 18 months, working toward the optimum balance of large-format mall anchors and smaller off-mall stores, Mitchell said.

“We see a portfolio of healthy big box stores, where we will continue to invest, complemented by a large number of small format stores,” he said.

But that and other tactics are questionable, given the company’s past struggles in maintaining merchandising standards plus the added challenges coming from the current macroeconomic environment, according to GlobalData’s Saunders. Macy’s sales fell 7.5% compared to 2019, while overall non-food retail spending in the U.S. rose about 32.1%, he noted.

“This shows that Macy’s is not only running in the opposite direction to most other retailers, but that it has lost a very significant amount of market share,” he said. In our view this throws the company’s entire strategy into doubt. Management can put out all the warm platitudes it likes, but it does not change the fact that Macy’s is a retailer in decline. Unfortunately, in the present environment we believe that the pace of deterioration will only accelerate.”

The pressure is on Bloomingdale’s CEO Tony Spring, who has been tapped to replace Gennette at the helm of the overall company next year.

“While past internal appointments have been disappointing, we are hoping that Tony’s background in luxury and merchandising will help produce a change in Macy’s approach to retail,” Saunders said.

Macys stock plunged 14%, its biggest one day drop since the US economy was shut down in early 2020.