Authored by Simon White, Bloomberg macro strategist,

Despite disappointing European data released this morning, PMIs around the world are in the main beginning to rise. The dollar is thus likely to fade the current rally and soon re-establish its downwards trend.

Today is PMI day, with France, Germany, the euro-zone, UK, and US data all out.. .and disappointing.

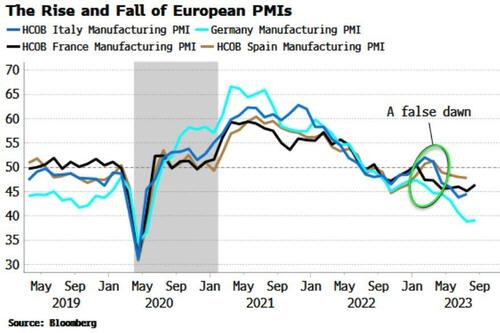

The temporary bump in Europe’s PMIs earlier this year fueled heady optimism that not only had the euro zone escaped the worst predictions made in the early days of the Ukraine war, but was on course to perform well in general terms.

But as the weaker-than-expected European data underscores, PMIs are just hopium if not followed by solid hard data.

Euro-zone growth as a whole stagnated in 4Q22 and 1Q23, and despite picking up slightly in 2Q23, the outlook for the rest of the year remains tepid at best. Germany is effectively in a recession, the Netherlands is in a technical one, while Italy is flirting with a downturn.

US PMIs for August both slowed more than expected with orders sliding but prices rising.

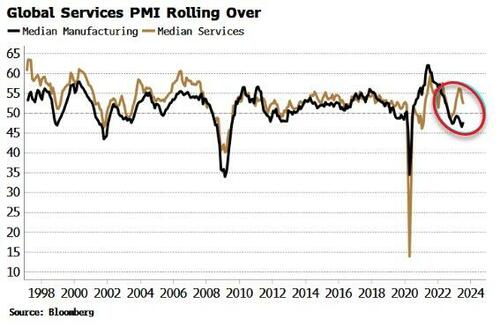

Globally, manufacturing is very interest-rate sensitive and remains in a recession.

The median manufacturing PMI from DM and EM countries remains stuck below the 50 level that marks the line between expansion and contraction.

Services – which were late to catch up to the goods economy after the disruption caused by the pandemic – are above 50, but have been rolling over.

France and German PMI services from today both weakened from last month.

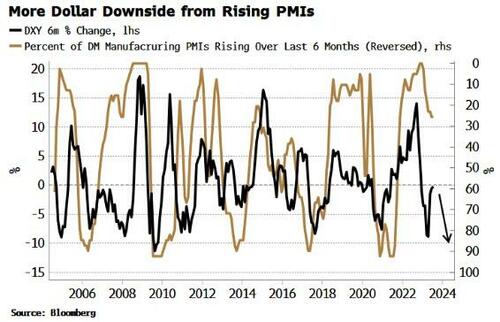

Nonetheless, at the margin, manufacturing PMIs are improving.

The chart below shows the percentage of DM manufacturing PMIs that have risen over the last six months. That was at zero at the start of the year, but has slowly risen as the manufacturing outlook of some PMIs begins to improve from beaten-down levels.

The chart also shows that a rise in the number of DM manufacturing PMIs increasing lead to a weaker dollar.

This is a reflection of the dollar-smile theory, where the geared impact from the US economy causes other economies and thus their currencies to strengthen even more, i.e. the dollar weakens.

The tallies with the ongoing message from the flattening real yield curve, which also leads a weaker dollar, intimating the current counter-trend rally should soon peter out.

Tyler Durden Wed, 08/23/2023 – 13:25