It’s that time of year again.

It’s that time of year again.

The Global Elites are gathering in Wyoming and Powell will speak tomorrow morning in the grand theater of Global Economics, where Policymakers and Central Bankers gather in their annual symposiums for an audience of both academics and investors. This stage, known as the Jackson Hole economic symposium, brings to the forefront the intersections of theory and reality, revealing the follies of Capitalism as orchestrated by the out-of-touch elites.

As the Federal Reserve officials return to the picturesque Grand Teton National Park, their economic symposium is set against the backdrop of a paradoxical economy. The aggressive sequence of rate hikes, ostensibly designed to combat inflation, stands as a testament to the precarious balancing act the Central Banks perform under the economic big top. The outcome has been a mixed bag so far – headline inflation has retreated from four-decade highs but core inflation stubbornly lingers at nearly double the Fed’s target.

The irony isn’t lost on the astute observer – Central Banks and their Policymakers, often hailed as the maestros of economic stability, wrestle with a reality that evades their orchestration. Kenneth Rogoff, a Harvard University economist, encapsulates this irony by acknowledging that the outcomes achieved lie somewhere in the realm of hoped-for percentiles. The economic symposium, however, is not just an academic exercise; it’s a spectacle watched by Global Investors, hungry for insights into the decisions that shape the markets and their portfolios.

Jackson Hole emerges is the Super Bowl of Central Banking. This juxtaposition of academic discourse and real-world consequences is where the intersection of interests and ideologies takes center stage. The historical precedence of this event as a stage for high drama is a testament to the fallibility of human judgment and the often out-of-touch nature of the elites.

Remember the 2008 financial crisis and the ensuing deliberations, or the 2014 laying of groundwork for a bond-buying campaign to stimulate the European economy. These moments reveal the illusory nature of control that elites try to portray. Last year’s revelation by Fed Chair Jerome Powell about prioritizing inflation control even at the cost of recession stands as a stark reminder that these decisions have far-reaching ramifications beyond the confines of mere economic theory.

Chairman Powell, the chief protagonist of this symposium, steps onto the stage with a script that seeks to provide guidance in an uncertain economic landscape. Investors and analysts keenly listen, parsing each word for the clues they hope will guide their future strategies. The dilemma, however, lies in the enigma of economic prognostication. How can they predict the trajectory of an economy influenced by a myriad of complex variables, from global geopolitical tensions to technological disruptions?

Chairman Powell, the chief protagonist of this symposium, steps onto the stage with a script that seeks to provide guidance in an uncertain economic landscape. Investors and analysts keenly listen, parsing each word for the clues they hope will guide their future strategies. The dilemma, however, lies in the enigma of economic prognostication. How can they predict the trajectory of an economy influenced by a myriad of complex variables, from global geopolitical tensions to technological disruptions?

The juxtaposition of policy rate increases and the resilient U.S. economy’s performance underlines the delicate nature of economic control. Powell’s likely avoidance of very near-term policy discussions highlights the tenuous nature of making concrete predictions. The quest for the elusive sweet spot – where inflation is tamed and growth isn’t stifled – becomes a process of navigating treacherous waters.

As the symposium progresses, the notion of the “last mile” of the inflation fight comes to the forefront. Powell is expected to traverse the precarious terrain of hinting at strategies for this final stretch. The current economic context, characterized by tight labor markets and the potential for underlying inflation to persist, illuminates the challenges faced by Central Banks in steering economies toward stability.

As the symposium progresses, the notion of the “last mile” of the inflation fight comes to the forefront. Powell is expected to traverse the precarious terrain of hinting at strategies for this final stretch. The current economic context, characterized by tight labor markets and the potential for underlying inflation to persist, illuminates the challenges faced by Central Banks in steering economies toward stability.

Ellen Meade’s assertion that Powell is navigating the end of tightening and the “how-long-to-hold” conversation resonates with the inherent uncertainty of these economic waters. The last mile, an abstract yet profoundly important concept, encapsulates the fine line between victory and vulnerability.

The Jackson Hole symposium, a fusion of academic inquiry and financial markets, illuminates the intricacies of capitalism’s follies and the challenges of managing economies from ivory towers. Central bankers, despite their expertise, grapple with an economic reality that is inherently unpredictable. As we watch the drama unfold on this global stage, we are reminded that the complexities of economic management are both an intellectual pursuit and a real-world conundrum, constantly reshaped by historical context and the capricious forces of global markets.

“Stopped into a church

I passed along the way

Well, I got down on my knees (got down on my knees)

And I pretend to pray (I pretend to pray)” – Mommas & Poppas

President Putin, meanwhile, is taking care of business as defiant Wagner Chief, Yevgeny Prigozhin has died in a plane crash with 9 other people. Andrei Saldatov notes that: “Politically Putin removed all critics of Russia’s performance in the war and has shown everyone that he is in total control of the situation.”

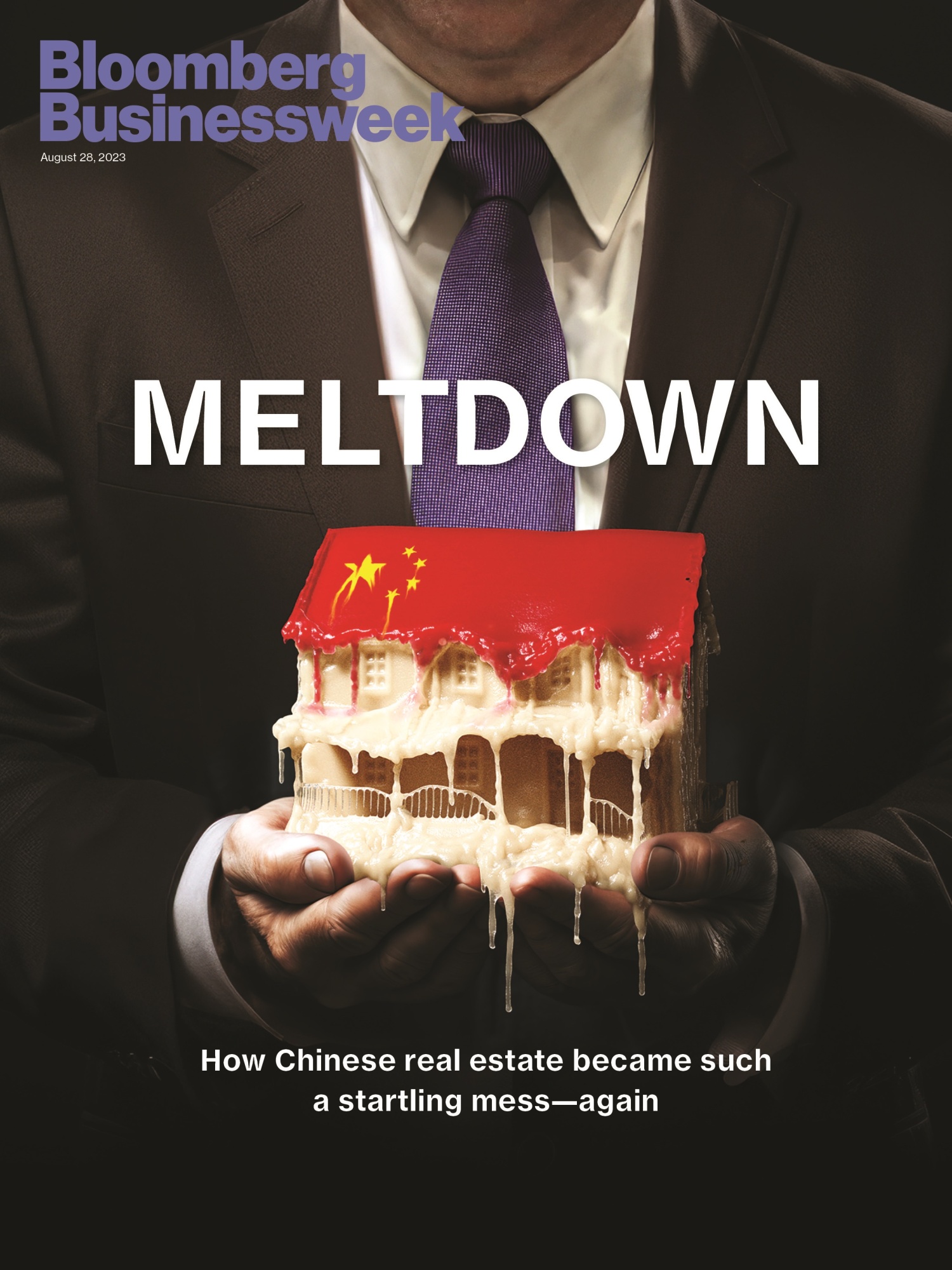

China’s Real Estate Market continues to melt down and US Investors, for the most part, continue to ignore it. Country Garden Holdings Co., a developer that was once a pillar of the industry, is on the verge of default, suggesting no company is too big to fail. There are signs the situation is spiraling, too with more developers are on the brink, home prices are collapsing in smaller cities, and fears of contagion have spread to the nation’s $60 Trillion financial system with Zhongrong International Trust (no longer trusted) having missed payments on dozens of high-yield investment products this month.

China’s Real Estate Market continues to melt down and US Investors, for the most part, continue to ignore it. Country Garden Holdings Co., a developer that was once a pillar of the industry, is on the verge of default, suggesting no company is too big to fail. There are signs the situation is spiraling, too with more developers are on the brink, home prices are collapsing in smaller cities, and fears of contagion have spread to the nation’s $60 Trillion financial system with Zhongrong International Trust (no longer trusted) having missed payments on dozens of high-yield investment products this month.

For years, China’s debt-fueled property boom underpinned one of the world’s great economic miracles. Even though it was bound to be unsustainable, the speed at which it now seems to be unraveling has been startling, compounding challenges for a Chinese economy already beset by weak consumer demand, slumping exports and growing tensions with the US.

In many ways, the current real estate meltdown is a crisis of the government’s own making. China’s privatization of property in the 1990s created one of the largest transfers of wealth in the country’s history, and entrepreneurs leapt at the opportunity to borrow heavily from banks. The boom invigorated local governments, global bond investors and China’s middle class, and real estate grew to play an enormous role in China’s economy. At its peak, the sector directly and indirectly accounted for about a quarter of domestic output and almost 80% of household assets.

While the property woes have spread to China’s giant Commercial Banks – the amount of soured real estate loans at the 10 biggest lenders will likely soar to $120 billion next year assuming the rate of nonperforming loans triples from 2022, according to Bloomberg Intelligence—the bigger concern is falling home prices. Official statistics show a steady drip of monthly declines of less than 1%; reports on the ground from agents show drops of 15% or more in some areas over the last two years. Even though it helps Beijing’s affordability push, the dropping home values have shattered consumer confidence. After years of price gains, Chinese consumers had come to see real estate as a can’t-miss investment, prompting some to buy multiple apartments to profit from the rally. For those who borrowed to do so, paying their expensive mortgages will make less and less sense the lower property values go.

As noted by Bloomberg:

“All that roaring growth made prices unaffordable for a younger generation, challenging Xi’s bid to narrow the wealth gap. In late 2020, China Evergrande Group’s liquidity scare triggered aggressive regulatory tightening. Coupled with two bruising years of Covid-19 lockdowns, developers including Evergrande and Sunac China Holdings Ltd. defaulted. Global bondholders, who’d provided a major source of real estate financing, were spooked by the alarming rate of distress, pushing up funding costs. Eventually the $200 billion market for real estate bonds—at one time one of the most profitable trades in the world of high-yield dollar debt (also known as junk bonds)—all but vanished.

“Almost a third of all 498 dollar bonds issued by Chinese developers are in default, according to data compiled by Bloomberg, leaving $60 billion in unpaid debt to investors including Pacific Investment Management Co. and Fidelity International Ltd. The rash of failures may be just starting. The government is showing little inclination to bail out developers such as Country Garden, formerly the biggest by sales. Almost half of the 38 publicly traded state-owned real estate companies reported preliminary losses for the first half of this year.”

- China’s LGFV Insiders Say $9 Trillion Debt Problem Is Worsening

- China Braces for $38 Billion in Losses in Troubled Trust Sector

In an even bigger catastrophe, Japan is starting to dump the Fukushima wastewater into the Pacific and China is, in turn, banning the sale of fish from Japan, which can have catastrophic trade consequences as the Chinese people’s substitutes will put strain on other food sources and, of course, cause over-fishing from other suppliers that can have serious, long-term environmental impacts.

In an even bigger catastrophe, Japan is starting to dump the Fukushima wastewater into the Pacific and China is, in turn, banning the sale of fish from Japan, which can have catastrophic trade consequences as the Chinese people’s substitutes will put strain on other food sources and, of course, cause over-fishing from other suppliers that can have serious, long-term environmental impacts.

In better news, NVDA will continue to boost the Dow and the Nasdaq and the S&P as they knocked it out of the park on earnings. You might think we can’t keep rallying the market based on good news from the same 10 stocks – but so far, you would be wrong…

NVDA is now about $1.25Tn in valuation and that’s up from $400Bn in January so +$800Bn in 8 months is 4.4% of where we started the Nasdaq ($18Bn) in January from just that one stock. NVDA is now 5% of the Nasdaq but still nowhere near as ridiculous as AAPL, who are $3Tn of the now $25Tn index (12%) after gaining 40% since January – also $800Bn.

Durable Goods were a disaster at -5.2% but Ex-Transportation it was up 0.5% but last month they said it was 0.6% and now that’s been revised to 0.2%, which essentially wipes out all of this month’s gains (and it means the but that’s using logic and we can’t expect that to work with ordinary traders.

Meanwhile, in other news:

- US stocks gained as yields softened on weak PMI data

- Bonds, Bitcoin, Big-Tech, & Bullion Soar As ‘Bad News’ Is Good News Again

- Major Supply Chain Issues Are Starting To Develop All Over The Country

- How High a Rate Can Housing Take?

- Blinken Repeats “Crimea Is Ukraine” As Kiev Steps Up Attacks On Peninsula

- SEC Passes New Rules Aimed at Private Equity, Hedge Funds

- As concerns mount about organized retail crime, these are the products being targeted

- To Combat Crime Surge In American Cities, Many Turn To Private Alternatives

- Retailers ‘Shrink’ From Plain Talk About Theft

- US in Talks With Venezuela Over Sanctions Relief in Return for “Fair” Elections

- Oil Drops for Fourth Day With Venezuela Aiding Supply Outlook.

- China’s deflation could spill over into a global concern, economists say

- Unlikely Bidder Behind $7.8 Billion US Steel Deal Backs Away

- Nvidia’s AI Windfall Set to Rescue Nasdaq 100 From Dismal August

- Nvidia Erupts To New Record High On Blowout Q2 Earnings, Whisper-Shattering Q3 Guidance, And New $25BN Buyback

- Huawei To Dodge US Sanctions With ‘Secret’ Network Of Chip Factories

- Watch: Trump Warns Tucker, “There’s A Level Of Passion… And Hatred I’ve Never Seen” And That’s “Probably A Bad Combination”