It was the definition of selling the news (and pre-positioning for another Powell punch below the market belt).

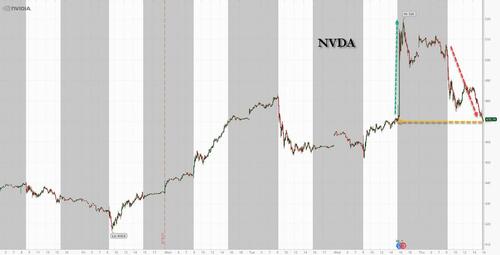

After what many said was the biggest blowout in corporate earnings history, when Nvidia not only smashed estimates but projected Q3 results that were above the highest whisper number, the stock initially soared in the premarket, only to slump and completely fill the earnings gap, before closing up 0.1% (after trading as much as 10% higher overnight), and even dipping red after the close.

The broader market tracked NVDA’s slump tick for tick, and after an early attempt to push to fresh highs, a burst of selling quickly dragged spoos to session lows…

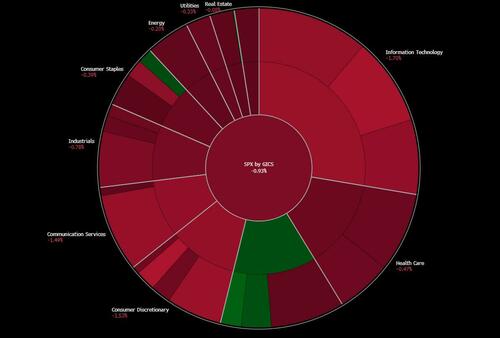

… with virtually all sectors (except banks) dragged kicking and screaming into the red.

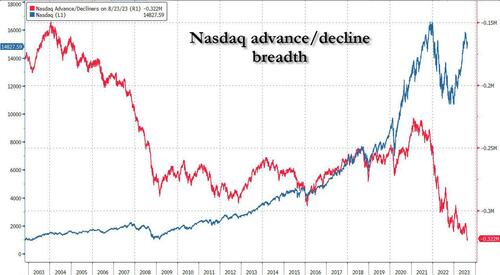

Which is hardly a surprise in a market when just a handful of stocks are again leading the entire market: yes, the breadth on the Nasdaq is the lowest it has ever been.

Option traders did their best to keep the market from sinking, with delta sinking far more slowly than overall risk, at both the shorter-term, 0DTE time horizon…

… and across longer-dated options…

… but in the end, the selling just proved to powerful for a delta reversal or an attempted gamma squeeze.

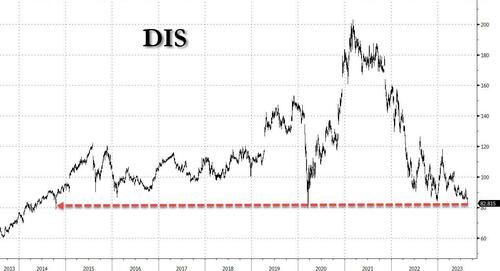

While NVDA did its best to keep stocks in the green, other names did not, with woke Disney extending its recent rout, and tumbling to the lowest closing price since 2014 (March 18, 2020 saw a lower intraday print but even the covid low closes were higher than today).

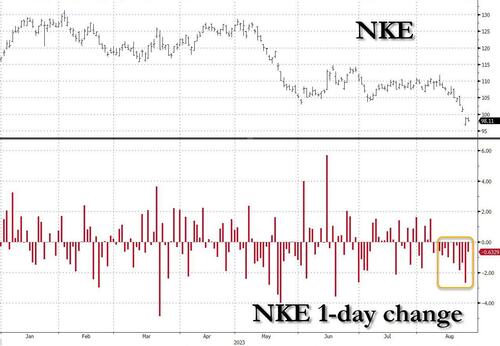

Meanwhile, another woke icon (which pretends it doesn’t use child labor), Nike, suffered its 11th consecutive day of declines, extending the longest stretch without a green close on record.

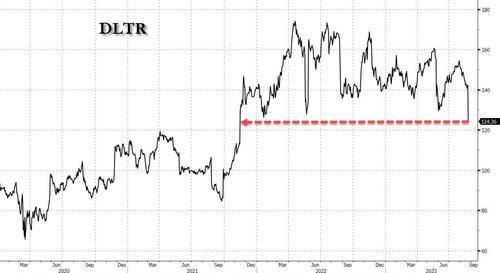

And in a testament to US consumer weakness, not even the retail outlet for increasingly more Americans who keep drowning under Bidenomics, could hold its own and Dollar Tree plunged 13% to close at the lowest level since Dec 2021.

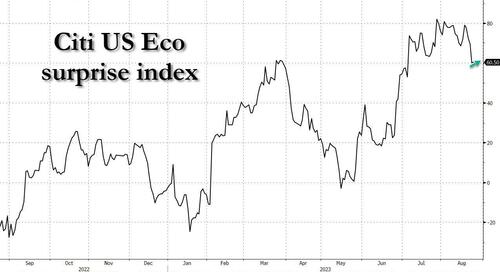

In addition to the micro considerations, we also had a continuation of systematic factors, and as futures tumbled below the key support level of 4,400 and triggered renewed systematic/CTA/vol-control selling as confirmed by the massive Market on Close sell imbalance to the tune of $3.5 billion, macro was also in the picture, with the Citi eco surprise index posting a modest rebound after suffering the biggest set of “bad news” since April, and rising modestly on today’s stronger than expected Initial Claims and Durables reports…

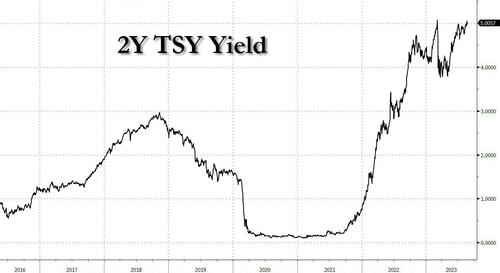

… which in turn triggered a rebound in yields after their sharp drop on Wednesday…

… and sent the 2Y yield back over 5% again.

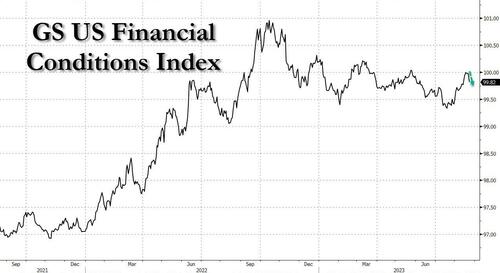

And speaking of yoyo-ing rates, tomorrow’s Jackson Hole meeting (previewed extensively here) was certainly on investors’ minds, especially since we saw some easing in recent days, although within a range that hasn’t really budged much in the past years, despite Powell’s explicit warning one year ago that pain is coming…

… which so far it has failed to make an appearance.

Angst over what the Fed chair will say has also sent the dollar sharply higher, reversing all of yesterday’s big drop, and continuing the range trade seen in the past week.

Despite the bounce in the dollar, oil managed to eek out tiny gains, and remains in the middle of the past month’s range; where it goes next will depend on what, if any, stimulus China will release next.

Finally, while the BRICs did not reveal a gold-backed currency despite some speculation ahead of the meeting (which has added 6 new countries to the famous acronym), gold held yesterday’s gain, with silver going even better.

So with that in mind ahead of Powell’s speech tomorrow, we say: “Go Jerome” and let’s hope you get it right this time.