The Great and Awful Thing About These Interest Rates

The era of low interest rates is over. In the blink of an eye, the Fed went from punishing savers to punishing borrowers. If you’re depending on income to fund your retirement, 5% rates are a blessing. But if you’re in need of credit, current rates are a curse.

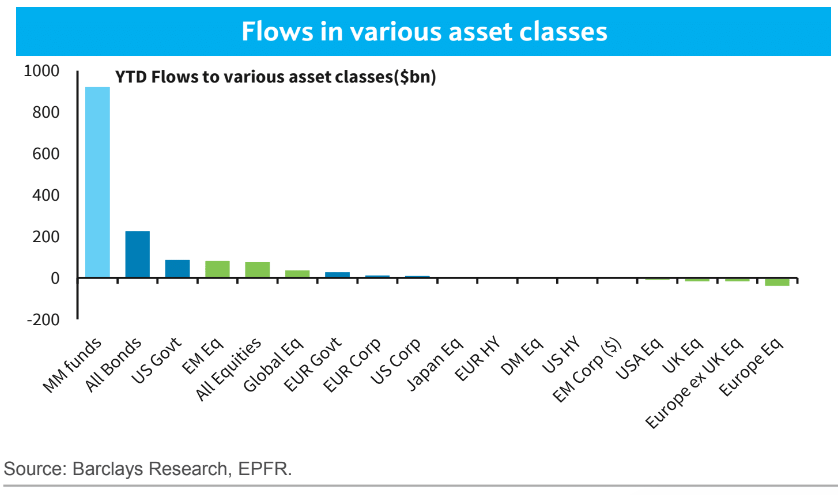

For years and years, investors bemoaned that the Fed was forcing them out on the risk curve. If you wanted to earn some yield, bonds at 2% weren’t a great option. So they bought junk bonds at 5%. Or they bought bond substitutes like consumer staples and their 3% coupons. Now, investors don’t have to reach for yield. Forget about bonds, they’re getting them in money market funds! And they can’t get enough of them. Money market funds are sucking up everything like Mega Maid to the tune of $900 billion, dwarfing everything else.

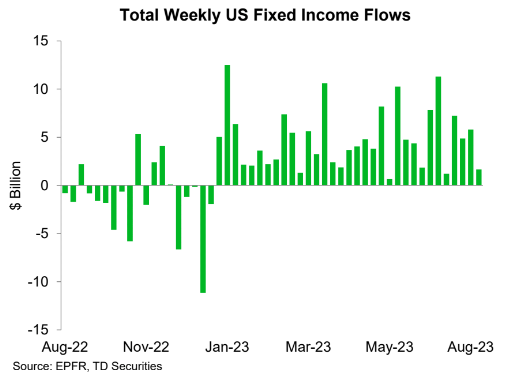

Bonds are also seeing money flowing in for the 33rd consecutive week. Investors would have preferred rates hadn’t risen as quickly as they did, but sometimes it’s best to rip off the bandaid. Sharp price declines in bonds weren’t fun, but the flip side is that current interest rates are acting like Aquaphor and will heal those wounds if you give it enough time.

If you have money to lend (invest), future returns look infinitely more attractive today than they did at any time over the past decade.

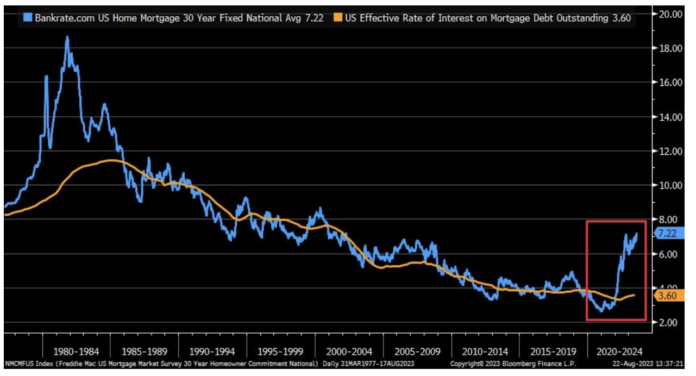

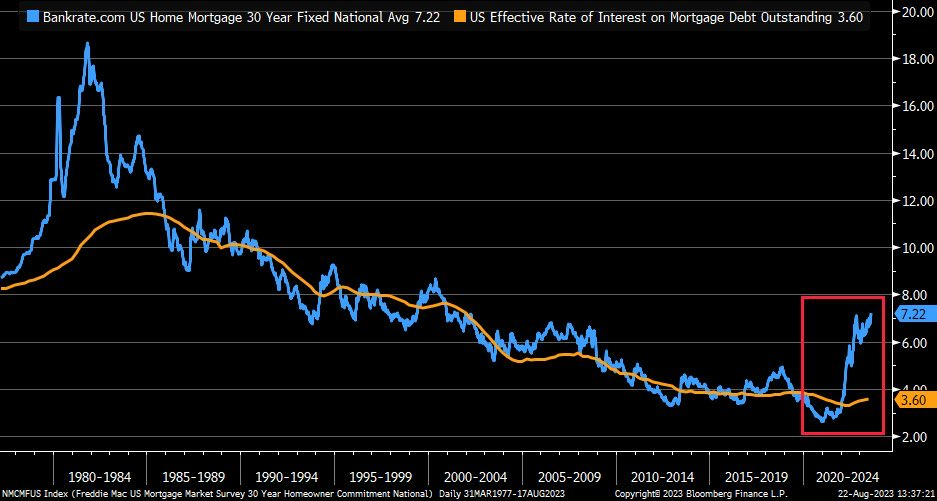

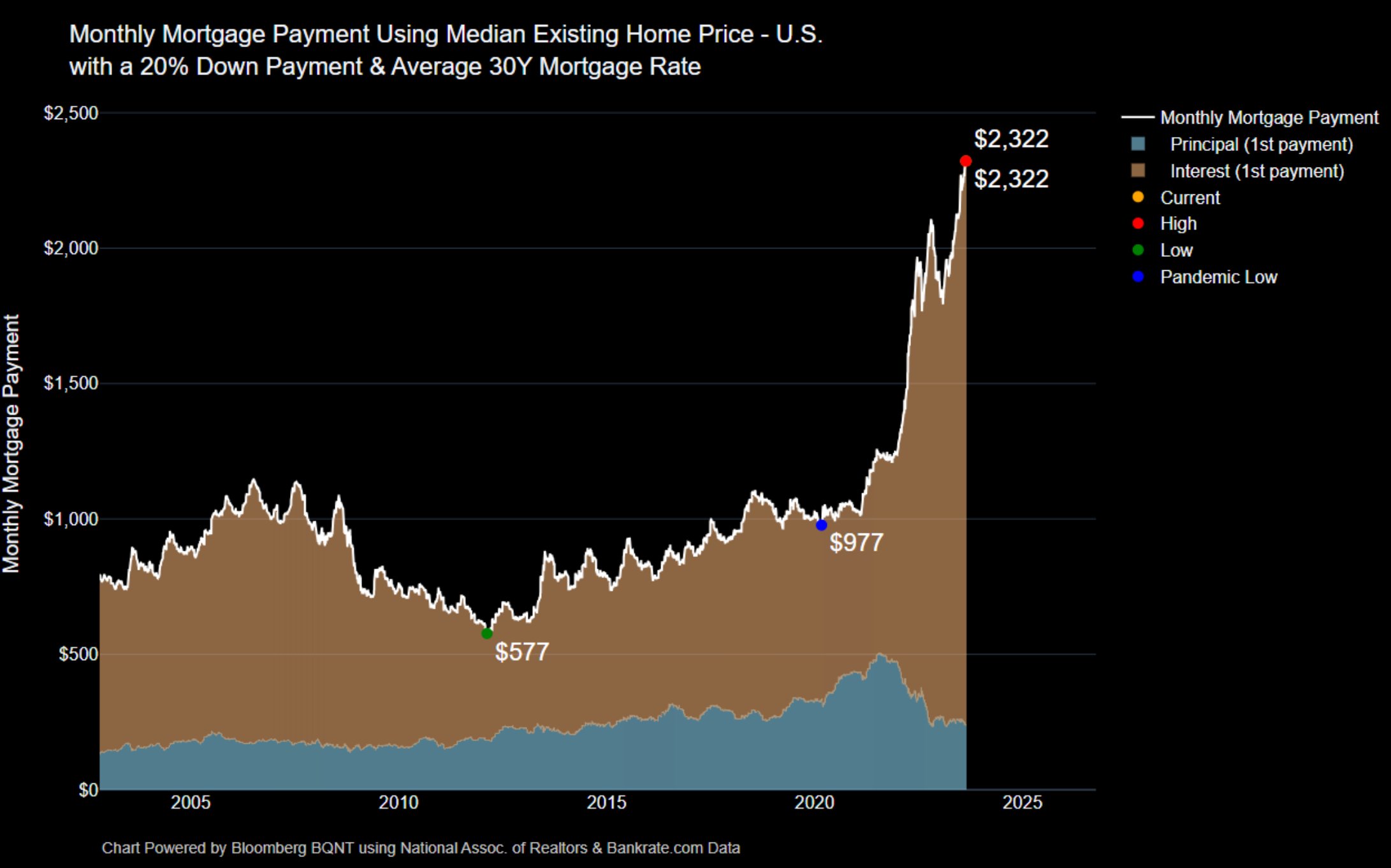

And if you borrowed money at any time in recent history, consider yourself very lucky. The spread between interest on existing mortgages versus where they are today is not pretty.

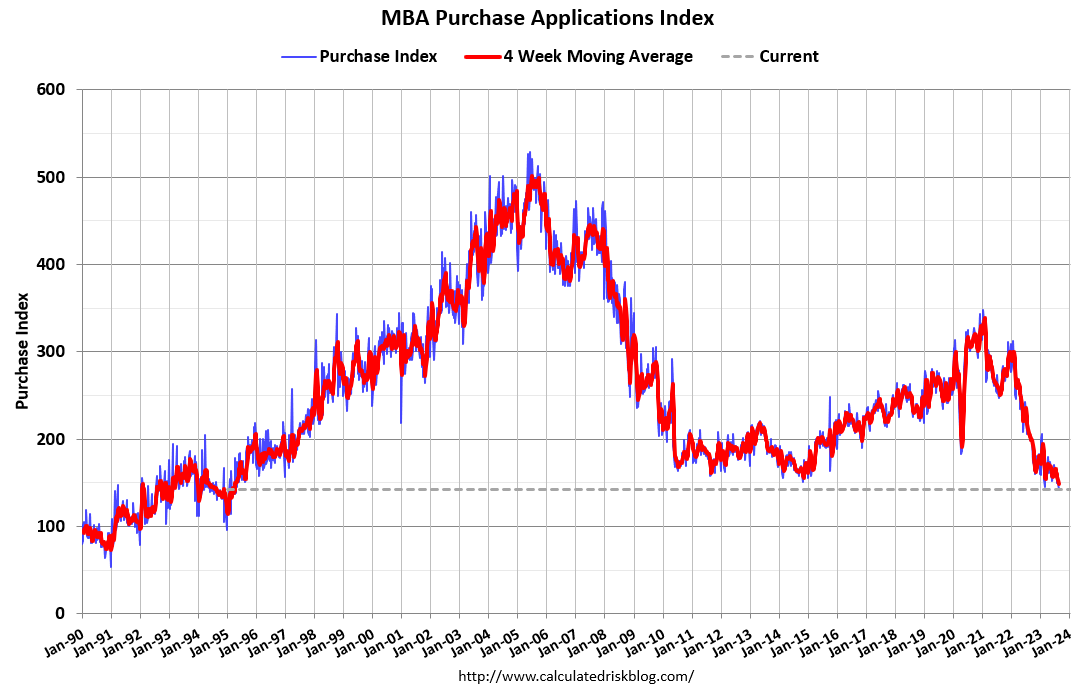

High rates are turning the housing market upside down. Applications for home purchase mortgages fell to their lowest level since 1995.

And to add insult to injury, prices aren’t coming down! Paradoxically, high interest rates are making it unaffordable to move, which is shrinking supply and making it unaffordable to buy!

It’s not just aspiring home buyers who feel the pain of higher rates. Auto loans are 7.5%, and that’s assuming you have great credit. Subprime borrowers are paying through the nose to buy a car. And credit cards, forget about it. Rates are as high as they’ve been since at least 1995.

Needless to say, it’s much harder to service a loan that is more than double what it was a year ago. And as of the second quarter, we’re starting to see auto and credit card loans transition into delinquency at a rate that gets us back to pre-pandemic levels. Nothing to freak out about yet, but it’s certainly something to keep an eye on.

Higher rates are a blessing or a curse, depending on where you are in life. This is a good reminder that the market pendulum is always swinging from too hot to too cold with little in-between. Goldilocks is a fairy tale.