Here we are again!

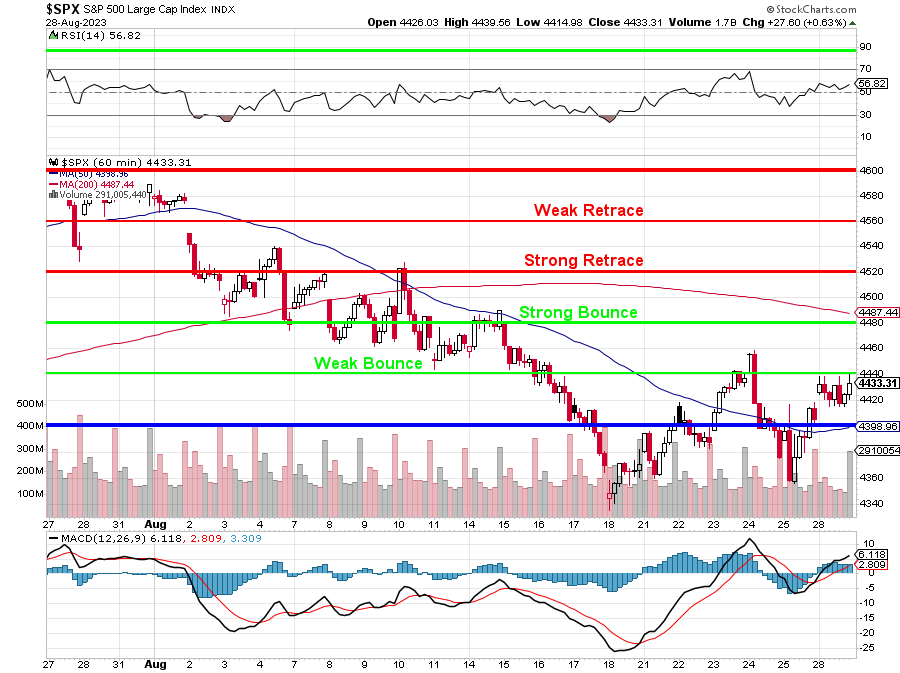

We did this last week so the show is starting to get a little stale but hope springs eternal on Wall Street. Keep in mind we’re not even impressed until the Strong Bounce line holds for 2 consecutive days yet here we are getting all excited over a weak bounce – 11 days after hitting the bottom for August.

This is more like we are consolidating around the “Must Hold” line at 4,400 for a move down than we are building a base for a move higher. We’ve been higher – it did not work out… Notice both the RSI and the MACD have both moved higher in their 1-hour channels – that means there’s probably not that much gas left in the tank.

We have Consumer Confidence at 10 this morning and that was already falling in July, when Gasoline went from $2.40 to $2.80 (+16.66%) and, since then, it’s been $2.80+ in August so fill up 4 times at $60-100 vs $50-85 and how confident are you feeling? Mortgage Rates also spiked higher, meat got expensive but the Dollar gained 4% – so that helped a bit.

Consumers are, in fact, pretty confident – though their expectations are a bit low. We scored 117 in July but “Present Situation” was 160 while “Expectations” were 88.3. In other words: “I had a great day at the park, Daddy but now the monster under my bed is going to eat me.” – that kind of outlook…

Is there an Economic Monster under the bed? Sure there is – just look at the Dollar, which is up about 5% since mid-July. That’s kind of working to our advantage and keeping the price of Oil, Food and other commodities down for the moment but it’s not doing any good for the other 8Bn people on the planet.

The strong Dollar is keeping our Bonds and TBills looking attractive to foreign investors and that’s keeping rates down – for the moment. While the Dollar’s strength might have its advantages, it’s not a solution that fits everyone’s needs. The challenges it poses to other Economies could potentially have repercussions that eventually find their way back to our own markets.

As we navigate these choppy waters, keeping a diversified portfolio strategy is the most effective approach. While we are focusing on the market’s immediate reactions, it’s important to remember that our investments are LONG-TERM commitments. Balancing the Short-Term indicators with a broader perspective will be essential in making well-informed decisions down the road.

Speaking of consumption – Best Buy (BBY) had a nice beat this morning, as did Big Lots (BIG), who we just discussed yesterday as still too cheap in our Live Member Chat Room. SJM, MBUU and PDD also beat but BMO, BNS, CTLT, DCI, and NIO all missed and SJM guided down so let’s call it 5 winners and 5 losers this morning – not stellar.

We’ll see how Consumer Confidence works out but yesterday’s SPY volume was just 61M on that “rally” so this is just low-volume, manipulated BS to close the month on a high note – nothing worth betting on…