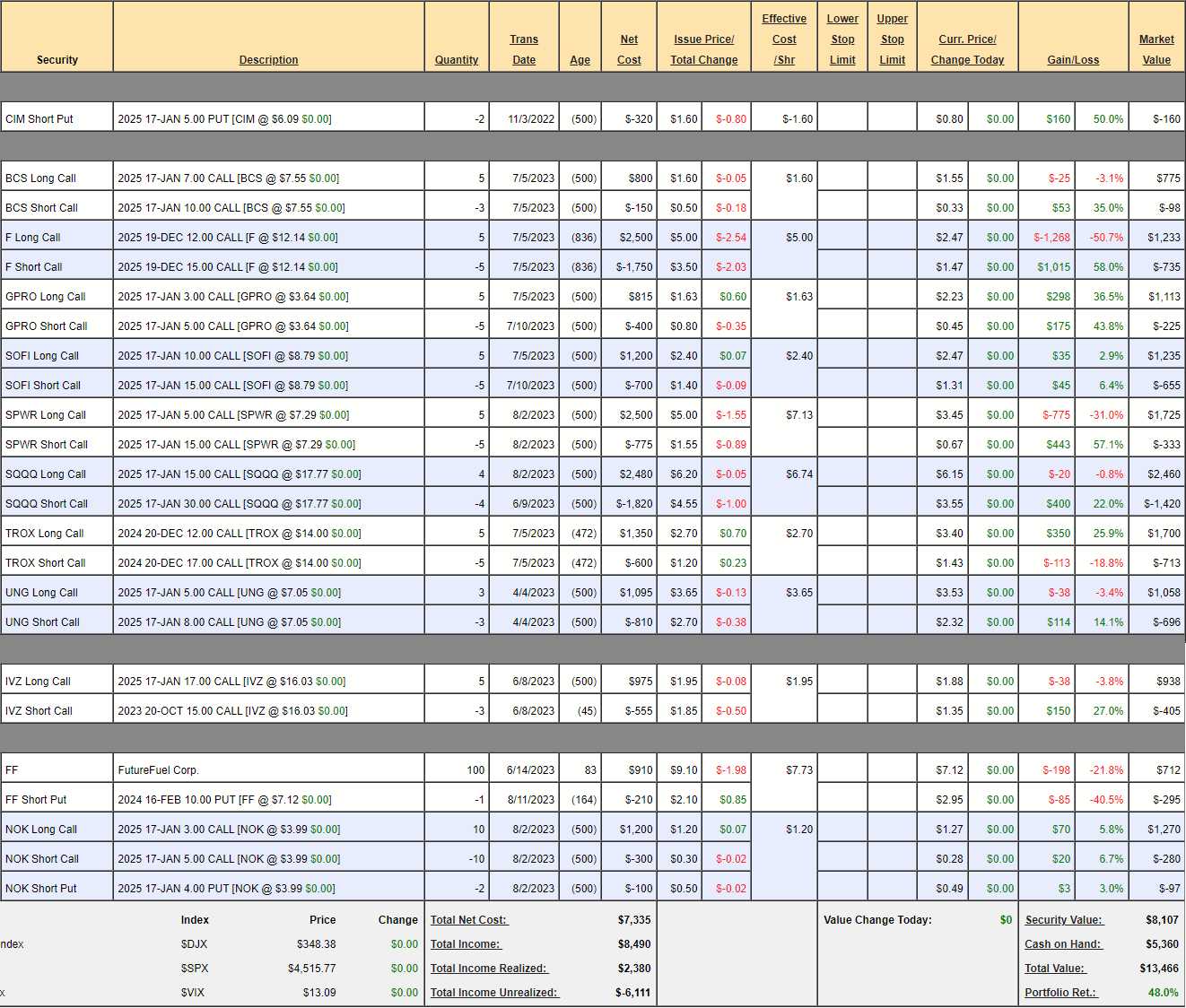

$13,466 (up 48%)!

We’re up $1,311 from our Aug 2nd review but $700 of that is our monthly contribution to the Portfolio and the other $411 (3.3%) is gains and we’ll take it as it’s starting our year off on another 40% gain-pace, which is double what we aim for so we’re on pace to hit $1M in 10 years, not 30 – if things keep going so well – which is certainly not something we count on.

Since the goal of this portfolio (which we are already miles ahead of) is to have $1M in 30 years, you haven’t missed very much at $13,466 and you can go over months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11 and 12 to see all the moves we’ve made to get this far. This is small portfolio, which means we can’t use our favorite option techniques but it’s a great way to learn how to get started on a wealth-building adventure.

Our buying power at the moment is $2,560 including this month’s $700 contribution as we assume full margin in this account – as you would have in an IRA or 401K account. We’re still cautious in this overpriced market and, before we spend – we need to look over our current positions to see if anything needs to be nudged back on track:

-

- CIM – We’re up 50% already and now we’re using $1,000 in margin to make $160 – so kind of diminishing returns. If we have a need for $1,000 in buying power, this is where we’ll take it.

-

- BCS – Just added these and a tiny profit already.

-

- F – Also new and I would buy them today if we hadn’t already. Cheaper than where we entered it.

-

- GPRO – Another new one and we have a nice, conservative entry.

-

- SOFI – Hasn’t gone anywhere yet but I really like this one (we cashed in the original, winning play).

-

- SPWR – Down but not out. It’s tricky in a small portfolio as I’d like to double down and buy back the short calls but that’s $2,000 so we have to be creative. Let’s double down ($1,725) and buy back the short 2025 $15 calls ($333) and sell 10 of the 2025 $10 calls for $1.50 ($1,500) so now we’ve spent just net $558 to move from a $5,000 spread that’s $1,145 in the money to a $5,000 spread that’s $2,290 in the money and now our goal is $10, not $15.

You see, we don’t make these phenomenal gains by sitting passively by and HOPING something will happen – we ADJUST our positions – always trying to be realistic about the probable FUTURE valuation of our holdings. In the SPWR spread, we spent net $558 to LOWER our target by 33% and to put ourselves $1,145 more in the money – so we immediately added net $587 of intrinsic value to our position. That’s money well-spent!

-

- SQQQ – We made so much money in year one we had to hedge! Don’t laugh, some people are doing this portfolio with $70,000/month, not $700 – hedging is always important. Our timing was good and we’re still ahead on this one, it’s at the money and offers us $60,000 worth of protection – we would make more money if the market crashes than if our positions double at the moment…

-

- TROX – This one is on track with an encouraging recent pop.

-

- UNG – Also on track with a long time to go so no worries.

-

- IVZ – The short calls still have premium and we’re only 3/5 covered so we can roll the short calls up to a 2x position so I’m not worried and we’ll let it play out for another month.

-

- FF – Just paid an 0.06 dividend baby! Took a huge dive on earnings and we bought back the Nov $7.50 calls and sold the Feb $10 puts so we’ll see what happens next.

-

- NOK – This was our new addition last month and we caught it just in time as they had a nice pop back to $4 last week. That covers out short puts and we’re in the $2,000 spread for net $800 so looking very good already.

Check out the logic for this entry last month, it’s still valid!

So we have spent just $558 to adjust our existing positions and that leaves us with $2,002 in buying power for something new.

I know Yodi was very excited to see WBA drop so hard last week when their 3-year CEO was shown the door and the stock dropped from $27 to $23.50 (13%) for the month. With short puts, it’s a fantastic opportunity but we can’t afford 100 shares of WBA but we can take advantage of the volatility with the following spread:

-

- Buy 4 WBA 2025 $20 calls for $5.10 ($2,040)

- Sell 4 WBA 2025 $25 calls for $2.65 ($1,060)

That’s net $980 on the $2,000 spread that’s $1,372 in the money and our upside potential is $1,020 (104%) in 16 months – worth the wait!

That leaves us with $1,022 of buying power and we’ll add another $700 next week so I think that’s enough excitement for one day. Actually, wealth-building portfolios are not meant to be exciting – they are meant to build wealth – and that’s what we’re doing here!

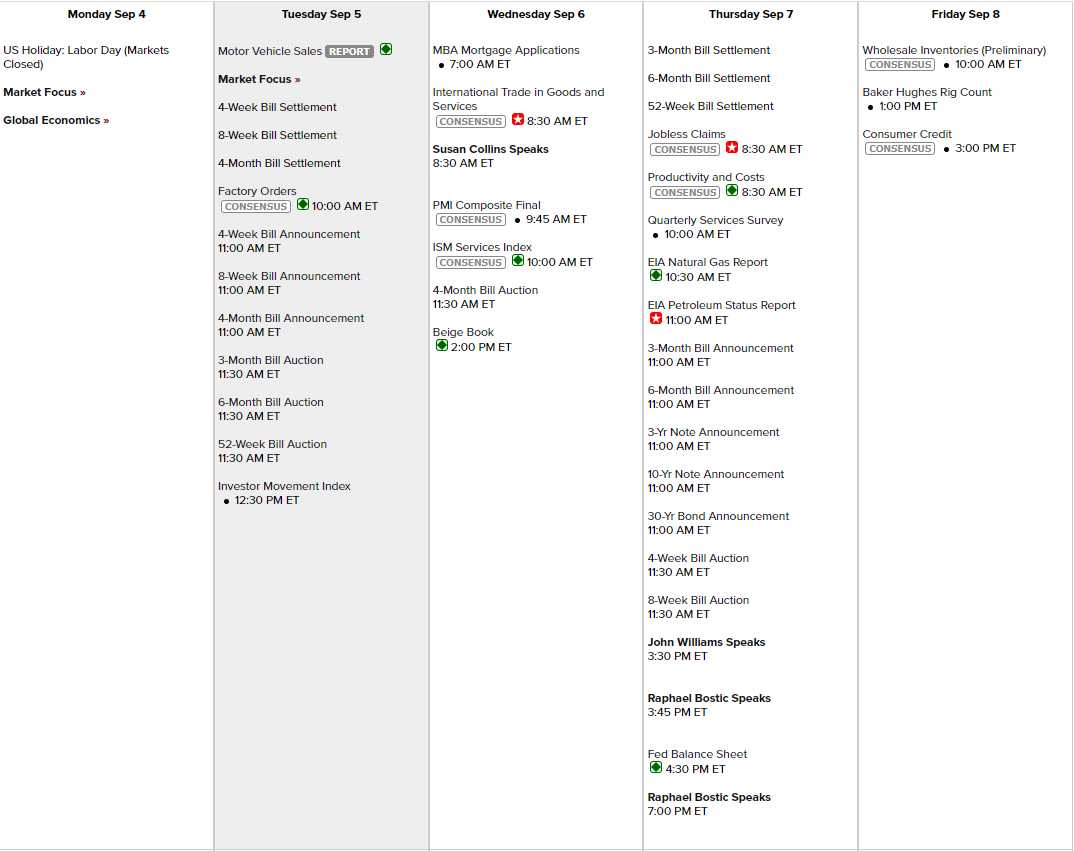

Now, since it is Tuesday but also the first day of the week, let’s take a quick look at the Economic Calendar:

Not a very exciting week but we do have 4 Fed Speeches scheduled and the Beige Book tomorrow. PMI, ISM as well and Thursday is Productivity, which has sucked all summer and then Consumer Credit is very important on Friday.

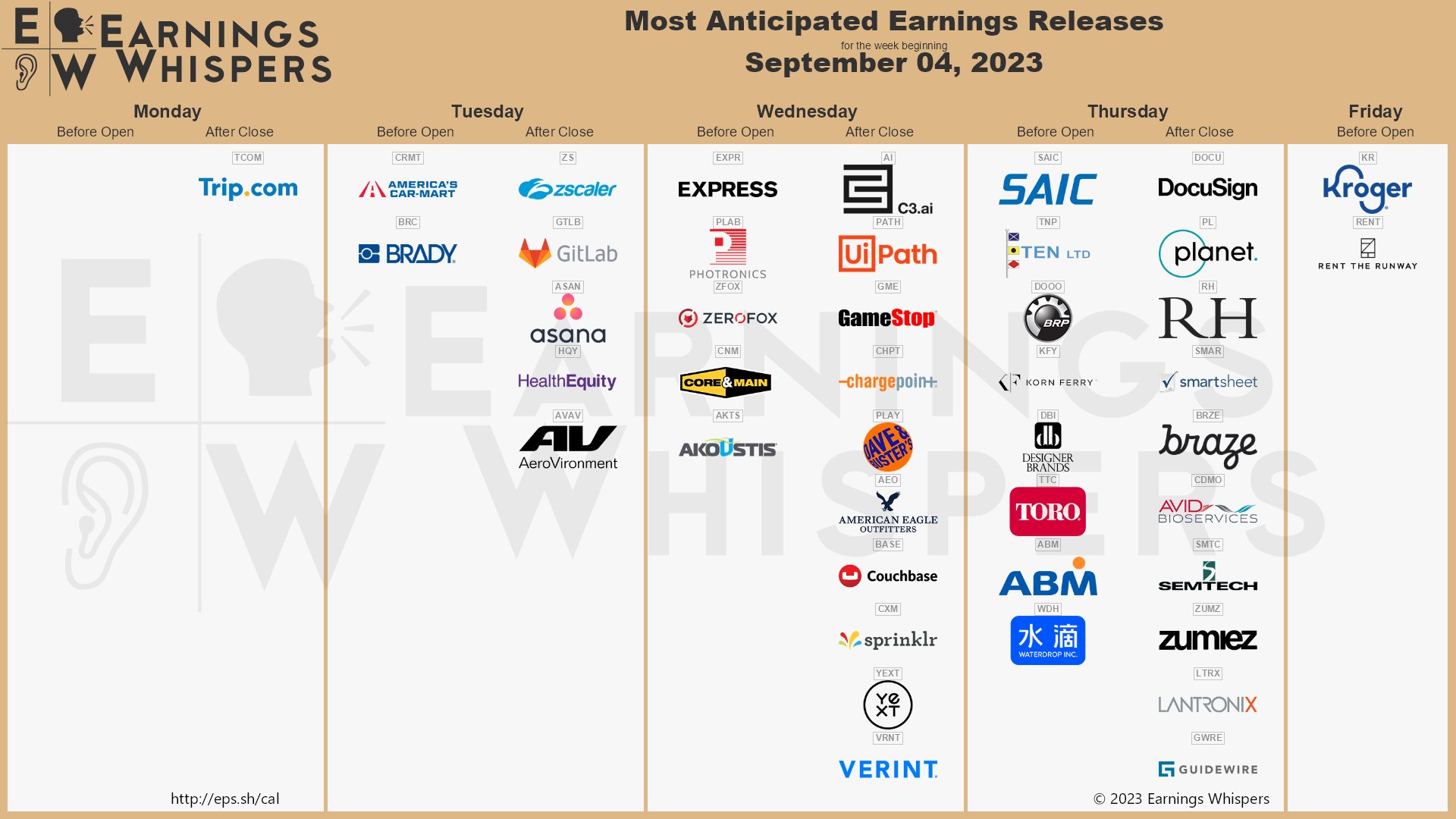

We even have some earnings reports still coming in:

Today is like a Monday and not much will matter so we’ll just have to sit back and see what sticks. Oil is spiking higher ($87.60) this morning and so is the Dollar (104.50) and we’ll see who pulls back first. This pop puts Brent Crude (/BZ) over $90 and that is not a zone that is likely to hold but, if it does – Inflation is back!