The Fed’s latest beige book released this afternoon was a rather boring affair, one signaling US economic growth was “modest” during July and August.

What was most interesting within this drab big picture, was the divergence within consumer spending, where according to the Beige Book, “consumer spending on tourism was stronger than expected, surging during what most contacts considered the last stage of pent-up demand for leisure travel from the pandemic era.” But, it’s the other side of the equation that was more concerning, as the Fed found that “other retail spending continued to slow, especially on non-essential items.”

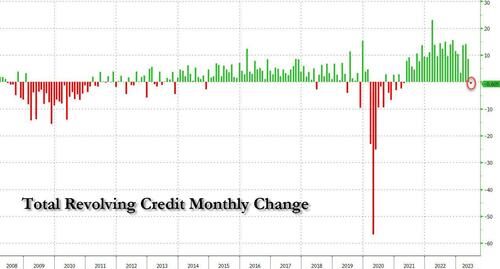

And the punchline: “some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending.” Bingo: this is precisely what we said last week in “US Consumers Paid For July Spending Spree By Burning Through $150BN In Savings“, and while the Fed is right that households have burned though savings, it is wrong that they have borrowing capacity to support spending: as we showed last month, households paid down credit card debt for the first time since the covid crash, a clear sign that US consumers are now hunkering down.

Here are some other details from the latest Beige Book:

- New auto sales did expand in many Districts, but contacts noted this had more to do with better availability of inventory rather than increased consumer demand.

- Manufacturing contacts in several Districts also noted that supply chain delays improved, and that they were better able to meet existing orders.

- New orders were stable or declined in most Districts, and backlogs shortened as demand for manufactured goods waned.

- One sector where supply did not become more available was single-family housing. Nearly all Districts reported the inventory of homes for sale remained constrained.

- Accordingly, new construction activity picked up for single-family housing. But multiple Districts noted that construction of affordable housing units was increasingly challenged by higher financing costs and rising insurance premiums.

- Bankers from different Districts had mixed experiences with growth in loan demand. Most indicated that consumer loan balances rose, and some Districts reported higher delinquencies on consumer credit lines.

- Agriculture conditions were somewhat mixed, but reports of drought and higher input costs were widespread.

- Energy activity was mostly unchanged during the final months of the summer

Turning to labor markets, the Beige Book noted that “job growth was subdued across the nation. Though hiring slowed, most Districts indicated imbalances persisted in the labor market as the availability of skilled workers and the number of applicants remained constrained. Worker retention improved in several Districts, but only in certain sectors such as manufacturing and transportation.” And the clearest sign yet that the wage party is over, “many contacts suggested “the second half of the year will be different” when describing wage growth.” For now, however, growth in labor cost pressures was elevated in most Districts (thanks to Biden’s explicit greenlighting of Labor union demands for double digit wage increases) often exceeding expectations during the first half of the year. “But nearly all Districts indicated businesses renewed their previously unfulfilled expectations that wage growth will slow broadly in the near term.”

Turning to prices, most Districts reported price growth slowed overall, decelerating faster in manufacturing and consumer-goods sectors. However, and as discussed here previously, “several Districts highlighted sharp increases in property insurance costs during the past few months.”

The worst news however is that the profit margin expansion is over as “contacts in several Districts indicated input price growth slowed less than selling prices, as businesses struggled to pass along cost pressures. As a result, profit margins reportedly fell in several Districts.“

Turning to the specific regional Feds, we found these summaries notable:

- Boston: Business activity expanded modestly on balance. New car inventories normalized further but used cars remained scarce. Home sales fell further, resulting in a disappointing spring and summer season. Concerning the outlook, fewer contacts mentioned a recession as a looming risk and pricing pressures were expected to ease further.

- New York: Regional economic activity held steady through the summer. Labor market conditions generally remained solid, with steady wage growth. Consumer spending grew steadily, while manufacturing activity declined. Home sales remained constrained due to low inventory and rising mortgage rates. Inflationary pressures picked up slightly after easing much of the past year.

- Philadelphia: Business activity continued to decline slightly during the current Beige Book period. Although manufacturers indicated an uptick in August, consumer spending declined overall as did nonmanufacturing activity. Labor availability improved further, and employment edged up once more. Wage growth and inflation continued to subside. Sentiment was somewhat divided, but expectations generally grew more positive.

- Cleveland: Economic activity was generally flat in the Fourth District, though conditions shifted notably in some industries. While consumer spending and demand for manufactured goods softened, freight activity stabilized, and nonresidential construction activity increased. Contacts expected similar economic conditions to persist in the near term.

- Richmond: The regional economy grew slightly in recent weeks. Consumer spending on retail and food service, as well as on travel and tourism, picked up modestly. Manufacturers noted a decrease in demand. Transportation volumes remained steady across freight modes. Residential real estate was constrained by limited inventory. Commercial real estate activity and lending declined. Employment increased moderately and price growth eased slightly.

- Atlanta: Economic activity grew modestly. Labor markets improved, and wage pressures eased. Nonlabor costs moderated, on net. Retail sales were robust. New auto sales were strong. Domestic leisure travel slowed, while international and business travel rose. Housing demand was durable. Transportation activity slowed. Energy demand was strong. Agricultural conditions were mixed.

- Chicago: Economic activity increased slightly. Employment increased moderately; business and consumer spending increased slightly; construction and real estate was flat; nonbusiness contacts saw little change in activity; and manufacturing decreased slightly. Prices and wages rose moderately, while financial conditions tightened moderately. Expectations for farm incomes in 2023 were little changed.

- St. Louis: Economic conditions have remained unchanged since our previous report. Employers reported continued tight labor markets and easing wage growth. Businesses struggled to pass on price increases and reported continuing increases in price sensitivity and weaker demand for high-end goods.

- Minneapolis: Regional economic activity crept up on balance. Employment grew slightly, with hiring activity remaining healthy. Wage pressures were flat, while job seekers prioritized work-life balance. Prices increased moderately; firms were finding it harder to pass on higher costs. Consumer spending rose and auto sales benefited from improved inventory. Manufacturing and real estate activity fell; farm conditions weakened.

- Kansas City: Economic activity across the District was stable over the last two months. Manufacturing production and sales at service businesses improved due to a greater ability to meet existing orders, as delays along supply chains were resolved. Job growth remained flat, but wage growth continued to exceed historical norms and businesses’ expectations. Contacts renewed expectations for slower wage growth ahead. Prices grew at a moderate pace.

- Dallas: Modest expansion continued, though activity was mixed across sectors. Solid growth was seen in the nonfinancial services sector, while retail sales were flat and activi-ty in the manufacturing, energy, and financial services sectors declined. Employment growth picked up slightly overall, and wage growth remained high. Price pressures remained elevated in the service sector. Outlooks were fairly stable, though uncertainty persists.

- San Francisco: Economic activity strengthened slightly. Labor availability improved and wage pressures softened further. Price increases persisted, albeit at a slower pace. Retail sales rose slightly, on balance, and manufacturing activity was stable. Lending activity moderated in recent weeks. Local communities observed increased demand for support services, particularly in areas impacted by wildfires and other severe weather in Hawaii and California.

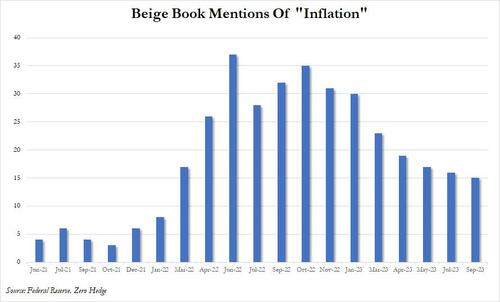

Finally, taking a visual approach to the data, we find that the mentions of inflation were the fewest since Jan 2022…

… although the chart above correlates perfectly, if with a 3 month lag, to the price of oil. So expect a jump in inflation mentions next month when the Beige Book participants realize that crude oil is at 2023 highs.

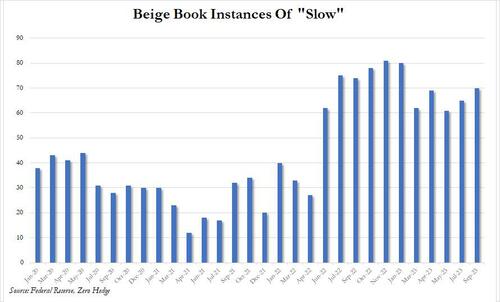

And while mentions of “slow” persisted at a far higher rate…

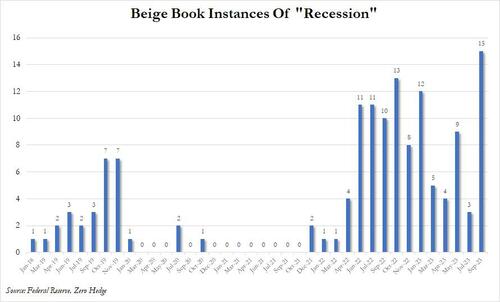

… what we found most interesting is that mentions of recession jumped to the highest level since at least 2018. Granted, some were in a favorable context, but the fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary, tells you all you need to know about what the Fed is most worried about today.

More in the full Beige Book (link).