The Dollar is up 5% since July.

That has kept inflation down this summer but it’s an illusion that can quickly reverse. The Dollar has gotten so strong that it’s having a negative impact on other currencies with both Japan and China announcing their intent to intervene to boost their currencies.

“If these moves continue, the government will deal with them appropriately without ruling out any options,” Masato Kanda, Japan’s vice finance minister for international affairs, said on Wednesday.

“We have jumped from level four on our verbal intervention scale straight to levels six or seven and a warning of imminent FX intervention,” said David Forrester, a senior FX strategist at Credit Agricole CIB in Singapore. “Importantly, dollar-yen has moved from 146 to nearly 148 in the space of a trading day and policymakers have defined excessive volatility as 2-3 big figure moves in a day.”

Japan’s monetary policy stance is contributing to the weakness in the Yen. While the Federal Reserve edges closer to the end of its aggressive rate hikes to combat the strongest inflation in decades, the Bank of Japan has stuck resolutely to the last remaining negative interest rates among major Central Banks.

The Yen and Yuan are among the worst performers among Asian currencies this year. While Japan has stopped short of using more aggressive tools to support its currency, China already sought to bolster the Yuan by asking state-owned banks to sell dollars while tightening liquidity offshore to squeeze short currency bets.

There was a round of intervention last October and that took the Dollar down from 114 to 101 in February but that wore off and the Dollar has been regaining strength and the Yuan and Yen have been weakening again (along with most Asian currencies) and these interventions get more and more expensive and more and more difficult to pull off when they have to be done over and over again to prop up a currency.

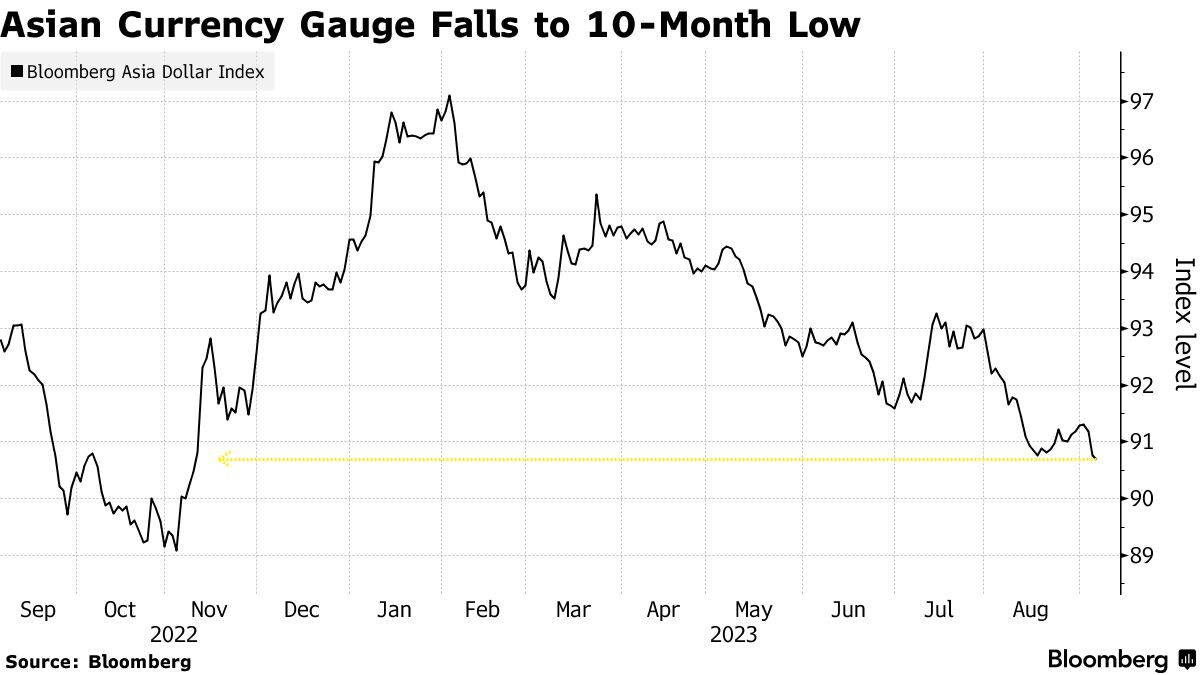

Indications of US economic resilience are persuading some traders that the Federal Reserve will keep interest rates higher for longer. That’s helped lift the Bloomberg Dollar Spot Index by around 5% since a July low, while a gauge of Asian currencies has plumbed its lowest since November.

Elsewhere, the Euro and the Pound have dropped to the weakest levels since June, on the view that Central Banks in the Euro Zone and the UK may need to cut rates faster than the Fed as their economies suffer the impact of higher borrowing costs.

It’s never a good thing when Central Banksters start manipulating their currencies – it’s a clear indication that all the other BS they’ve been doing hasn’t worked and now they are getting desperate. The potential consequences of currency interventions, especially when they involve major players like Japan and China, can easily destabilize the Global Markets.

Currency interventions occur when a government or central bank actively buys or sells its own currency in the foreign exchange market to influence its value. While these interventions are often seen as a tool to stabilize or boost a nation’s economy, they can indeed be a double-edged sword.

While the appreciation of the U.S. Dollar can create a temporary illusion of lower inflation by making imports cheaper, this can quickly reverse when other countries decide to intervene to strengthen their own currencies. Such interventions can lead to a “currency war,” where nations compete to devalue their currencies, which can result in heightened volatility and uncertainty in global markets.

Japan and China’s recent intent to intervene is indicative of their concern about the adverse effects of a strong U.S. Dollar on their export-driven economies. Japan, in particular, has been dealing with a weaker Yen due to its monetary policy stance, including negative interest rates. Meanwhile, China has been using various measures to support the Yuan, including selling dollars and tightening offshore liquidity. The repeated need for interventions can erode a nation’s foreign exchange reserves and may not yield lasting results.

In essence, Central Bank currency interventions are a sign of desperation and a reflection of the limited tools they have at their disposal to influence their economies. It’s a situation worth monitoring closely, as it can have far-reaching implications for global markets and investors.