Oil prices rallied to fresh 10-monthhighs today (9 straight days higher) as traders digested a decision by OPEC+ leaders Saudi Arabia and Russia to extend supply curbs through the end of the year.

“It was absolutely a surprise,” said Nadia Martin Wiggen, a director at commodities-focused hedge fund Svelland Capital.

“When we look toward the start of next year after these cuts, we’re going to see OECD commercial stock levels at lows we haven’t seen except in very big years.”

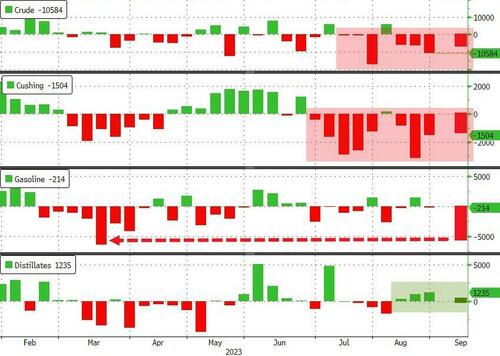

The big question is – will we see inventory draws continuing

API

-

Crude -5.2mm (-2.1mm exp)

-

Cushing -1.4mm

-

Gasoline -5.09mm (-1.2mm exp) – biggest draw since March

-

Distillates +310k (-200k exp)

API reports a 5.2mm barrel inventory draw, bigger than expected and will be the 4th weekly draw in a row if it carries over to tomorrow’ official data. A huge gasoline draw was also notable..

Source: Bloomberg

WTI was hovering around $87.50 into the API print and held gains after…

Goldman Sachs said that the moves by OPEC+ brought bullish risks to its outlook for prices, according to a report. The bank’s analysts outlined several scenarios, including one that saw Brent extending gains to above $100 a barrel, though they stressed that this wasn’t a base-case view.