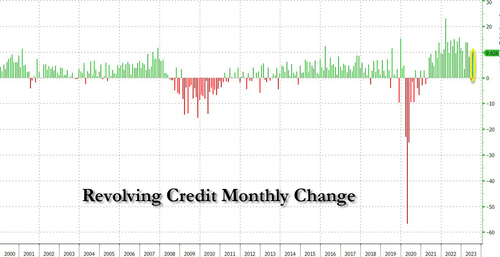

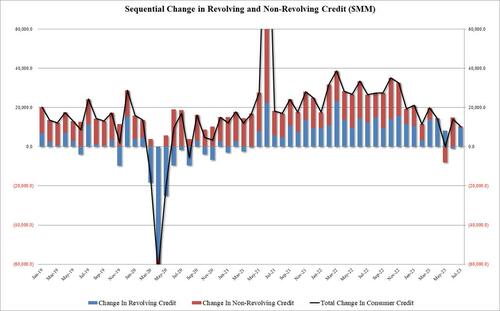

Last month’s consumer credit report was a big shock because it revealed that, for the first time since the covid crash, consumer revolving credit declined by $0.6 billion as Americans paid down their credit card debt, something they only do when a recession looms, which prompted us to conclude that the US consumer had finally tapped out.

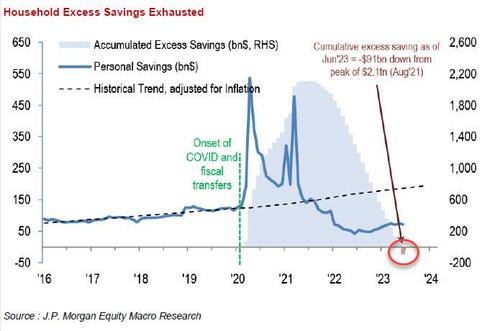

Well fast forward one month, when consumers had two more major headaches to add to their list: i) the restart of student loan and interest payments, and ii) the exhaustion of over $2 trillion in excess savings from the covid crisis, according to JPM calculations.

But since Americans have only three modes: sleep, eat and shop (sometimes the three are combined into two or even one), it was not a surprise that with savings now exhausted, US households which had already maxed out their credit cards, had to dig extra deep in the month of July to “charge it”, which they did thanks to a surge in revolving credit (i.e., credit card debt) which surged by $9.6BN after June’s shocking $872 million drop.

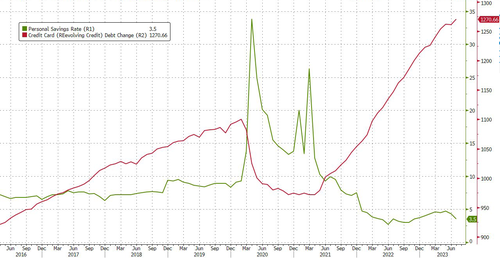

The ~$10BN increase in revolving credit pushed the total outstanding to $1.271 trillion, a new all time high, and one which comes just as the personal savings rate drops to just 3.5%, the lowest since November 2022, and adding to the woes from the excess savings depletion. In other words, rarely if ever have US consumers been in worse shape.

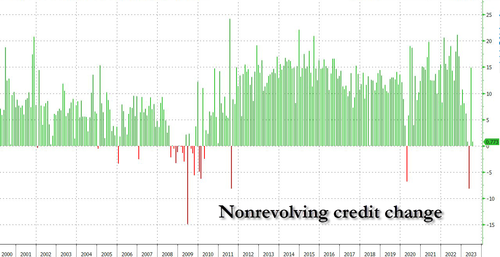

But while revolving credit surged, if only out of necessity to keep up with an unsustainable lifestyle, non-revolving credit barely rose, and two months after suffering the biggest drop since the global financial crisis, non-revolving rose by just $0.8 billion, a stark outlier to a series which in the past decade had increase on average by an average of $10 billion monthly.

And while revolving credit did unexpectedly soar, the combined monthly increase in revolving and non-revolving credit confirms what we already know: the gradual decline since the peak levels of 2022, when the number was in the mid-$30 billion range every month, to just $10.4BN this month, down from $14.9 billion, confirms that the US consumer is increasingly retrenching, and the momnt hte black line turns decidedly black, one can declare the recession as started.

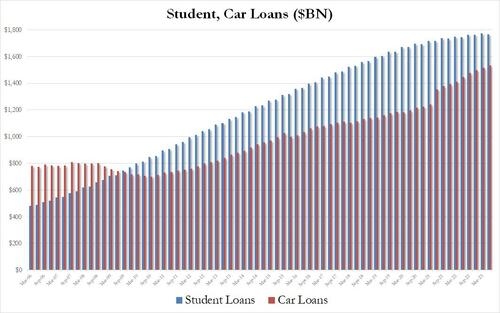

Drilling deeper into the non-revolving credit print reveals that not all is well here either, because while in Q2 auto loans increased by a healthy, if hardly, blockbuster $17.6 billion (to be expected when rates on 60-month auto loans are at all time high), student loans actually shrank by $9.1 billion, the first decline since Q2 2022, and at a time when most student borrowers are still in forebearance.

And now that repayment of student loans has officially resumed (we will get the September data in early November), watch out below.

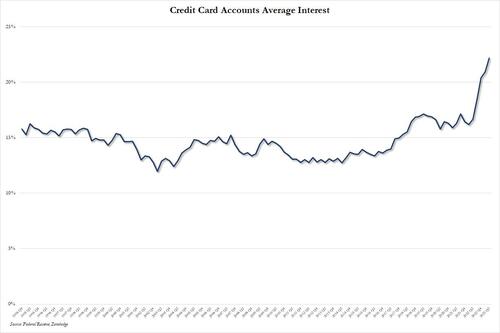

Meanwhile, with average credit card interest rates rising above 22% to a new record high…

… the real drop in credit card debt is only just starting.