Last week saw the magic of The Fed’s “seasonal adjustments” turn a $66BN outflow into a $41BN deposit inflow for domestic banks. With money market fund inflows accelerating and usage of The Fed’s emergency funding facility at a new record high, who knows what imaginative gifts the clever people at The Eccles Building will drop on us today.

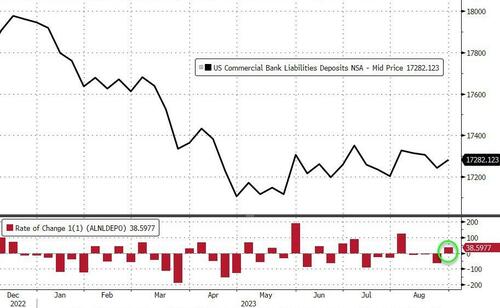

Total bank deposits (on a seasonally-adjusted basis) plunged by $70BN last week to its lowest since May…

Source: Bloomberg

But, of course, non-seasonally-adjusted deposits saw inflows of $38BN…

Source: Bloomberg

Are bank deposits about to catch-down to their money-market-fund implied levels?

Source: Bloomberg

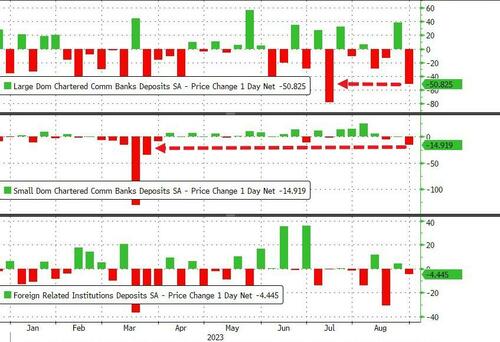

Large banks saw over $50BN deposits outflows (SA) (biggest since July) and Small Banks $15BN outflows (biggest since March)…

Source: Bloomberg

Large Bank deposits(SA) are at their lowest since April 2021 (and Small Bank deposits (SA) are at their lowest since July)…

Source: Bloomberg

The flip-flopping from last week’s SA vs NSA flows to this week’s SA vs NSA flows is risible..

Source: Bloomberg

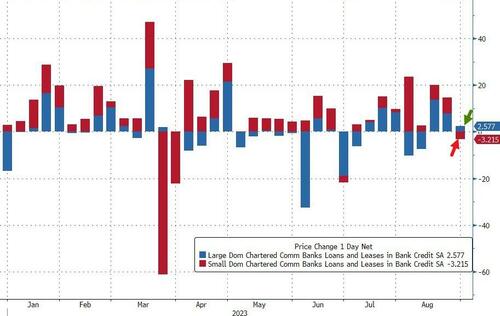

On the other side of the ledger, loan volumes shrank for Small Banks (by $3BN) while Large Banks saw loan volumes increase by $2.5BN for basically no loan change on the week in the aggregate…

Source: Bloomberg

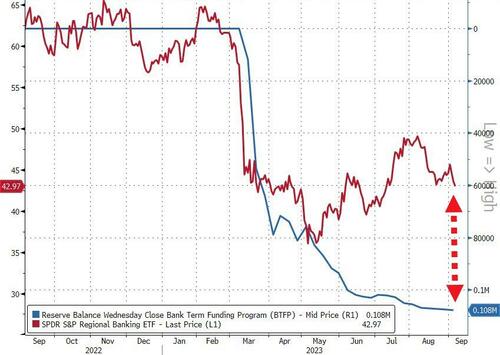

Finally, we note that Small Banks are leaking (accelerating) back down towards their ‘reserve constraint’…

Source: Bloomberg

We leave you with one thought – in 6 months and counting, America’s ‘smaller’ banks will need to find that $108-billion plus from somewhere as that is when the BTFP bailout program ends (theoretically).

Will regional bank balance sheets be stabilized by then? They better hope for a serious recession to smash yields back down (and TSY prices up).