It’s been fun pretending the Fed has gone away.

It’s been fun pretending the Fed has gone away.

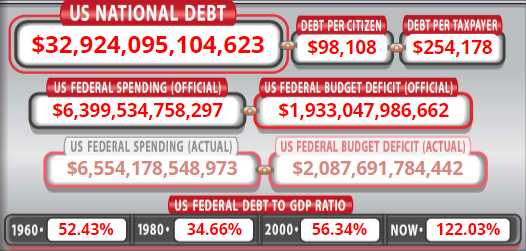

Unfortunately, today’s CPI Report is likely to show inflation bouncing back ($90 Oil anyone?) and, just in case people miss that point this morning, the Treasury Budget at 2pm is likely to show another $200Bn in debt – on the way to $2Tn for the year as we pass $33Tn in total debt this month.

People tend not to think about debt as stimulus but, if our Government didn’t spend $2,000,000,000,000 per year that they don’t have – what would our economy look like? It’s not a trick question – it would be down by 2/25 or 8% but the 25 is FAKE!!! – so it’s really more like 10% if the Government were to stop spending money they don’t have.

And if we were to stop spending $2Tn per year we don’t have then our $33Tn debt would be divided by a $23Tn GDP (even less since the $2Tn would not multiply as it flows through) and then our Debt to GDP ratio would be 143% or more and not the slightly more freindly 122% that is currently indicated.

Fortunately, however, we live in a World where reality is whatever we decide to believe in and facts are definitely somebody else’s problem so – enjoy!

That was 1965 so about 60 years ago and here’s 1985:

“As you’ve heard, the best estimates, they certainly have some uncertainty attached to them, are that at the present rate the burning of fossil fuels, the present rate of increase of minor infrared absorbing gases in the Earth’s atmosphere, that there will be a several centigrade degree temperature increase on the Earth’s global average by the middle to the end of the next century. And that has a variety of consequences, including redistribution of local climates and, through the melting of glaciers, an increase in global sea level. There is concern on a somewhat longer time scale about the collapse of the West Antarctic ice sheet and a general rise of many meters in sea level.

“So we have a kind of handwriting on the wall. Certainly, there’s more research to be done, but as I say, there is a consensus. What can be done about it? The idea that we should immediately stop burning fossil fuel has such severe economic consequences that no one, of course, will take it seriously. But there are many other things that can be done. One has to do with subsidies for fossil fuels. More efficient use could be encouraged by fewer government subsidies.

“Secondly, there are alternative energy sources, some of which are useful, at least locally. Solar power is certainly one that might be of more general use—safe fission power plants which are in principle possible. And then on a longer time scale, the prospect of fusion power, fission and fusion power plants in principle vent no infrared active gases, and therefore whatever other problems they may provide, they do not provide a greenhouse problem.

“I’d like to close by just saying a few words on the kind of perspective that this problem, as related problems, pose to us. Here is a problem that transcends our particular generation. It is an intergenerational problem if we don’t do the right thing now, there are very serious problems that our children and grandchildren will have to face. It is also a global problem.”

As noted by Sagan, Al Gore was the Congressman leading the awareness campaign (1985 was his first year in office) and last year, they interviewed and older and angrier version of Al Gore:

-

- “We have everything we need, save sufficient political will.”

- “It is quite literally insane.” (Referring to financial institutions investing more in fossil fuels)

- “We are nearing a political event horizon.”

- “This is a fossil fuel war, as many have said.”

- “We should see this as a threat to national security and global security.”

- “This is not a time for moral cowardice. This is not a time for surrender and reckless indifference to the fate of humanity.”

- “We can’t keep pumping more and more money in pursuit of short term profit in activities that are destroying the future of humanity.”

- “What will we say to the next generations when they look back and see, you had the chance to do this?”

- “We have to stop destroying our future. It sounds so simple, but we have to break through this paralysis.”

- “Do not give up hope. And remember always, that political will is itself a renewable resource.”

Al Gore has been vilified by the right – as was Socrates, Jesus, Lincoln, Ghandi, Martin Luther King, Nelson Mandella… It’s what they do to their enemies, isn’t it?

Anyway, just venting while we’re waiting for the CPI Report. Just don’t tell you children/grandchildren you didn’t know about climate change – we’ve known for more than 40 years and we STILL aren’t doing anything concrete about it – that is simply shameful!

8:30 Update: Well CPI is up 0.6%, 3 TIMES MORE than last month’s 0.2% (which I said was BS at the time). Even worse, Core CPI, which is supposed to suppress the volatility (by ignoring the things that make prices go up and down) is up 50% – back to 0.3% from 0.2% which, again, was BS last month. Here’s ShelBot with the breakdown:

🤓The indexes for gasoline, household furnishings and operations, food, and shelter all rose in August and contributed to the monthly all items seasonally adjusted increase. The energy index increased 2%, mainly due to a 2.8% increase in the gasoline index. The energy index rose 25% over the last 12 months. The food index rose 0.4% in August, with the indexes for food at home and food away from home both increasing over the month.

Also of note, Motor Vehicle insurance is up 19.1% over last year. Though rents slowed slightly to 0.4% for the month, housing costs at schools jumped 3.6%. Airline fares jumped 4.9% for the month and the overall Core CPI is up 4.3% annualized – more than double the Federal Reserve’s Target.

The Fed’s next interest rate decision will be on Wednesday, September 20, at 2 p.m3. The Fed will also update its economic projections and its dot plot of interest rate forecasts for the end of 2023 and beyond45. The bond market currently assigns a low probability of a rate hike in November or December, but this could change depending on how the inflation data evolves in the coming months and how the Fed communicates its policy stance.

We’ll see if the markets can ignore that as well…