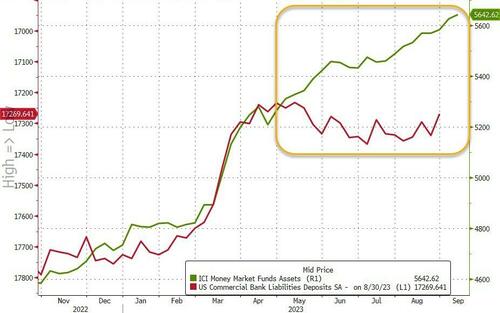

Another week, another big inflow into money-market funds (of $17.7BN), pushing total assets to a new record high of$5.642TN. That is the 8th weekly inflow of the last 9 weeks…

Source: Bloomberg

Once again the inflows were dominated by Retail (which haven’t seen an outflow since April) while institutional fund assets rose for the 3rd straight week…

Source: Bloomberg

Despite last week’s bank deposit outflow, the gap to money-market fund assets remains vast…

Source: Bloomberg

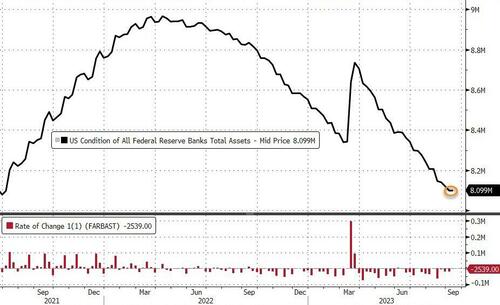

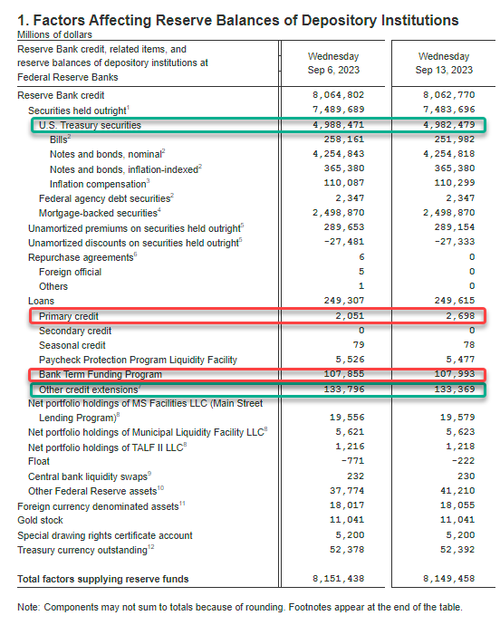

The Fed’s balance sheet shrank only marginally last week (-$2.5BN)…

Source: Bloomberg

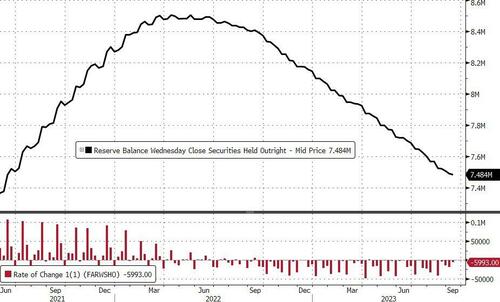

Interestingly, with regard the QT program, The Fed sold $6BN of securities last week (bigger than the decline in the Fed balance sheet)…

Source: Bloomberg

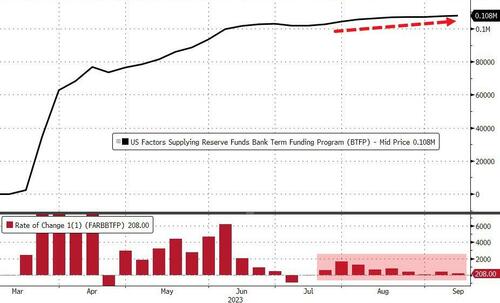

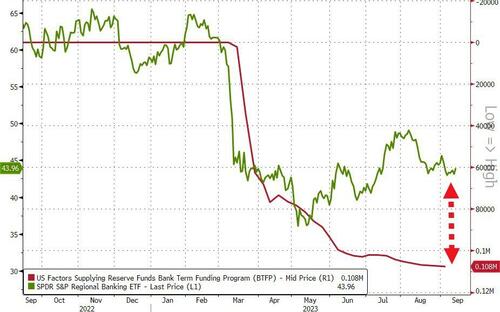

Usage of The Fed’s emergency bank funding facility rose once again (+$208M) to a new record high over $108BN…

Source: Bloomberg

Here is the detailed breakdown:

-

QT shrinks TSY holdings by $6BN to $4.982TN

-

Discount Window borrowings rise $0.6BN to $2.7BN

-

BTFP usage hits record high $108BN

-

Other credit extensions (FDIC loans) down $0.4BN to $133.4BN

The gap between bank reserves at The Fed and the US equity market cap is starting to narrow…

Source: Bloomberg

Tick, tock, banks!

Source: Bloomberg

You have six months to figure out how to clean up the $108 Billion hole in your balance sheet that you’re currently paying The Fed’s exorbitant rates to fill.