“In the year 2525, if man is still alive…” – Zager and Evans

“In the year 2525, if man is still alive…” – Zager and Evans

The market is very disappointed this morning, as it was yesterday, not because the Fed raised rates (they didn’t) but because they said they don’t see much chance of lowering them much until 2025 when the dominos they’ve already set in motion will have caused enough economic damage to push inflation down 50% from where it is now, back to their happy place at 2% annually.

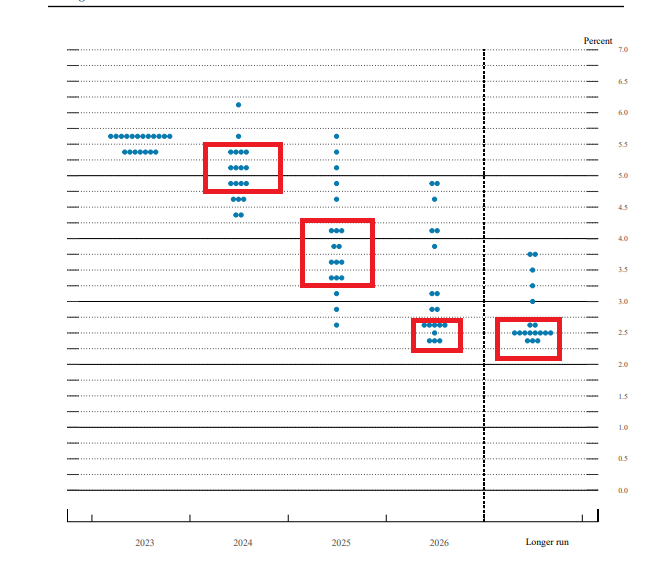

According to the Fed’s Projections, GDP will be coming down to 1.5% next year (2.1% this year) while Core PCE Inflation will drop from 3.7% to 2.6% but still too hot at 2.3% in 2025 – IF all goes well. Based on that, we can expect the Fed Funds Rate (now 5.25-5.5%) to be around 5.1% next year and still 3.9% in 2025 – both about half a point more than expected by our Leading Economorons.

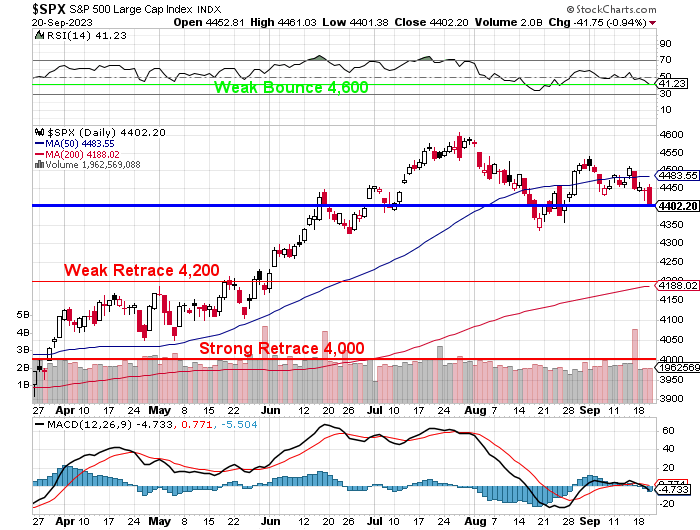

Hence the shock and awwwww that is bringing the S&P back down to 4,400 after bravely testing 4,500 last week. Now, keep in mind I said on Monday that:

“As long as 4,400 holds (220/200 = 1.1) we’ll still get there but about a week slower. So the only way we WON’T have a bullish cross of the 200 dma in the next month is for the S&P 500 to fall back below 4,000 within the next month and UNLESS that happens – we’re going to be happy with our hedges – which are protecting us from a 20% pullback – all the way to 3,560.”

So we are NOT happy with being below 4,400 this morning – IT’S RUINING EVERYTHING! – and we’ll see what sticks. Our hedges are find for now but if we head into the weekend below 4,400 – you can bet we’ll be adding more hedges. On Tuesday we thought we were well balanced into the Fed and I said to our Members that afternoon:

“Well, after all that the STP is at 0.9% ($201,885) and the LTP is at 10.9% ($554,298) and that’s up from $189,045 last week (to the day) and $545,355 (without new positions yet) so good balance as we were at 4,460 last week, 4,437 now.”

As of yesterday’s close our Long-Term Portfolio stood at $544,628 and our Short-Term Portfolio, where our hedges are, had a balance of $209,515 for a combined $754,143 – down just $1,960 with all the turmoil – THAT’S BALANCED! Now we’ll just have to sit back and see how much damage is done by the Fed and then we will get back to making our adjustments.

Our Fed’s pause has allowed the Bank of England to hold their rates steady this morning for the first time since November of 2021 as the UK Economy teeters on the brink of Recession (but still has 6.7% Inflation!). The BOE’s decision to keep its benchmark rate at 5.25% leaves it out of step with a number of other European central banks that have continued to raise their key rates at recent meetings of policy makers.

Earlier this morning the Central Banksters of Sweden and Norway matched last week’s move by the European Central Bank in raising their key rates by a quarter of a point to 4% and 4.25%, respectively. They both signaled further increases were still possible.

The OECD recently warned that inflation still has the potential to deliver unpleasant surprises, with a recent pickup in oil prices being just one development that could leave central banks with little option but to raise their key rates again. Brent crude futures, the international energy benchmark, are on track to rise by 26% this quarter, having already climbed to about $95 a barrel.

“With the eurozone and U.K. economies seemingly slipping into recession, European firms are soon likely to find it harder to pass on higher fuel costs to consumers,” said Simon MacAdam, an economist at Capital Economics.

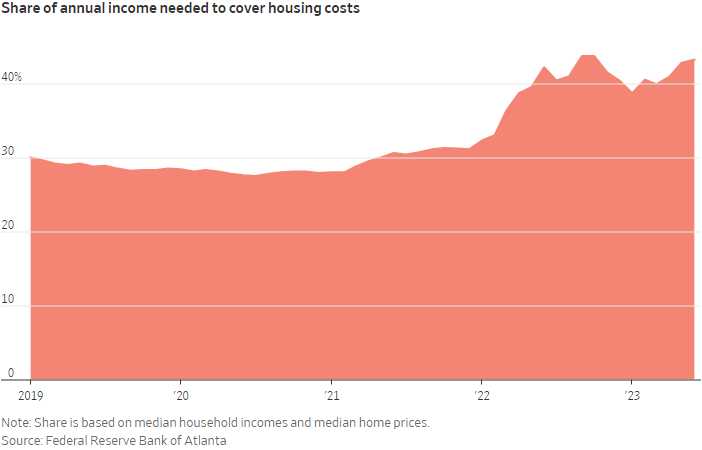

Meanwhile, the full effect of what the Fed has already done is starting to hit US consumers and UK mortgages, for example, are only fixed for 5 years so they are getting hit harder and fast than we are but we are in a slow-rolling disaster of our own – even with 30-year fixed rates:

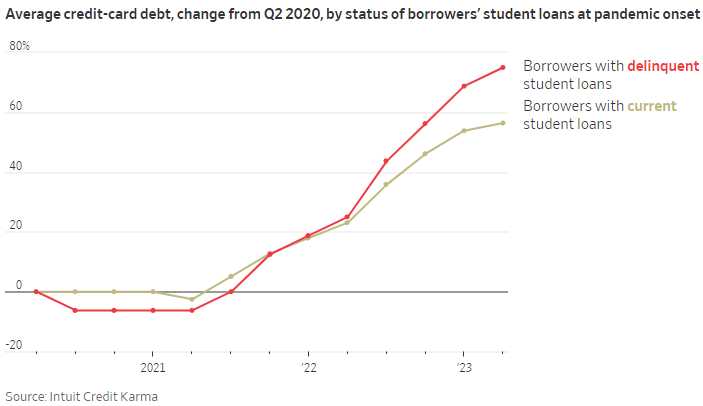

That’s what’s happening to the US consumer, Housing Costs are going through the roof and, so far, Consumers have been covering the shortfall by racking up $1Tn in Credit Card debt and that’s no longer an option as the banks are getting too many defaults and are beginning to tighten their lending standards so, very soon, Consumers will simply run out of money and SOMETHING will break in our system.