By Charlie Zhu and Helen Sun, Bloomberg Markets Live reporters and analysts

Three things we learned last week:

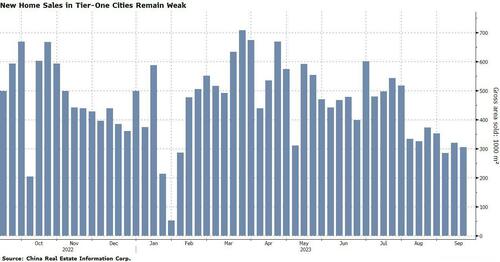

1. A multi-year property downturn looks increasingly likely as a raft of rescue measures have fallen flat. Disappointing home sales in China’s largest cities suggest policy supports have failed to turn around buyer sentiment. New home sales for the first two weeks of September in tier-one cities fell from August’s levels.

The fallout from the property crisis is spreading to investment-grade developers. Moody’s Investors Service put China Jinmao Holdings Group Ltd. and China Vanke Co. on review for possible downgrade, while lowering the outlook for seven other builders to negative.

Onshore investors shared the view that China’s property sector is facing a multi-year downturn and are even less optimistic on the outlook for commercial properties, Zerlina Zeng, senior analyst at Credit Sights, wrote in a note. Considering China’s aging population and slowing urbanization, a mild contraction of home construction and sales is appropriate, Zeng wrote.

Efforts to relax home-buying restrictions have continued, with 11 cities announcing such measures in September alone, according to China Index Holdings. Among the latest came from Guangzhou, which shortened the period of time non-residents need to pay tax before they’re allowed to buy homes.

2. As property woes cast a pall over the broader market, policymakers are bolstering efforts to court investors. Key Chinese stock gauges hit new 2023 lows last week, before rebounding Friday. A Bloomberg Intelligence gauge of China’s developer shares posted its biggest weekly decline since mid-August, while an index of high-yield dollar bonds, mostly developers, halted a four-week advance.

As capital flees at a pace unseen in years, the People’s Bank of China vowed to stabilize trade and improve business environment in a forum attended by top global financial institutions. China is also considering relaxing the rules that cap foreign ownership in domestic publicly traded firms, people familiar with the matter said.

Whether those efforts will bear fruit remains unclear. While onshore shares saw its biggest inflow via the trading links on Friday since the end of July, market rebounds this year have barely lasted two weeks.

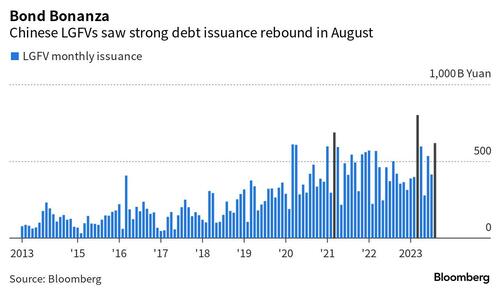

3. For all the skepticism engulfing Chinese markets, investor faith in the local government financing vehicles seems intact, at least for now. Their bond issuance onshore jumped 50% in August from July to notch the third-highest monthly tally on record.

While investors are betting that LGFVs will remain relatively safe in the near term given the central government’s efforts to tackle debt problems, there’s still a risk that when the music stops, someone will need to pay the price.

In the first eight months this year, 72% of LGFVs’ bond sales were used to pay back existing debt, analysts led by Liu Yu at GF Securities Co. wrote in a report, highlighting repayment pressure.