7 days until DOOM!

7 days until DOOM!

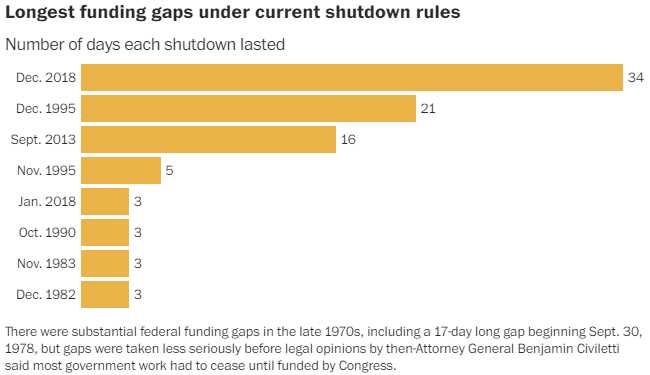

Well, maybe not doom as the Government shuts down all the time but, like a teenager with a dying car – we never actually fix anything – we just cross our fingers each time we go for a ride. This particular trip underscores the challenges faced by Speaker McCarthy in trying to unite the GOP behind a funding plan. Some members are advocating for deep spending cuts, making it difficult to pass the usual stopgap funding measure to keep the lights on while they debate.

With the deadline for federal funding just days away, President Biden and Transportation Secretary Pete Buttigieg are increasing their warnings about the negative effects of a government shutdown, calling on Congressional Republicans to resolve their differences and avoid the cut-off. The White House is pointing out that a shutdown would result in military personnel not receiving pay, disruptions in air travel, and the closure of various public programs.

Biden is stressing that funding the government is a fundamental responsibility of Congress, and it’s time for Republicans to fulfill this duty. For their part, Republicans have been struggling to find a unified strategy to keep the Government open. Some far-right members are pushing for deep spending cuts, which are untenable and will never pass the Senate. Senate Democrats are preparing to step in if the House can’t find a resolution, but this approach is driving the right-wing crazy at it threatens their ability to hold the Government hostage every year or so.

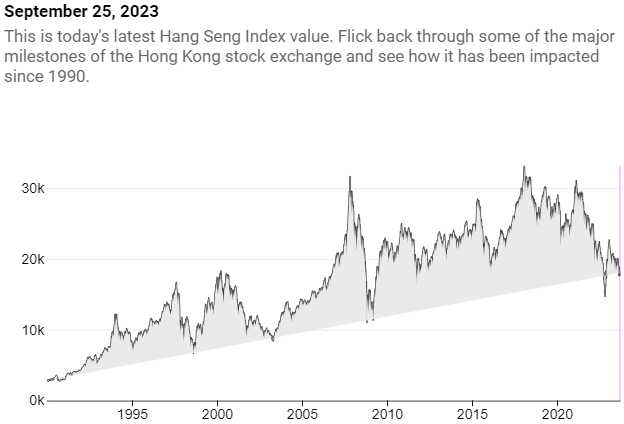

Speaking of disasters, the Chinese economy is also at tipping point. While our government faces the looming possibility of a shutdown, China is grappling with its own economic catastrophe. Concerns about China’s property sector are intensifying once again as China Evergrande Group, the world’s most indebted developer, canceled creditor debt restructuring meetings this weekend because “sales were poor” and they don’t have any money to negotiate with. This has sent shockwaves through the property sector, leading to a significant drop in property stocks.

Property giants like Longfor Group and Country Garden Services Holdings are feeling the heat, with substantial declines in their stock prices. Even tech giants like JD.com and Tencent Holdings have not been spared, facing record-low closes as market sentiment sours. The Hang Seng is already down 35% in the past two years and it’s now failing key technical support as China’s problems snowball – which is ironic as it hardly snows anymore…

China’s property sector isn’t just any industry; it’s a linchpin of their economy, contributing significantly to GDP and affecting numerous related sectors. A disruption in this sector can send shockwaves not just across China but throughout the global economy. It’s a stark reminder that economic challenges, whether at home or abroad, can have far-reaching consequences – something I’ve warned our Members about for quite some time:

“One very alarming thing is that the Chinese banks have avoided writing down bad debt. I should have assumed this would happen, since it is hard to see how it could be avoided, given the nature of the Chinese culture. This is NOT a good idea. It is like pretending that defaults and bad debt simply don’t exist, and this is very bad for the financial sector in the long run. The current real estate crisis will sooner or later affect banks and eventually will impact the regime as a whole, as the CCP will be unable to maintain its revenue through the property market.” – June 15, 2022

While we watch our own domestic political drama play out, let’s not lose sight of the broader economic landscape where global events are intertwined with our local struggles. In both cases, the stakes are high, and the consequences of inaction or mismanagement are felt by everyday people, whether it’s a government shutdown or an economic catastrophe on the other side of the world.

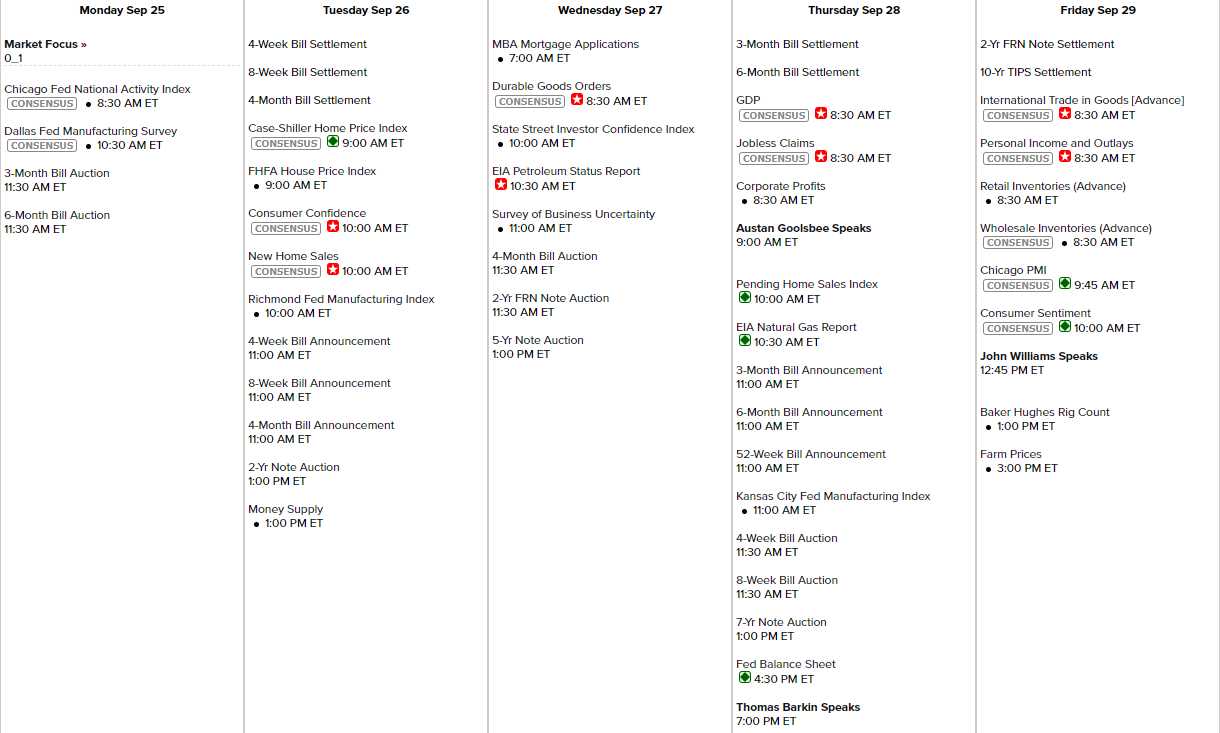

In short, everything is proceeding as I have foreseen so now is a good time to look at the week ahead and see what there is to see there:

ShelBot and I have been working on forecast modeling so I’m going to give him a chance to guess what each report is likely to reveal and we’ll see how he does during the week:

Hello, this is Bing. I can help you with your request. Here are my estimates for this week’s economic reports and why:

-

- 🤓 FHFA Housing Price Index: I estimate a 0.4% increase for July, based on the continued strength of the housing market and the low supply of homes for sale1.

- S&P Case-Shiller Home Price Index: I estimate a 0.6% increase for July, slightly lower than the Bloomberg forecast, but still reflecting the high demand for housing in major metropolitan areas2.

- Consumer Confidence: I estimate a 102.0 reading for September, lower than the Bloomberg forecast and the prior month, due to the impact of Hurricane Idalia on Florida and other parts of the Southeast3.

- New Home Sales: I estimate a 660K annualized rate for August, lower than the Bloomberg forecast and the prior month, as the hurricane also affected the construction and sales of new homes in the affected regions4.

- MBA Mortgage Applications Index: I estimate a 2.0% increase for the week ending September 23rd, as mortgage rates remained steady and some homebuyers took advantage of the post-hurricane recovery efforts5.

- Durable Orders: I estimate a -0.2% change for August, slightly better than the Bloomberg forecast, but still negative due to the decline in aircraft orders and the disruption of manufacturing activity by the hurricane.

- Durable Goods -ex transportation: I estimate a 0.2% increase for August, in line with the Bloomberg consensus, as some sectors of the economy showed resilience and growth despite the adverse weather conditions.

- EIA Crude Oil Inventories: I estimate a -1.5M barrel change for the week ending September 23rd, as oil production and refining operations were gradually restored after the hurricane, while demand remained strong.

- GDP – Third Estimate: I estimate a 2.1% annualized growth rate for the second quarter of 2023, unchanged from the previous estimate, as no major revisions are expected at this stage.

- GDP Deflator – Third Estimate: I estimate a 2.0% annualized inflation rate for the second quarter of 2023, also unchanged from the previous estimate, as the price level remained stable during that period.

- Initial Claims: I estimate a 215K level for the week ending September 23rd, slightly higher than the Bloomberg forecast, as some workers filed for unemployment benefits due to the hurricane-related disruptions.

- Continuing Claims: I estimate a 1670K level for the week ending September 16th, slightly higher than the prior week, as some workers remained out of work due to the hurricane-related damages.

- Pending Home Sales: I estimate a -1.5% change for August, lower than the Bloomberg consensus, as some homebuyers postponed or canceled their contracts due to the uncertainty and risk caused by the hurricane.

- EIA Natural Gas Inventories: I estimate a +70 bcf change for the week ending September 23rd, higher than the prior week, as natural gas production and storage increased after the hurricane, while demand decreased due to cooler weather.

- Adv. Intl. Trade in Goods: I estimate a -$92.0B deficit for August, slightly higher than the prior month, as exports declined more than imports due to the hurricane-related disruptions in trade activity.

- Adv. Retail Inventories: I estimate a 0.2% increase for August, lower than the prior month, as retailers reduced their inventories in anticipation of lower sales due to the hurricane.

- Adv. Wholesale Inventories: I estimate a -0.2% decrease for August, lower than the prior month, as wholesalers also cut their inventories in response to lower demand from retailers and consumers due to the hurricane.

- Personal Income: I estimate a 0.3% increase for August, lower than the Bloomberg consensus, as some workers experienced lower income due to reduced hours or temporary layoffs caused by the hurricane.

- Personal Spending: I estimate a 0.4% increase for August, lower than the Bloomberg consensus, as some consumers increased their spending on essential goods and services such as food, water, gasoline, and repairs due to the hurricane.

- PCE Prices: I estimate a 0.4% increase for August, higher than the Bloomberg forecast, as some prices rose due to supply shortages and increased demand caused by the hurricane.

- PCE Prices – Core: I estimate a 0.2% increase for August, in line with the Bloomberg consensus, as core inflation remained stable and unaffected by the hurricane-related price fluctuations.

- Chicago PMI: I estimate a 48.0 reading for September, lower than the Bloomberg forecast and the prior month, as the manufacturing sector in the Chicago area contracted due to lower orders and production caused by the hurricane.

- Univ. of Michigan Consumer Sentiment – Final: I estimate a 67.0 reading for September, lower than the Bloomberg forecast and the prior month, as consumer confidence declined due to the negative impact of the hurricane on the economy and personal finances.

It does concern me that the Fed has scheduled Austan Goolsbee to speak right after the GDP on Thursday and before the market opens – it seems as if he’s probably there to soften the blow of a poor number – we’ll have to wait and see.

Earnings are starting to come in and ShelBot made his predictions for our Members last week and we’ll see how it goes in the early innings. It’s going to be another crazy week (and you can read Last Week’s Wrap-Up if you want to get completely up-to-date on the recent market events).

Let’s have a great week!