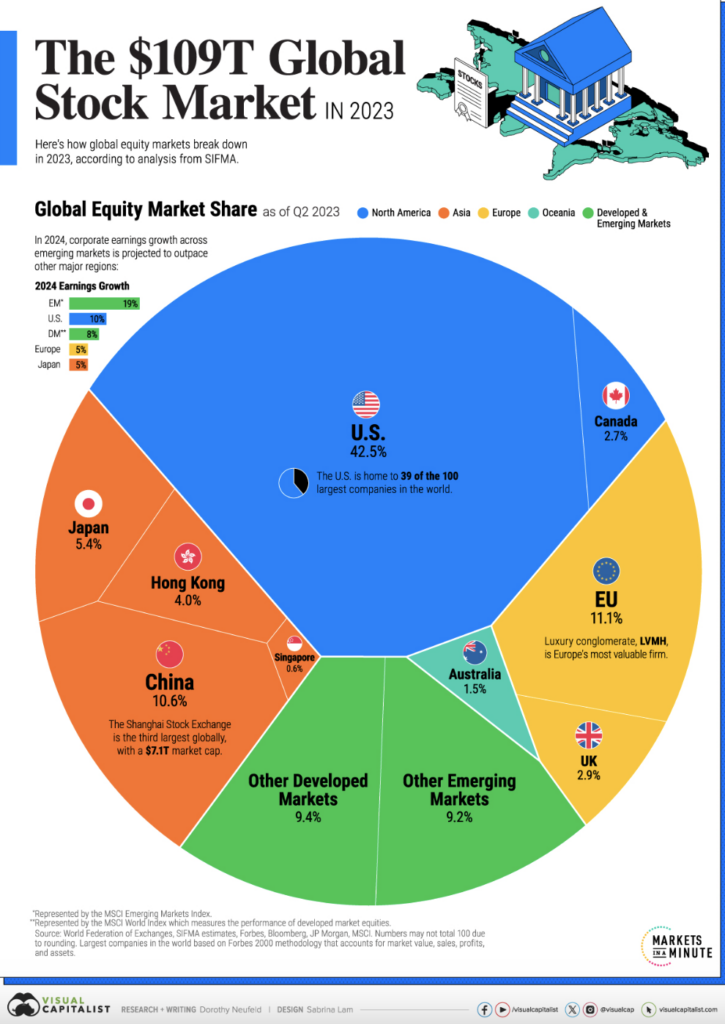

The $109 Trillion Global Stock Market in One Chart

By Dorothy Neufeld, Visual Capitalist

Graphics/Design: Sabrina Lam

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

Global equity markets have nearly tripled in size since 2003, climbing to $109 trillion in total market capitalization.

Over the last several decades, the growth in money supply and ultra-low interest rates have underpinned rising asset values across economies.

Given this backdrop, the above graphic shows the size of the global stock market in 2023, based on data from the World Federation of Exchanges (WFE) and the Securities Industry and Financial Markets Association (SIFMA).

The Global Stock Market, by Share

With the world’s deepest capital markets, the U.S. makes up 42.5% of global equity market capitalization, outpacing the next closest economy, the European Union by a significant margin.

Here are the world’s major equity markets based on global market cap share as of Q2 2023:

| Country / Region | Market Cap | Share (%) |

|---|---|---|

| 🇺🇸 U.S. | $46.2T | 42.5% |

| 🇪🇺 EU | $12.1T | 11.1% |

| 🇨🇳 China | $11.5T | 10.6% |

| 🇯🇵 Japan | $5.8T | 5.4% |

| 🇭🇰 Hong Kong | $4.3T | 4.0% |

| 🇬🇧 UK | $3.2T | 2.9% |

| 🇨🇦 Canada | $3.0T | 2.7% |

| 🇦🇺 Australia | $1.7T | 1.5% |

| 🇸🇬 Singapore | $0.6T | 0.6% |

| 🌏 Rest of Developed Markets | $10.2T | 9.4% |

| 🌍 Rest of Emerging Markets | $10.0T | 9.2% |

| Global Total | $108.6T | 100.0% |

Data as of Q2 2023. Numbers may not total 100 due to rounding.

Today, U.S. equity markets total over $46.2 trillion in market capitalization.

Compared to other rich nations, U.S. stocks have often outperformed over the last several decades. If an investor put $100 in the S&P 500 in 1990 this investment would have grown to about $2,000 in 2023, or four-fold the returns seen in other developed countries.

The second-largest equity market is the European Union at 11.1% of global share, followed by China, at 10.6%.

In the last 20 years, China’s economy has increased by roughly 12-fold, reaching $19.4 trillion this year. China’s equity markets have also grown considerably, fueled by the incorporation of Chinese domestic stocks into the MSCI Emerging Market Index in 2018, and earlier, with the internationalization of its equity markets in 2002.

Japan’s equity markets account for 5.4% of the global share, followed by Hong Kong, at 4%.

The Future Investment Landscape

Goldman Sachs projects that U.S. equity market capitalization will fall to 35% of the overall global market by 2030.

Meanwhile, emerging markets, including China and India, are collectively forecast to reach the 35% mark in the same timeframe. By 2050, the EM share is anticipated to far surpass the U.S., rising to 47% of global stock markets.

| Country / Region | Global Equity Market Share 2030 | Global Equity Market Share 2050 |

|---|---|---|

| 🇺🇸 U.S. | 34.7% | 26.9% |

| 🇪🇺 Euro Area | 8.3% | 7.9% |

| 🇨🇳 China | 14.1% | 15.0% |

| 🇮🇳 India | 4.1% | 8.3% |

| 🌏 Rest of Developed Markets | 21.5% | 17.8% |

| 🌍 Rest of Emerging Markets | 17.4% | 24.1% |

Numbers may not total 100 due to rounding.

The first factor underscoring this shift is the rapid growth projected for emerging economies.

Historically, as GDP per capita grows, capital markets in an economy become more sophisticated. We can see this in richer countries, which tend to have higher equitization of their markets.

India is projected to rise the fastest globally. By 2030, it is projected to account for 4.1% of global equity market cap. Furthermore, by 2050, this share is projected to outrank the euro area due to strong GDP per capita growth and demographic drivers.

The second factor, although to a lesser extent, is emerging market rising valuation multiples driven by higher GDP per capita. Richer countries, as seen in the U.S., often trade at higher earnings multiples because they are viewed to have lower risk.

Implications for Investors

What does this mean from an investment standpoint?

While the U.S. has outperformed in recent decades, it may not mean that it will continue on this trend, according to Goldman Sachs. Given the structural shifts stemming from growing populations and GDP growth, investors may consider diversifying their portfolios geographically looking ahead.